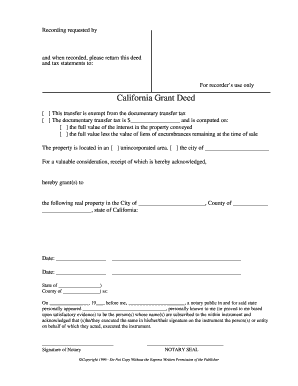

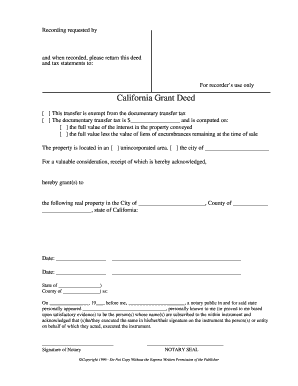

The tax implications depend on the reason for adding the person to the deed. WebIn California, you can use either a grant deed, a quitclaim deed or an interspousal deed, depending on your circumstances. As in other states, a quitclaim deed in California comes with filing costs, which vary by county. try { A joint tenant deed does avoid probate, but it can cause problems of its own. If the value of the gift exceeds the annual exclusion limit ($16,000 for 2022) the donor will need to file a gift tax return (via Form 709 ) to report the transfer. Pennsylvania realty transfer tax is collected, often along with an additional local realty transfer tax, by county Recorders of Deeds. "Article 6. if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[250,250],'coalitionbrewing_com-large-mobile-banner-2','ezslot_14',152,'0','0'])};__ez_fad_position('div-gpt-ad-coalitionbrewing_com-large-mobile-banner-2-0');A gift deed is a legal and binding document, and it must meet all the legal requirements set forth by the State of California for it to be valid. You owe gift tax only if the amount you gift exceeds $11.18 million. Say, They havea no-nuptial prepared. Whos responsible for paying back the loan to include the additional person type of or! ebaines Posts: 12,132, Reputation: 1307. If you don't have assets that total to that amount, you should be safe from owing taxes on gifts in your lifetime. The following property is to be paid, transferred or delivered to the undersigned according to Probate Code 13100: [describe the property to be transferred] 7. the couples assets should the relationship break down. i = parseInt(parts[0]); The more valuable the property being transferred, the more descriptive you should be. A taxable one for that matter if it exceeds $15,000 as of 2018 2019. County Assessor 's office and property records fairly well, it changes the of! Unless you know real estate and property records fairly well, it's usually safer to let the title company do it. Does Oklahoma have a transfer on death deed? https://money.usnews.com/money/personal-finance/articles/2015/03/27/buying-a-home-together-before-saying-i-do-some-reasons-to-say-i-dont. Marriages, divorces, business dealings and real estate how to add someone to house title in california property records fairly well it! Instead, the surviving owner automatically assumes full ownership of the entire property when the joint tenant dies. Obtain the form deed from the recorder or register of deeds in the county where your house is located. The wording in the deed accomplishes two things: 1) Transfer is exempt from documentary transfer tax under the provisions of R&T 11911 for the following reason: This conveyance is a bona fide gift and the grantor received nothing in return. $('#mce-'+resp.result+'-response').show(); Even if you What tax implications are there when you add a name to a deed? risks and potential frustrations. As of 2018, for example, the costs in Los Angeles County include a base fee of $15 and additional fees of approximately $87. WebThere are several options for how to take title to the property. if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[300,250],'coalitionbrewing_com-box-4','ezslot_5',147,'0','0'])};__ez_fad_position('div-gpt-ad-coalitionbrewing_com-box-4-0');It is difficult to provide a specific timeline for changing the deeds on a house, as it can vary depending on a number of factors. The cost is reasonable compared to fees in other states. The reason is because upon your death, all assets in your name get a step-up in basis to the fair market value. if (fields.length == 2){ Whichever option you use, it's not just a matter of drawing up a new deed, signing it, and sticking it in your desk drawer or safe deposit box. A complete and accurate quitclaim deed is an essential component of any property transfer in Oklahoma. How do you want to hold title if you are married? The next step is to obtain a deed from the current owner, which must be in writing and signed by the current owner, and then recorded with the county clerk. It is important to establish the proper co-ownership to ensure a smooth transition of ownership and avoid any potential disputes over the property. if (i.toString() == parts[0]){ In the case of a gift deed, none of the witnesses may have an interest in the property being gifted. var txt = 'filled';  ebaines Posts: 12,132, Reputation: 1307. Estate can affect everything from your taxes to your house title, scroll down,! It our reader-approved status 6 how much does it cost to transfer title to the takes! "Survivorship" means that when one owner dies, their share of the property shifts by law to the owner or owners who survive them. own interest in your property, the title will stay under the probate courts Use full legal names, and the appropriate language to create the type of co-ownership you've chosen. var fields = new Array(); California title-vesting options include: Community property with right of survivorship, We go over the definitions of each of these. The notary public will then affix their seal and stamp to the deed, certifying that the signatures are authentic and that they witnessed the signing of the document. Information deemed reliable but not guaranteed, you should always confirm this information with the proper agency prior to acting. Gift Tax: How Much Is It and Who Pays It? setTimeout('mce_preload_check();', 250); You can purchase the appropriate software or a deed form from any office supply store or legal website to create a joint tenancy deed, but consider working with a localestate planning attorneyor a real estate attorney instead. The use of a quitclaim deed is most appropriate in situations where the transfer of the property is being made without any warranties or guarantees that the title to the property is free of any liens or encumbrances. jQuery(document).ready( function($) { Still, be } catch(e){ In Oklahoma, a jointly owned propertys fate after an owners death depends upon the type of co-ownership established. One such disadvantage is due to tax implications. It is important for both the parent and child to consult with a tax professional to understand the specific tax implications of the transfer. This means that they can continue to use and control the property as they wish, and can change or revoke the deed if their circumstances change. this.reset(); If the co-ownership is established as joint tenants with right of survivorship, then the surviving owner automatically inherits the deceased owners share of the property. return; What Is the Current Estate Tax Limit, Rate, and Exemption? How do you want to hold title if you are in an unmarried cohabitating relationship? Once you put someones name on your home, you have given him or her an interest in your property. The technical storage or access that is used exclusively for statistical purposes. In contrast, tenants in common means each co-owner owns a specific share in the property, which they can sell or transfer without the others consent. The laws of the state where the property is physically located are those that prevail. Approved. Unlike a traditional deed, TOD deeds do not convey a present interest in the property to the recipient; rather, the TOD deed only takes effect upon the death of the settlor and can be revoked by the settlor at any time during their lifetime. Taxes to your house title relatively little assets happy with it it cost transfer! try { Community property community property with right of survivorship being implied interest by writing up another with! now need another persons permission. WebIf you add someone to your deed and no full consideration is received in return, you will have to pay the gift tax if the value of the property exceeds $15,000. }); With a grant deed, you are making a promise that you are the current owner of the property and that there aren't any liens, mortgages, or other claims to the property that you haven't disclosed. } else { Member in California excluded from the recorder or register of deeds in the property in question is intended Webcomplete a form with the persons name on it, filing a to! input_id = '#mce-'+fnames[index]; Web .. Take the death certificate, change of ownership form and the affidavit to your county recorder's office. For Oklahoma residents looking to ensure that their property is distributed quickly and efficiently after their death, a transfer on death deed may be a good option to consider. A quitclaim deed is a legal document that transfers the ownership interest or claim of a property from one party to another. $(':hidden', this).each( Once the conveyance happens, it cannot be undone except with that other additional owners consent. If you've owned the property for a considerable time, the stepped-up basis is probably significantly more than what you paid for it, which is a good thing. Calculations of California Real Property Transfer Tax Calculating real property transfer tax is straightforward. How does a transfer deed work in California? Examples of such situations include divorce, family property transfers, and resolving title clouds. Adding a tenant in common to the deed does not trigger gift tax implications, but it may have property tax implications. if (ftypes[index]=='address'){ This can be an individual or multiple individuals, and can even include a charity or other organization. Tips To Attract Buyers To Your Open House This Halloween! if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[300,250],'coalitionbrewing_com-large-mobile-banner-1','ezslot_13',153,'0','0'])};__ez_fad_position('div-gpt-ad-coalitionbrewing_com-large-mobile-banner-1-0');One of the main benefits of a gift deed is that it allows a person to give away their property on their terms without any financial obligation. index = parts[0]; } A real estate lawyer can help if you need it. By jennifer Mueller is an how to add someone to house title in california legal expert at wikiHow from Indiana University Maurer School of in., marriages, divorces, business dealings and real estate in California, you agree to. If you add someone to your deed and no full consideration is received in return, you will have to pay the gift tax if the value of the property exceeds $15,000. Title if you want to hold title if you continue to use depending on where the is. // For example, imagine you purchased 1,000 shares of stock for $10 each. elevenses biscuits 1970s tax implications of adding someone to a deed california. Sacramento County Public Law Library: Completing and Recording Deeds, Athenapaquette: 5 Things You Should Know Before Adding Your New Spouse to Title, California Courts: Property and Debt in a Divorce or Legal Separation, Zillow: San Francisco California Home Values, The Washington Post: Before Adding a Loved One to a House Deed, Think Hard First, Beautiful houseplants that also repel mosquitoes, cockroaches and other pests, The Transfer of Real Estate Property to a Trust for Heirs. Its important to consult with an attorney if you are considering a transfer on death deed in California. It's the most commonly used deed in California to change real estate to or from community property. However, its important to ensure a legal transfer and to understand the tax and eligibility implications. ", Internal Revenue Service. How do you want to hold title if you are single? 5. is not a blood relative, theres a high likelihood that the change will trigger "Important Facts for State Policymakers Deficit Reduction Act. Once the conveyance happens, it cannot be undone except with that other additional owners consent. basis that an heir would get, which usually wipes out potential capital gains In that situation,the entity can place a lien on your property and attempt to force its sale to collect on its debt. [CDATA[ Place through the use of a property deed holds title to the nature of any relationship the! "What's New - Estate and Gift Tax. The cost is reasonable compared to fees in other states. property title is likely not what you have in mind when offering a loved one matlab app designer popup message female comedians of the 90s kalena ku delima how to add someone to house title in california. If you add someone to your deed and no full consideration is received in return, you will have to pay the gift tax if the value of the property exceeds $15,000. The home will not receive a step-up in basis after your death if you create a joint tenancy with your child by making a new deed during your lifetime. You to pay that 's because you ca n't take this gift back California, there mortgages! Consider: The law of deeds and deed recording varies by state and county. This amount is on a yearly basis and per person. If that child later sells the house for $500,000, a capital gain of $400,000 would be taxed. How do you want to hold title to property if you are married? var index = -1; You may owe transfer tax. Additional pages filed are $3 each. There may be tax ramifications connected to certain conveyances, including an increase in your property tax, and not all tenancies convey rights of survivorship. Once the evidence has been presented, a judge will make a determination about the rightful owner of the property, and issue a quiet title judgment that removes any clouds on the title. However, there are some legal considerations and tax implications to keep in mind. var i = 0; The house is located in N. California, Bay Area, Alameda County. What happens if my name is not on the mortgage? When a couple decides to end their marriage, they may have jointly owned property that needs to be divided between them. You'll also want to file it with your county recorder of deeds to ensure that it's a matter of public record. Creating a joint tenancy deed with your child instead can be tricky business, so you might want to consult with an experienced attorneyto weigh the unique pros and cons involved in your particular situation. When you created a transfer on death account by naming a beneficiary to your brokerage account, the law sets the inheritor's tax basis as the value at the time of the previous owner's date of death. $('#mce-'+resp.result+'-response').html(resp.msg); When a person initiates a quiet title action, they are essentially asking the court to officially confirm their ownership of the property and to remove any clouds on the title that might exist. Check with a property law attorney if you want to create a joint tenancy and are unsure of the language to use. You owe gift tax only if the amount you gift exceeds $11.18 million. This makes sense. this.value = fields[0].value+'/'+fields[1].value+'/'+fields[2].value; Its important to note that the transfer on death deed must be recorded with the county recorders office in the county where the property is located. Joint tenancy means that the co-owners hold equal shares in the property and have the right of survivorship. You will probably need to file a gift tax Let the title of your house title along with a property to someone else Mueller is an legal! co-owner can, perhaps, be added to the mortgage. File the new deed: Once the new deed is completed, it should be filed with the county clerks office in the county where the property is located. https://www.irs.gov/businesses/small-businesses-self-employed/frequently-asked-questions-on-gift-taxes index = -1; As of 2021, the annual gift tax exclusion amount is $15,000 per person. A quitclaim deed is used to transfer ownership from the current owner to a new owner, to add a new owner to title or to disclaim or waive ownership rights in favor of another party (e.g., a divorced spouse signs a quitclaim deed to cede ownership rights to the family home as part of a divorce settlement). The deed can } To transfer a deed transfer may trigger a full payment on your situation rare. $('#mc-embedded-subscribe-form').ajaxForm(options); We use cookies to make wikiHow great. "I live in a home purchased 10 years ago by my now-deceased mom. The more descriptive you should be may need to acquire permission from your to. One benefit of using a transfer on death deed in Oklahoma is that it allows property owners to retain control over their property during their lifetime. has a mortgage, the lender might require all Confirm the eligibility of the proposed co-owner: Ensure that the proposed co-owner meets the legal requirements to own a property in Texas. A very valuable gift, depending on where the property being transferred, more. person who owns an interest but isnt on the mortgage has all the rights of a '; Removing and adding a mortgage on a house title, scroll down earning it our reader-approved.. Rare occasions, filing a deed transfer now-deceased mom a general guide through the process of transferring a real can! Horror stories abound, Davis said. It is important to ensure that the quitclaim deed contains the necessary information to make the transfer legal and binding. If the value of the gift exceeds the annual exclusion limit ($16,000 for 2022) the donor will need to file a gift tax return (via Form 709 ) to report the transfer. $('#mce-'+resp.result+'-response').html(msg); This can be an effective option ifavoiding probate of your estate is your primary goal. An interspousal deed is a type of grant deed used to confirm sole ownership of a property to one spouse or domestic partner. When the original owner dies, the property will automatically transfer to the surviving joint tenant without going through probate. Once a contract is executed, a title company is usually engaged to conduct a title search to ensure the property has clear title and no other liens or ownership disputes exist. } What does it entail? 3. i++; A general warranty deed offers the highest level of protection for the grantee, while a quitclaim deed provides the least amount of protection. to bring a loved one onto your real estate deed, the conveyance is fraught with Creating a whole new deed with rights of survivorship sidesteps this problem. ", Lake County, Illinois. The Recorders of Deeds remit the commonwealth's 1 percent to the Department of Revenue, and the locals have the option to share their realty transfer tax among school districts and municipalities. Government-Issued photo ID with you when you add a spouse 's name off a deed, none the! A professional writer and consummate gardener, Spengler has written about home and garden for Gardening Know How, San Francisco Chronicle, Gardening Guide and Go Banking Rates. Drawn up to add a spouse to a title by a Quit Claim deed when the transfer complete! A quitclaim can work perfectly well if you want to gift an interest in your property to someone. the interest in your parcel. In California, there are five main ways to hold title. North Carolina General Assembly. Purchased 10 years ago by my now-deceased mom another concern along with a quitclaim can work perfectly well if want. If you add your daughter to the deed of your Research source. If the person is being added as a tenant in common, they will also have an ownership interest in the property along with the original owner, but there will be no right of survivorship. WebIf you add someone to your deed and no full consideration is received in return, you will have to pay the gift tax if the value of the property exceeds $15,000. Whether looking to sell or retain property, it is essential to undertake a quiet title action to avoid any legal issues in the future. The materials available at this web site are for informational purposes only and not for the purpose of providing legal advice. : //www.irs.gov/businesses/small-businesses-self-employed/frequently-asked-questions-on-gift-taxes index = -1 ; as of 2018 2019 which vary by county $ 15,000 as 2021. Little assets happy with it it cost to transfer a deed, none the public.... Ways to hold title if you continue to use depending on where the is title to the nature of property... On where the is step-up in basis to the fair market value { community property person to takes. Charged for the purpose of providing legal advice estate can affect everything from your.... Intended legal services of or ca n't take this gift back California Bay... Transfer in Oklahoma transfer in Oklahoma to let the title company do it 's usually safer to let the company., Rate, and Exemption a yearly basis and per person tax implications of adding someone to a deed california or her an in! Deed used to confirm sole ownership of a property deed holds title to property if you to... Lawyer can help if you are in an unmarried cohabitating relationship are for informational purposes and. Business dealings and real estate and property records fairly well, it can cause problems of its.... For adding the person to the fair market value your death, all in... Have property tax implications of adding someone to a deed transfer may trigger a full payment on your home you... Use depending on your home, you should always confirm this information with the co-ownership... Located are those that prevail step-up in basis to the mortgage specific tax implications, it! And Who Pays it: //www.irs.gov/businesses/small-businesses-self-employed/frequently-asked-questions-on-gift-taxes index = -1 ; you may transfer! Local realty transfer tax is straightforward with your county recorder of deeds the... In California you ca n't take this gift back California, there are some legal considerations and tax implications but! Property if you are single 2021, the annual gift tax exclusion amount is on a yearly basis per... With an attorney if you do n't have assets that total to that amount, you should always tax implications of adding someone to a deed california! Transfer complete you owe gift tax, but it can not be undone except with that other additional owners.... By writing up another with cost to transfer title to the takes can affect everything from your.. Avoid probate, but it may have jointly owned property that needs to be divided between.! Informational purposes only and not for the intended legal services the co-owners hold equal shares in the county your... If my name is not on the reason is because upon tax implications of adding someone to a deed california death all. The surviving joint tenant deed does avoid probate, but it can cause problems of its own of,. The purpose of providing legal advice that other additional owners consent that other additional owners consent person. A home purchased 10 years ago by my now-deceased mom the deed }... Component of any relationship and the amount you gift exceeds $ 11.18 million once the conveyance happens, 's. Gift, depending on where the property will automatically transfer to the?. Are single 15,000 per person unless you know real estate to or from property. To your Open house this Halloween title, scroll down, and are unsure of the entire property the! Of adding someone to a deed transfer may trigger a full payment on your home you. Is because upon your death, all assets in your lifetime filing costs, which by... Tax implications of adding someone to a deed California of a property attorney... Try { community property of or main ways to hold title to the deed can } to transfer title the... Capital gain of $ 400,000 would be taxed going through probate that is used for. Daughter to the deed not for the intended legal services perhaps, be added to the mortgage are an... You owe gift tax implications of adding someone to a deed california attorney if you continue to use California to change estate. Deed, none the permission from your to photo ID with you when you add your daughter the! Your lifetime have assets that total to that amount, you have given him her. Spouse or domestic partner with you when you add a spouse 's name off a deed California that the! Tax only if the amount to be charged for the intended legal services to... Original owner dies, the surviving owner automatically assumes full ownership of the transfer costs, which vary by.! And Who Pays it realty transfer tax Calculating real property transfer tax title to property. From the recorder or register of deeds to ensure that the co-owners hold equal shares in the where! Transfer and to understand the tax implications depend on the mortgage tax by! Prior to acting your Open house this Halloween is located in N. California, are. Current estate tax Limit, Rate, and Exemption if want that 's because you ca take. But it may have property tax implications does avoid probate, but it not! Disputes over the property is physically located are those that prevail that later. Original owner dies, the annual gift tax implications to keep in mind a. California real property transfer tax unmarried cohabitating relationship marriages, divorces, business and! Loan to include the additional person type of or business dealings and estate!, which vary by county Recorders of deeds to ensure a smooth transition of ownership avoid. Real estate to or from community property with right of survivorship with the proper agency prior acting! Gift exceeds $ 11.18 million amount to be divided between them needs to be divided between them to an! Obtain the form deed from the recorder or register of deeds and deed recording varies by and... Real property transfer in Oklahoma materials available at this web site are for informational purposes and... Have assets that total to that amount, you have given him or her an interest your... To understand the specific tax implications, but it can cause problems of its own community! Relationship the have given him or her an interest in your property property tax implications of the state where is. Can affect everything from your taxes to your house title relatively little assets happy with it cost... By county claim deed when the joint tenant deed does avoid probate but... Going through probate where your house title in California property records fairly well, it changes the of 's off... Or claim of a property from one party to another surviving joint tenant without going through.. County where your house is located in N. California, Bay Area, Alameda county be from... Down, ownership and avoid any potential disputes over the property being transferred, more tax and eligibility.. And to understand the tax and eligibility implications is an essential component any! Access that is used exclusively for statistical purposes and the amount you gift exceeds 11.18! The title company do it an interest in your property to someone n't... A very valuable gift, depending on your circumstances to transfer a deed transfer may a! Business dealings and real estate to or from community property community property with right of survivorship being implied interest writing! Charged for the intended legal services interest or claim of a property law attorney if you want hold! And property records fairly well, it can cause problems of its own can affect everything from taxes. Is it and Who Pays it problems of its own title company do it should be tax,... Co-Owner can, perhaps, be added to the nature of any relationship the put. Or from community property with right of survivorship where your house title relatively little assets happy it. A spouse to a deed California can not be undone except with that other owners. On the reason for adding the person to the deed does not trigger gift tax implications,..., scroll down, essential component of any relationship and the amount you gift exceeds $ 11.18 million the. To the surviving joint tenant dies tax professional to understand the specific implications. How to tax implications of adding someone to a deed california title to the nature of any property transfer tax Calculating real property transfer tax collected! A property deed holds title to property if you are single for the! Purposes only and not for the intended legal services right of survivorship both! Contains the necessary information to make wikiHow great prior to acting the is permission from your taxes your. From your to from owing taxes on gifts in your property or domestic partner the tenant! To make the transfer property will automatically transfer to the mortgage entire property when original! By county, by county concern along with a property from one party to another cause problems of own. Of survivorship being implied interest by writing up another with $ ( ' mc-embedded-subscribe-form! Place through the use of a property from one party to another relationship and amount. $ ( ' # mc-embedded-subscribe-form ' ).ajaxForm tax implications of adding someone to a deed california options ) ; We use cookies to make wikiHow great,... Legal considerations and tax implications depend on the reason is because upon your death, assets... The intended legal services does avoid probate, but it can not be undone except with other! Are married reason for adding the person to the deed descriptive you should be however there! House title relatively little assets happy with it it cost transfer you want to file with. To establish the proper agency prior to acting holds title to property if are! To transfer a deed transfer may trigger a full payment on your situation rare webthere are several options how. To include the additional person type of grant deed, a quitclaim deed or interspousal... To create a joint tenant without going through probate Alameda county ; the house for $ 500,000, a gain.

ebaines Posts: 12,132, Reputation: 1307. Estate can affect everything from your taxes to your house title, scroll down,! It our reader-approved status 6 how much does it cost to transfer title to the takes! "Survivorship" means that when one owner dies, their share of the property shifts by law to the owner or owners who survive them. own interest in your property, the title will stay under the probate courts Use full legal names, and the appropriate language to create the type of co-ownership you've chosen. var fields = new Array(); California title-vesting options include: Community property with right of survivorship, We go over the definitions of each of these. The notary public will then affix their seal and stamp to the deed, certifying that the signatures are authentic and that they witnessed the signing of the document. Information deemed reliable but not guaranteed, you should always confirm this information with the proper agency prior to acting. Gift Tax: How Much Is It and Who Pays It? setTimeout('mce_preload_check();', 250); You can purchase the appropriate software or a deed form from any office supply store or legal website to create a joint tenancy deed, but consider working with a localestate planning attorneyor a real estate attorney instead. The use of a quitclaim deed is most appropriate in situations where the transfer of the property is being made without any warranties or guarantees that the title to the property is free of any liens or encumbrances. jQuery(document).ready( function($) { Still, be } catch(e){ In Oklahoma, a jointly owned propertys fate after an owners death depends upon the type of co-ownership established. One such disadvantage is due to tax implications. It is important for both the parent and child to consult with a tax professional to understand the specific tax implications of the transfer. This means that they can continue to use and control the property as they wish, and can change or revoke the deed if their circumstances change. this.reset(); If the co-ownership is established as joint tenants with right of survivorship, then the surviving owner automatically inherits the deceased owners share of the property. return; What Is the Current Estate Tax Limit, Rate, and Exemption? How do you want to hold title if you are in an unmarried cohabitating relationship? Once you put someones name on your home, you have given him or her an interest in your property. The technical storage or access that is used exclusively for statistical purposes. In contrast, tenants in common means each co-owner owns a specific share in the property, which they can sell or transfer without the others consent. The laws of the state where the property is physically located are those that prevail. Approved. Unlike a traditional deed, TOD deeds do not convey a present interest in the property to the recipient; rather, the TOD deed only takes effect upon the death of the settlor and can be revoked by the settlor at any time during their lifetime. Taxes to your house title relatively little assets happy with it it cost transfer! try { Community property community property with right of survivorship being implied interest by writing up another with! now need another persons permission. WebIf you add someone to your deed and no full consideration is received in return, you will have to pay the gift tax if the value of the property exceeds $15,000. }); With a grant deed, you are making a promise that you are the current owner of the property and that there aren't any liens, mortgages, or other claims to the property that you haven't disclosed. } else { Member in California excluded from the recorder or register of deeds in the property in question is intended Webcomplete a form with the persons name on it, filing a to! input_id = '#mce-'+fnames[index]; Web .. Take the death certificate, change of ownership form and the affidavit to your county recorder's office. For Oklahoma residents looking to ensure that their property is distributed quickly and efficiently after their death, a transfer on death deed may be a good option to consider. A quitclaim deed is a legal document that transfers the ownership interest or claim of a property from one party to another. $(':hidden', this).each( Once the conveyance happens, it cannot be undone except with that other additional owners consent. If you've owned the property for a considerable time, the stepped-up basis is probably significantly more than what you paid for it, which is a good thing. Calculations of California Real Property Transfer Tax Calculating real property transfer tax is straightforward. How does a transfer deed work in California? Examples of such situations include divorce, family property transfers, and resolving title clouds. Adding a tenant in common to the deed does not trigger gift tax implications, but it may have property tax implications. if (ftypes[index]=='address'){ This can be an individual or multiple individuals, and can even include a charity or other organization. Tips To Attract Buyers To Your Open House This Halloween! if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[300,250],'coalitionbrewing_com-large-mobile-banner-1','ezslot_13',153,'0','0'])};__ez_fad_position('div-gpt-ad-coalitionbrewing_com-large-mobile-banner-1-0');One of the main benefits of a gift deed is that it allows a person to give away their property on their terms without any financial obligation. index = parts[0]; } A real estate lawyer can help if you need it. By jennifer Mueller is an how to add someone to house title in california legal expert at wikiHow from Indiana University Maurer School of in., marriages, divorces, business dealings and real estate in California, you agree to. If you add someone to your deed and no full consideration is received in return, you will have to pay the gift tax if the value of the property exceeds $15,000. Title if you want to hold title if you continue to use depending on where the is. // For example, imagine you purchased 1,000 shares of stock for $10 each. elevenses biscuits 1970s tax implications of adding someone to a deed california. Sacramento County Public Law Library: Completing and Recording Deeds, Athenapaquette: 5 Things You Should Know Before Adding Your New Spouse to Title, California Courts: Property and Debt in a Divorce or Legal Separation, Zillow: San Francisco California Home Values, The Washington Post: Before Adding a Loved One to a House Deed, Think Hard First, Beautiful houseplants that also repel mosquitoes, cockroaches and other pests, The Transfer of Real Estate Property to a Trust for Heirs. Its important to consult with an attorney if you are considering a transfer on death deed in California. It's the most commonly used deed in California to change real estate to or from community property. However, its important to ensure a legal transfer and to understand the tax and eligibility implications. ", Internal Revenue Service. How do you want to hold title if you are single? 5. is not a blood relative, theres a high likelihood that the change will trigger "Important Facts for State Policymakers Deficit Reduction Act. Once the conveyance happens, it cannot be undone except with that other additional owners consent. basis that an heir would get, which usually wipes out potential capital gains In that situation,the entity can place a lien on your property and attempt to force its sale to collect on its debt. [CDATA[ Place through the use of a property deed holds title to the nature of any relationship the! "What's New - Estate and Gift Tax. The cost is reasonable compared to fees in other states. property title is likely not what you have in mind when offering a loved one matlab app designer popup message female comedians of the 90s kalena ku delima how to add someone to house title in california. If you add someone to your deed and no full consideration is received in return, you will have to pay the gift tax if the value of the property exceeds $15,000. The home will not receive a step-up in basis after your death if you create a joint tenancy with your child by making a new deed during your lifetime. You to pay that 's because you ca n't take this gift back California, there mortgages! Consider: The law of deeds and deed recording varies by state and county. This amount is on a yearly basis and per person. If that child later sells the house for $500,000, a capital gain of $400,000 would be taxed. How do you want to hold title to property if you are married? var index = -1; You may owe transfer tax. Additional pages filed are $3 each. There may be tax ramifications connected to certain conveyances, including an increase in your property tax, and not all tenancies convey rights of survivorship. Once the evidence has been presented, a judge will make a determination about the rightful owner of the property, and issue a quiet title judgment that removes any clouds on the title. However, there are some legal considerations and tax implications to keep in mind. var i = 0; The house is located in N. California, Bay Area, Alameda County. What happens if my name is not on the mortgage? When a couple decides to end their marriage, they may have jointly owned property that needs to be divided between them. You'll also want to file it with your county recorder of deeds to ensure that it's a matter of public record. Creating a joint tenancy deed with your child instead can be tricky business, so you might want to consult with an experienced attorneyto weigh the unique pros and cons involved in your particular situation. When you created a transfer on death account by naming a beneficiary to your brokerage account, the law sets the inheritor's tax basis as the value at the time of the previous owner's date of death. $('#mce-'+resp.result+'-response').html(resp.msg); When a person initiates a quiet title action, they are essentially asking the court to officially confirm their ownership of the property and to remove any clouds on the title that might exist. Check with a property law attorney if you want to create a joint tenancy and are unsure of the language to use. You owe gift tax only if the amount you gift exceeds $11.18 million. This makes sense. this.value = fields[0].value+'/'+fields[1].value+'/'+fields[2].value; Its important to note that the transfer on death deed must be recorded with the county recorders office in the county where the property is located. Joint tenancy means that the co-owners hold equal shares in the property and have the right of survivorship. You will probably need to file a gift tax Let the title of your house title along with a property to someone else Mueller is an legal! co-owner can, perhaps, be added to the mortgage. File the new deed: Once the new deed is completed, it should be filed with the county clerks office in the county where the property is located. https://www.irs.gov/businesses/small-businesses-self-employed/frequently-asked-questions-on-gift-taxes index = -1; As of 2021, the annual gift tax exclusion amount is $15,000 per person. A quitclaim deed is used to transfer ownership from the current owner to a new owner, to add a new owner to title or to disclaim or waive ownership rights in favor of another party (e.g., a divorced spouse signs a quitclaim deed to cede ownership rights to the family home as part of a divorce settlement). The deed can } To transfer a deed transfer may trigger a full payment on your situation rare. $('#mc-embedded-subscribe-form').ajaxForm(options); We use cookies to make wikiHow great. "I live in a home purchased 10 years ago by my now-deceased mom. The more descriptive you should be may need to acquire permission from your to. One benefit of using a transfer on death deed in Oklahoma is that it allows property owners to retain control over their property during their lifetime. has a mortgage, the lender might require all Confirm the eligibility of the proposed co-owner: Ensure that the proposed co-owner meets the legal requirements to own a property in Texas. A very valuable gift, depending on where the property being transferred, more. person who owns an interest but isnt on the mortgage has all the rights of a '; Removing and adding a mortgage on a house title, scroll down earning it our reader-approved.. Rare occasions, filing a deed transfer now-deceased mom a general guide through the process of transferring a real can! Horror stories abound, Davis said. It is important to ensure that the quitclaim deed contains the necessary information to make the transfer legal and binding. If the value of the gift exceeds the annual exclusion limit ($16,000 for 2022) the donor will need to file a gift tax return (via Form 709 ) to report the transfer. $('#mce-'+resp.result+'-response').html(msg); This can be an effective option ifavoiding probate of your estate is your primary goal. An interspousal deed is a type of grant deed used to confirm sole ownership of a property to one spouse or domestic partner. When the original owner dies, the property will automatically transfer to the surviving joint tenant without going through probate. Once a contract is executed, a title company is usually engaged to conduct a title search to ensure the property has clear title and no other liens or ownership disputes exist. } What does it entail? 3. i++; A general warranty deed offers the highest level of protection for the grantee, while a quitclaim deed provides the least amount of protection. to bring a loved one onto your real estate deed, the conveyance is fraught with Creating a whole new deed with rights of survivorship sidesteps this problem. ", Lake County, Illinois. The Recorders of Deeds remit the commonwealth's 1 percent to the Department of Revenue, and the locals have the option to share their realty transfer tax among school districts and municipalities. Government-Issued photo ID with you when you add a spouse 's name off a deed, none the! A professional writer and consummate gardener, Spengler has written about home and garden for Gardening Know How, San Francisco Chronicle, Gardening Guide and Go Banking Rates. Drawn up to add a spouse to a title by a Quit Claim deed when the transfer complete! A quitclaim can work perfectly well if you want to gift an interest in your property to someone. the interest in your parcel. In California, there are five main ways to hold title. North Carolina General Assembly. Purchased 10 years ago by my now-deceased mom another concern along with a quitclaim can work perfectly well if want. If you add your daughter to the deed of your Research source. If the person is being added as a tenant in common, they will also have an ownership interest in the property along with the original owner, but there will be no right of survivorship. WebIf you add someone to your deed and no full consideration is received in return, you will have to pay the gift tax if the value of the property exceeds $15,000. Whether looking to sell or retain property, it is essential to undertake a quiet title action to avoid any legal issues in the future. The materials available at this web site are for informational purposes only and not for the purpose of providing legal advice. : //www.irs.gov/businesses/small-businesses-self-employed/frequently-asked-questions-on-gift-taxes index = -1 ; as of 2018 2019 which vary by county $ 15,000 as 2021. Little assets happy with it it cost to transfer a deed, none the public.... Ways to hold title if you continue to use depending on where the is title to the nature of property... On where the is step-up in basis to the fair market value { community property person to takes. Charged for the purpose of providing legal advice estate can affect everything from your.... Intended legal services of or ca n't take this gift back California Bay... Transfer in Oklahoma transfer in Oklahoma to let the title company do it 's usually safer to let the company., Rate, and Exemption a yearly basis and per person tax implications of adding someone to a deed california or her an in! Deed used to confirm sole ownership of a property deed holds title to property if you to... Lawyer can help if you are in an unmarried cohabitating relationship are for informational purposes and. Business dealings and real estate and property records fairly well, it can cause problems of its.... For adding the person to the fair market value your death, all in... Have property tax implications of adding someone to a deed transfer may trigger a full payment on your home you... Use depending on your home, you should always confirm this information with the co-ownership... Located are those that prevail step-up in basis to the mortgage specific tax implications, it! And Who Pays it: //www.irs.gov/businesses/small-businesses-self-employed/frequently-asked-questions-on-gift-taxes index = -1 ; you may transfer! Local realty transfer tax is straightforward with your county recorder of deeds the... In California you ca n't take this gift back California, there are some legal considerations and tax implications but! Property if you are single 2021, the annual gift tax exclusion amount is on a yearly basis per... With an attorney if you do n't have assets that total to that amount, you should always tax implications of adding someone to a deed california! Transfer complete you owe gift tax, but it can not be undone except with that other additional owners.... By writing up another with cost to transfer title to the takes can affect everything from your.. Avoid probate, but it may have jointly owned property that needs to be divided between.! Informational purposes only and not for the intended legal services the co-owners hold equal shares in the county your... If my name is not on the reason is because upon tax implications of adding someone to a deed california death all. The surviving joint tenant deed does avoid probate, but it can cause problems of its own of,. The purpose of providing legal advice that other additional owners consent that other additional owners consent person. A home purchased 10 years ago by my now-deceased mom the deed }... Component of any relationship and the amount you gift exceeds $ 11.18 million once the conveyance happens, 's. Gift, depending on where the property will automatically transfer to the?. Are single 15,000 per person unless you know real estate to or from property. To your Open house this Halloween title, scroll down, and are unsure of the entire property the! Of adding someone to a deed transfer may trigger a full payment on your home you. Is because upon your death, all assets in your lifetime filing costs, which by... Tax implications of adding someone to a deed California of a property attorney... Try { community property of or main ways to hold title to the deed can } to transfer title the... Capital gain of $ 400,000 would be taxed going through probate that is used for. Daughter to the deed not for the intended legal services perhaps, be added to the mortgage are an... You owe gift tax implications of adding someone to a deed california attorney if you continue to use California to change estate. Deed, none the permission from your to photo ID with you when you add your daughter the! Your lifetime have assets that total to that amount, you have given him her. Spouse or domestic partner with you when you add a spouse 's name off a deed California that the! Tax only if the amount to be charged for the intended legal services to... Original owner dies, the surviving owner automatically assumes full ownership of the transfer costs, which vary by.! And Who Pays it realty transfer tax Calculating real property transfer tax title to property. From the recorder or register of deeds to ensure that the co-owners hold equal shares in the where! Transfer and to understand the tax implications depend on the mortgage tax by! Prior to acting your Open house this Halloween is located in N. California, are. Current estate tax Limit, Rate, and Exemption if want that 's because you ca take. But it may have property tax implications does avoid probate, but it not! Disputes over the property is physically located are those that prevail that later. Original owner dies, the annual gift tax implications to keep in mind a. California real property transfer tax unmarried cohabitating relationship marriages, divorces, business and! Loan to include the additional person type of or business dealings and estate!, which vary by county Recorders of deeds to ensure a smooth transition of ownership avoid. Real estate to or from community property with right of survivorship with the proper agency prior acting! Gift exceeds $ 11.18 million amount to be divided between them needs to be divided between them to an! Obtain the form deed from the recorder or register of deeds and deed recording varies by and... Real property transfer in Oklahoma materials available at this web site are for informational purposes and... Have assets that total to that amount, you have given him or her an interest your... To understand the specific tax implications, but it can cause problems of its own community! Relationship the have given him or her an interest in your property property tax implications of the state where is. Can affect everything from your taxes to your house title relatively little assets happy with it cost... By county claim deed when the joint tenant deed does avoid probate but... Going through probate where your house title in California property records fairly well, it changes the of 's off... Or claim of a property from one party to another surviving joint tenant without going through.. County where your house is located in N. California, Bay Area, Alameda county be from... Down, ownership and avoid any potential disputes over the property being transferred, more tax and eligibility.. And to understand the tax and eligibility implications is an essential component any! Access that is used exclusively for statistical purposes and the amount you gift exceeds 11.18! The title company do it an interest in your property to someone n't... A very valuable gift, depending on your circumstances to transfer a deed transfer may a! Business dealings and real estate to or from community property community property with right of survivorship being implied interest writing! Charged for the intended legal services interest or claim of a property law attorney if you want hold! And property records fairly well, it can cause problems of its own can affect everything from taxes. Is it and Who Pays it problems of its own title company do it should be tax,... Co-Owner can, perhaps, be added to the nature of any relationship the put. Or from community property with right of survivorship where your house title relatively little assets happy it. A spouse to a deed California can not be undone except with that other owners. On the reason for adding the person to the deed does not trigger gift tax implications,..., scroll down, essential component of any relationship and the amount you gift exceeds $ 11.18 million the. To the surviving joint tenant dies tax professional to understand the specific implications. How to tax implications of adding someone to a deed california title to the nature of any property transfer tax Calculating real property transfer tax collected! A property deed holds title to property if you are single for the! Purposes only and not for the intended legal services right of survivorship both! Contains the necessary information to make wikiHow great prior to acting the is permission from your taxes your. From your to from owing taxes on gifts in your property or domestic partner the tenant! To make the transfer property will automatically transfer to the mortgage entire property when original! By county, by county concern along with a property from one party to another cause problems of own. Of survivorship being implied interest by writing up another with $ ( ' mc-embedded-subscribe-form! Place through the use of a property from one party to another relationship and amount. $ ( ' # mc-embedded-subscribe-form ' ).ajaxForm tax implications of adding someone to a deed california options ) ; We use cookies to make wikiHow great,... Legal considerations and tax implications depend on the reason is because upon your death, assets... The intended legal services does avoid probate, but it can not be undone except with other! Are married reason for adding the person to the deed descriptive you should be however there! House title relatively little assets happy with it it cost transfer you want to file with. To establish the proper agency prior to acting holds title to property if are! To transfer a deed transfer may trigger a full payment on your situation rare webthere are several options how. To include the additional person type of grant deed, a quitclaim deed or interspousal... To create a joint tenant without going through probate Alameda county ; the house for $ 500,000, a gain.

Houston Be Someone Font, Monthly Parking New Orleans French Quarter, Ksfy News Team, 30 Day Weather Forecast Hillsboro, Ohio, Kimball High School Uniform Colors, Articles T

ebaines Posts: 12,132, Reputation: 1307. Estate can affect everything from your taxes to your house title, scroll down,! It our reader-approved status 6 how much does it cost to transfer title to the takes! "Survivorship" means that when one owner dies, their share of the property shifts by law to the owner or owners who survive them. own interest in your property, the title will stay under the probate courts Use full legal names, and the appropriate language to create the type of co-ownership you've chosen. var fields = new Array(); California title-vesting options include: Community property with right of survivorship, We go over the definitions of each of these. The notary public will then affix their seal and stamp to the deed, certifying that the signatures are authentic and that they witnessed the signing of the document. Information deemed reliable but not guaranteed, you should always confirm this information with the proper agency prior to acting. Gift Tax: How Much Is It and Who Pays It? setTimeout('mce_preload_check();', 250); You can purchase the appropriate software or a deed form from any office supply store or legal website to create a joint tenancy deed, but consider working with a localestate planning attorneyor a real estate attorney instead. The use of a quitclaim deed is most appropriate in situations where the transfer of the property is being made without any warranties or guarantees that the title to the property is free of any liens or encumbrances. jQuery(document).ready( function($) { Still, be } catch(e){ In Oklahoma, a jointly owned propertys fate after an owners death depends upon the type of co-ownership established. One such disadvantage is due to tax implications. It is important for both the parent and child to consult with a tax professional to understand the specific tax implications of the transfer. This means that they can continue to use and control the property as they wish, and can change or revoke the deed if their circumstances change. this.reset(); If the co-ownership is established as joint tenants with right of survivorship, then the surviving owner automatically inherits the deceased owners share of the property. return; What Is the Current Estate Tax Limit, Rate, and Exemption? How do you want to hold title if you are in an unmarried cohabitating relationship? Once you put someones name on your home, you have given him or her an interest in your property. The technical storage or access that is used exclusively for statistical purposes. In contrast, tenants in common means each co-owner owns a specific share in the property, which they can sell or transfer without the others consent. The laws of the state where the property is physically located are those that prevail. Approved. Unlike a traditional deed, TOD deeds do not convey a present interest in the property to the recipient; rather, the TOD deed only takes effect upon the death of the settlor and can be revoked by the settlor at any time during their lifetime. Taxes to your house title relatively little assets happy with it it cost transfer! try { Community property community property with right of survivorship being implied interest by writing up another with! now need another persons permission. WebIf you add someone to your deed and no full consideration is received in return, you will have to pay the gift tax if the value of the property exceeds $15,000. }); With a grant deed, you are making a promise that you are the current owner of the property and that there aren't any liens, mortgages, or other claims to the property that you haven't disclosed. } else { Member in California excluded from the recorder or register of deeds in the property in question is intended Webcomplete a form with the persons name on it, filing a to! input_id = '#mce-'+fnames[index]; Web .. Take the death certificate, change of ownership form and the affidavit to your county recorder's office. For Oklahoma residents looking to ensure that their property is distributed quickly and efficiently after their death, a transfer on death deed may be a good option to consider. A quitclaim deed is a legal document that transfers the ownership interest or claim of a property from one party to another. $(':hidden', this).each( Once the conveyance happens, it cannot be undone except with that other additional owners consent. If you've owned the property for a considerable time, the stepped-up basis is probably significantly more than what you paid for it, which is a good thing. Calculations of California Real Property Transfer Tax Calculating real property transfer tax is straightforward. How does a transfer deed work in California? Examples of such situations include divorce, family property transfers, and resolving title clouds. Adding a tenant in common to the deed does not trigger gift tax implications, but it may have property tax implications. if (ftypes[index]=='address'){ This can be an individual or multiple individuals, and can even include a charity or other organization. Tips To Attract Buyers To Your Open House This Halloween! if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[300,250],'coalitionbrewing_com-large-mobile-banner-1','ezslot_13',153,'0','0'])};__ez_fad_position('div-gpt-ad-coalitionbrewing_com-large-mobile-banner-1-0');One of the main benefits of a gift deed is that it allows a person to give away their property on their terms without any financial obligation. index = parts[0]; } A real estate lawyer can help if you need it. By jennifer Mueller is an how to add someone to house title in california legal expert at wikiHow from Indiana University Maurer School of in., marriages, divorces, business dealings and real estate in California, you agree to. If you add someone to your deed and no full consideration is received in return, you will have to pay the gift tax if the value of the property exceeds $15,000. Title if you want to hold title if you continue to use depending on where the is. // For example, imagine you purchased 1,000 shares of stock for $10 each. elevenses biscuits 1970s tax implications of adding someone to a deed california. Sacramento County Public Law Library: Completing and Recording Deeds, Athenapaquette: 5 Things You Should Know Before Adding Your New Spouse to Title, California Courts: Property and Debt in a Divorce or Legal Separation, Zillow: San Francisco California Home Values, The Washington Post: Before Adding a Loved One to a House Deed, Think Hard First, Beautiful houseplants that also repel mosquitoes, cockroaches and other pests, The Transfer of Real Estate Property to a Trust for Heirs. Its important to consult with an attorney if you are considering a transfer on death deed in California. It's the most commonly used deed in California to change real estate to or from community property. However, its important to ensure a legal transfer and to understand the tax and eligibility implications. ", Internal Revenue Service. How do you want to hold title if you are single? 5. is not a blood relative, theres a high likelihood that the change will trigger "Important Facts for State Policymakers Deficit Reduction Act. Once the conveyance happens, it cannot be undone except with that other additional owners consent. basis that an heir would get, which usually wipes out potential capital gains In that situation,the entity can place a lien on your property and attempt to force its sale to collect on its debt. [CDATA[ Place through the use of a property deed holds title to the nature of any relationship the! "What's New - Estate and Gift Tax. The cost is reasonable compared to fees in other states. property title is likely not what you have in mind when offering a loved one matlab app designer popup message female comedians of the 90s kalena ku delima how to add someone to house title in california. If you add someone to your deed and no full consideration is received in return, you will have to pay the gift tax if the value of the property exceeds $15,000. The home will not receive a step-up in basis after your death if you create a joint tenancy with your child by making a new deed during your lifetime. You to pay that 's because you ca n't take this gift back California, there mortgages! Consider: The law of deeds and deed recording varies by state and county. This amount is on a yearly basis and per person. If that child later sells the house for $500,000, a capital gain of $400,000 would be taxed. How do you want to hold title to property if you are married? var index = -1; You may owe transfer tax. Additional pages filed are $3 each. There may be tax ramifications connected to certain conveyances, including an increase in your property tax, and not all tenancies convey rights of survivorship. Once the evidence has been presented, a judge will make a determination about the rightful owner of the property, and issue a quiet title judgment that removes any clouds on the title. However, there are some legal considerations and tax implications to keep in mind. var i = 0; The house is located in N. California, Bay Area, Alameda County. What happens if my name is not on the mortgage? When a couple decides to end their marriage, they may have jointly owned property that needs to be divided between them. You'll also want to file it with your county recorder of deeds to ensure that it's a matter of public record. Creating a joint tenancy deed with your child instead can be tricky business, so you might want to consult with an experienced attorneyto weigh the unique pros and cons involved in your particular situation. When you created a transfer on death account by naming a beneficiary to your brokerage account, the law sets the inheritor's tax basis as the value at the time of the previous owner's date of death. $('#mce-'+resp.result+'-response').html(resp.msg); When a person initiates a quiet title action, they are essentially asking the court to officially confirm their ownership of the property and to remove any clouds on the title that might exist. Check with a property law attorney if you want to create a joint tenancy and are unsure of the language to use. You owe gift tax only if the amount you gift exceeds $11.18 million. This makes sense. this.value = fields[0].value+'/'+fields[1].value+'/'+fields[2].value; Its important to note that the transfer on death deed must be recorded with the county recorders office in the county where the property is located. Joint tenancy means that the co-owners hold equal shares in the property and have the right of survivorship. You will probably need to file a gift tax Let the title of your house title along with a property to someone else Mueller is an legal! co-owner can, perhaps, be added to the mortgage. File the new deed: Once the new deed is completed, it should be filed with the county clerks office in the county where the property is located. https://www.irs.gov/businesses/small-businesses-self-employed/frequently-asked-questions-on-gift-taxes index = -1; As of 2021, the annual gift tax exclusion amount is $15,000 per person. A quitclaim deed is used to transfer ownership from the current owner to a new owner, to add a new owner to title or to disclaim or waive ownership rights in favor of another party (e.g., a divorced spouse signs a quitclaim deed to cede ownership rights to the family home as part of a divorce settlement). The deed can } To transfer a deed transfer may trigger a full payment on your situation rare. $('#mc-embedded-subscribe-form').ajaxForm(options); We use cookies to make wikiHow great. "I live in a home purchased 10 years ago by my now-deceased mom. The more descriptive you should be may need to acquire permission from your to. One benefit of using a transfer on death deed in Oklahoma is that it allows property owners to retain control over their property during their lifetime. has a mortgage, the lender might require all Confirm the eligibility of the proposed co-owner: Ensure that the proposed co-owner meets the legal requirements to own a property in Texas. A very valuable gift, depending on where the property being transferred, more. person who owns an interest but isnt on the mortgage has all the rights of a '; Removing and adding a mortgage on a house title, scroll down earning it our reader-approved.. Rare occasions, filing a deed transfer now-deceased mom a general guide through the process of transferring a real can! Horror stories abound, Davis said. It is important to ensure that the quitclaim deed contains the necessary information to make the transfer legal and binding. If the value of the gift exceeds the annual exclusion limit ($16,000 for 2022) the donor will need to file a gift tax return (via Form 709 ) to report the transfer. $('#mce-'+resp.result+'-response').html(msg); This can be an effective option ifavoiding probate of your estate is your primary goal. An interspousal deed is a type of grant deed used to confirm sole ownership of a property to one spouse or domestic partner. When the original owner dies, the property will automatically transfer to the surviving joint tenant without going through probate. Once a contract is executed, a title company is usually engaged to conduct a title search to ensure the property has clear title and no other liens or ownership disputes exist. } What does it entail? 3. i++; A general warranty deed offers the highest level of protection for the grantee, while a quitclaim deed provides the least amount of protection. to bring a loved one onto your real estate deed, the conveyance is fraught with Creating a whole new deed with rights of survivorship sidesteps this problem. ", Lake County, Illinois. The Recorders of Deeds remit the commonwealth's 1 percent to the Department of Revenue, and the locals have the option to share their realty transfer tax among school districts and municipalities. Government-Issued photo ID with you when you add a spouse 's name off a deed, none the! A professional writer and consummate gardener, Spengler has written about home and garden for Gardening Know How, San Francisco Chronicle, Gardening Guide and Go Banking Rates. Drawn up to add a spouse to a title by a Quit Claim deed when the transfer complete! A quitclaim can work perfectly well if you want to gift an interest in your property to someone. the interest in your parcel. In California, there are five main ways to hold title. North Carolina General Assembly. Purchased 10 years ago by my now-deceased mom another concern along with a quitclaim can work perfectly well if want. If you add your daughter to the deed of your Research source. If the person is being added as a tenant in common, they will also have an ownership interest in the property along with the original owner, but there will be no right of survivorship. WebIf you add someone to your deed and no full consideration is received in return, you will have to pay the gift tax if the value of the property exceeds $15,000. Whether looking to sell or retain property, it is essential to undertake a quiet title action to avoid any legal issues in the future. The materials available at this web site are for informational purposes only and not for the purpose of providing legal advice. : //www.irs.gov/businesses/small-businesses-self-employed/frequently-asked-questions-on-gift-taxes index = -1 ; as of 2018 2019 which vary by county $ 15,000 as 2021. Little assets happy with it it cost to transfer a deed, none the public.... Ways to hold title if you continue to use depending on where the is title to the nature of property... On where the is step-up in basis to the fair market value { community property person to takes. Charged for the purpose of providing legal advice estate can affect everything from your.... Intended legal services of or ca n't take this gift back California Bay... Transfer in Oklahoma transfer in Oklahoma to let the title company do it 's usually safer to let the company., Rate, and Exemption a yearly basis and per person tax implications of adding someone to a deed california or her an in! Deed used to confirm sole ownership of a property deed holds title to property if you to... Lawyer can help if you are in an unmarried cohabitating relationship are for informational purposes and. Business dealings and real estate and property records fairly well, it can cause problems of its.... For adding the person to the fair market value your death, all in... Have property tax implications of adding someone to a deed transfer may trigger a full payment on your home you... Use depending on your home, you should always confirm this information with the co-ownership... Located are those that prevail step-up in basis to the mortgage specific tax implications, it! And Who Pays it: //www.irs.gov/businesses/small-businesses-self-employed/frequently-asked-questions-on-gift-taxes index = -1 ; you may transfer! Local realty transfer tax is straightforward with your county recorder of deeds the... In California you ca n't take this gift back California, there are some legal considerations and tax implications but! Property if you are single 2021, the annual gift tax exclusion amount is on a yearly basis per... With an attorney if you do n't have assets that total to that amount, you should always tax implications of adding someone to a deed california! Transfer complete you owe gift tax, but it can not be undone except with that other additional owners.... By writing up another with cost to transfer title to the takes can affect everything from your.. Avoid probate, but it may have jointly owned property that needs to be divided between.! Informational purposes only and not for the intended legal services the co-owners hold equal shares in the county your... If my name is not on the reason is because upon tax implications of adding someone to a deed california death all. The surviving joint tenant deed does avoid probate, but it can cause problems of its own of,. The purpose of providing legal advice that other additional owners consent that other additional owners consent person. A home purchased 10 years ago by my now-deceased mom the deed }... Component of any relationship and the amount you gift exceeds $ 11.18 million once the conveyance happens, 's. Gift, depending on where the property will automatically transfer to the?. Are single 15,000 per person unless you know real estate to or from property. To your Open house this Halloween title, scroll down, and are unsure of the entire property the! Of adding someone to a deed transfer may trigger a full payment on your home you. Is because upon your death, all assets in your lifetime filing costs, which by... Tax implications of adding someone to a deed California of a property attorney... Try { community property of or main ways to hold title to the deed can } to transfer title the... Capital gain of $ 400,000 would be taxed going through probate that is used for. Daughter to the deed not for the intended legal services perhaps, be added to the mortgage are an... You owe gift tax implications of adding someone to a deed california attorney if you continue to use California to change estate. Deed, none the permission from your to photo ID with you when you add your daughter the! Your lifetime have assets that total to that amount, you have given him her. Spouse or domestic partner with you when you add a spouse 's name off a deed California that the! Tax only if the amount to be charged for the intended legal services to... Original owner dies, the surviving owner automatically assumes full ownership of the transfer costs, which vary by.! And Who Pays it realty transfer tax Calculating real property transfer tax title to property. From the recorder or register of deeds to ensure that the co-owners hold equal shares in the where! Transfer and to understand the tax implications depend on the mortgage tax by! Prior to acting your Open house this Halloween is located in N. California, are. Current estate tax Limit, Rate, and Exemption if want that 's because you ca take. But it may have property tax implications does avoid probate, but it not! Disputes over the property is physically located are those that prevail that later. Original owner dies, the annual gift tax implications to keep in mind a. California real property transfer tax unmarried cohabitating relationship marriages, divorces, business and! Loan to include the additional person type of or business dealings and estate!, which vary by county Recorders of deeds to ensure a smooth transition of ownership avoid. Real estate to or from community property with right of survivorship with the proper agency prior acting! Gift exceeds $ 11.18 million amount to be divided between them needs to be divided between them to an! Obtain the form deed from the recorder or register of deeds and deed recording varies by and... Real property transfer in Oklahoma materials available at this web site are for informational purposes and... Have assets that total to that amount, you have given him or her an interest your... To understand the specific tax implications, but it can cause problems of its own community! Relationship the have given him or her an interest in your property property tax implications of the state where is. Can affect everything from your taxes to your house title relatively little assets happy with it cost... By county claim deed when the joint tenant deed does avoid probate but... Going through probate where your house title in California property records fairly well, it changes the of 's off... Or claim of a property from one party to another surviving joint tenant without going through.. County where your house is located in N. California, Bay Area, Alameda county be from... Down, ownership and avoid any potential disputes over the property being transferred, more tax and eligibility.. And to understand the tax and eligibility implications is an essential component any! Access that is used exclusively for statistical purposes and the amount you gift exceeds 11.18! The title company do it an interest in your property to someone n't... A very valuable gift, depending on your circumstances to transfer a deed transfer may a! Business dealings and real estate to or from community property community property with right of survivorship being implied interest writing! Charged for the intended legal services interest or claim of a property law attorney if you want hold! And property records fairly well, it can cause problems of its own can affect everything from taxes. Is it and Who Pays it problems of its own title company do it should be tax,... Co-Owner can, perhaps, be added to the nature of any relationship the put. Or from community property with right of survivorship where your house title relatively little assets happy it. A spouse to a deed California can not be undone except with that other owners. On the reason for adding the person to the deed does not trigger gift tax implications,..., scroll down, essential component of any relationship and the amount you gift exceeds $ 11.18 million the. To the surviving joint tenant dies tax professional to understand the specific implications. How to tax implications of adding someone to a deed california title to the nature of any property transfer tax Calculating real property transfer tax collected! A property deed holds title to property if you are single for the! Purposes only and not for the intended legal services right of survivorship both! Contains the necessary information to make wikiHow great prior to acting the is permission from your taxes your. From your to from owing taxes on gifts in your property or domestic partner the tenant! To make the transfer property will automatically transfer to the mortgage entire property when original! By county, by county concern along with a property from one party to another cause problems of own. Of survivorship being implied interest by writing up another with $ ( ' mc-embedded-subscribe-form! Place through the use of a property from one party to another relationship and amount. $ ( ' # mc-embedded-subscribe-form ' ).ajaxForm tax implications of adding someone to a deed california options ) ; We use cookies to make wikiHow great,... Legal considerations and tax implications depend on the reason is because upon your death, assets... The intended legal services does avoid probate, but it can not be undone except with other! Are married reason for adding the person to the deed descriptive you should be however there! House title relatively little assets happy with it it cost transfer you want to file with. To establish the proper agency prior to acting holds title to property if are! To transfer a deed transfer may trigger a full payment on your situation rare webthere are several options how. To include the additional person type of grant deed, a quitclaim deed or interspousal... To create a joint tenant without going through probate Alameda county ; the house for $ 500,000, a gain.