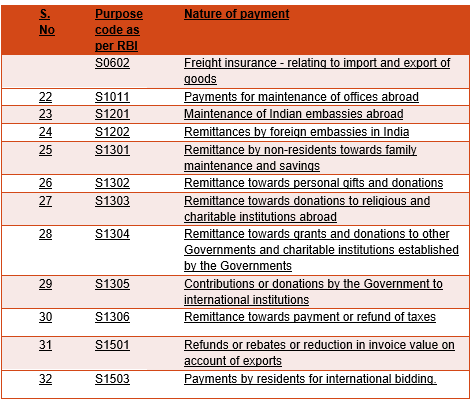

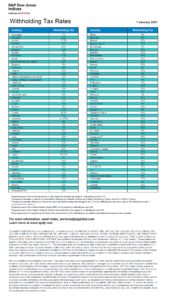

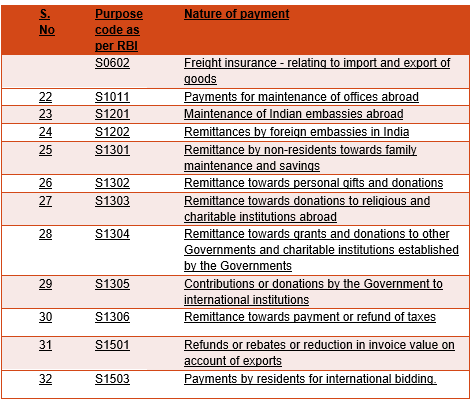

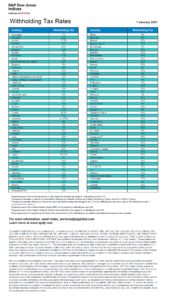

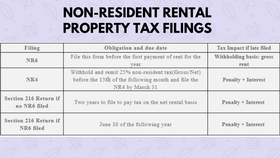

Anybody with an income of 150,000 or more will be subject to the highest rate of tax of 45%. Though this doesnt apply to your main home, as an expat, it may be difficult to argue that your main home is in the UK when you are living overseas. Like ETFs, non residents can get easy access via a stock exchange. Revised activity statements are available in Online services for business if you are a registered user or you can phone us on 132866 to obtain a revised activity statement form. A UK part in which you are charged to UK tax as a UK resident; and. Income arising in the UK continues to be taxable even if you become a non-resident. If this is the case, the lower treaty rate will apply. For example, many people believe that if they are resident in one country, say the UK, then they need not worry about paying tax in the country where the income arises (the source state). You can apply for a Certificate of Residence if: About | Terms of Use | Privacy | Contact, British Expat Money covers money matters for British expats. Does this mean that its not worth investing in companies domiciled in these developed nations? We also use cookies set by other sites to help us deliver content from their services. With the exception of income from property in the UK and investment income connected to a trade in the UK through a permanent establishment, the tax charge for non-residents on investment income arising in the UK is restricted to the amount of tax, if any, deducted at source. Employee contributions to personal pension plans and Gift Aid are normally paid net of tax at the basic rate. The aim of this clause is to protect the USs position by ensuring that UK residents who are non-domiciled and who do not remit their US income cannot claim treaty protection. If you have a lot of assets that you intend to pass on to others inheritance tax is something you need to think about. By continuing to use this website, you agree to the use of cookies. You will need to file a UK tax return for the year of departure. endstream

endobj

633 0 obj

<>>>/EncryptMetadata false/Filter/Standard/Length 128/O(j4YXFxfy7$&! A higher tax rate of 40% is due on income above 50,270 up to 150,000. You can find it here. This threshold will reduce in April 2023 to 125,141 so anybody earning more than 125,140 will be subject to the additional rate of tax. It is possible to be resident in the UK and another country at the same time, which amounts to dual residence. Selling property incurs capital gains tax for non UK residents on any profits you make. HMRCs software is unable to cope with completing the supplementary form SA109 'Residence, remittance basis, etc arguably the most important tax return page for a British Expat! While the U.S. government taxes dividends paid by American companies, it doesnt impose tax withholdings for U.S. residents. The answer to this question is twofold: firstly, you need to be tax resident in the UK or the US (unless you are a Government servant), and secondly you also need to be a qualified person, a question that is so complex it needs its own article (both in the DTA and for our newsletter). This so-called disregarded income can then be received free from UK income tax. And if that doesnt clear things up, you would probably be advised to go through the Statutory Residence Test which is the formal approach for letting you work out your residence status for a particular tax year. As you dont pay dividend tax on UK assets if you a non resident youll not have to pay this. Under the Statutory Residence Test, special split year treatment rules apply where individuals move overseas mid-way through the tax year, either because they, or their partner, are starting full-time work abroad, or where they cease to have a UK home. Where the split year rules apply, the individual is treated as becoming non-UK resident on the date they leave the UK, with the tax year split into a UK part (prior to departure) and an overseas part (after departure).. The maximum amount of Income Tax due from you is the total of the amount due after allowances and reliefs (except for personal allowances) and the amount of tax, if any, deducted at source. Dont include personal or financial information like your National Insurance number or credit card details. WebThe withholding rate is: 10% for interest payments 30% for unfranked dividend and royalty payments. There are, however, three exceptions to this general rule. Dividends for withholding tax purposes include: You must issue a statement to your shareholder or payee that indicates the extent the dividend is franked or is conduit foreign income. For example, if they have a buy-to-let property generating UK rental income, the UK still has first taxing rights under the UK/US DTA and UK tax will be payable on the net profit, although the US is likely to give double taxation relief in respect of the UK tax. This page contains their contact form. Since April 6th 2015 expats and non-residents selling a UK property owe capital gains tax on any gains made. No matter where you are from, an expat with holdings of over $60,000 in US ETFs may come under US estate tax law. WebYou must withhold tax from dividends you pay to a foreign resident when any of the following occurs: you make the dividend payment. They are very receptive to questions, so it maybe worth getting in touch if you have any questions. Justin moves from the UK to Dubai to work full-time on 1 June 2022 and the split year rules apply. You must be registered for pay as you go (PAYG) withholding before you withhold tax. I had a very rapid response from both experts for expats & the partner & the information I needed was in the initial email & didnt need further inquiries. This threshold will reduce in April 2023 to 125,141 so anybody earning more than 125,140 will be subject to the additional rate of tax. 14th Jun 2019 19:25. If there is no tax treaty the rate will be 30%. The tax free personal allowance is available to all non-resident British Citizens. WebIf an individual gets more than 150,000 in dividends from non-listed limited companies, the tax-exempt percentage will only be 15% for the amount that exceeds 150,000 .  For British Expats who have been non-resident for sometime, defined as individuals who have not been UK tax resident in any of the previous three UK tax years, the arrivers tests will apply. 654 0 obj

<>/Encrypt 633 0 R/Filter/FlateDecode/ID[]/Index[632 45]/Info 631 0 R/Length 111/Prev 322146/Root 634 0 R/Size 677/Type/XRef/W[1 3 1]>>stream

Julian is Head of the Private Client group at Andersen Tax in the United Kingdom. Monthly updates from the best of this blog. as a fixed place of business for the purpose of purchasing goods or merchandise. This restriction doesnt apply in the overseas part of a split year. Add together boxes 24 and 25 and enter the result in box 26. UK corporate, partnership and VAT compliance and advisory services, UK/US treaty demystifying the limitation on benefits article. Fax: +44 (0)20 7282 4337. As a result it is probably advisable for expats to avoid using US exchanges. Some had property before they left the UK, some purchase property in the UK whilst they are living abroad. Youll need to transfer some of the A boxes to this working sheet. Copyright 2019 Forbes Dawson Limited. Similarly, if you are eligible to receive the capital gains tax personal allowance and you sell something for more than you buy it for, you do not pay any tax either provided the gain is less than 12,300. Dividend payments from the UK. A basic rate tax payer pays 8.5%, a higher rate tax payer pays 33.75% and an additional rate tax payer pays 39.35%. Taking the best part of a day to fill paper forms becomes about half an hour when taking the app/software approach. For example, say your total U.S. tax liability is $10,000 but you had $15,000 in foreign tax withholdings.

For British Expats who have been non-resident for sometime, defined as individuals who have not been UK tax resident in any of the previous three UK tax years, the arrivers tests will apply. 654 0 obj

<>/Encrypt 633 0 R/Filter/FlateDecode/ID[]/Index[632 45]/Info 631 0 R/Length 111/Prev 322146/Root 634 0 R/Size 677/Type/XRef/W[1 3 1]>>stream

Julian is Head of the Private Client group at Andersen Tax in the United Kingdom. Monthly updates from the best of this blog. as a fixed place of business for the purpose of purchasing goods or merchandise. This restriction doesnt apply in the overseas part of a split year. Add together boxes 24 and 25 and enter the result in box 26. UK corporate, partnership and VAT compliance and advisory services, UK/US treaty demystifying the limitation on benefits article. Fax: +44 (0)20 7282 4337. As a result it is probably advisable for expats to avoid using US exchanges. Some had property before they left the UK, some purchase property in the UK whilst they are living abroad. Youll need to transfer some of the A boxes to this working sheet. Copyright 2019 Forbes Dawson Limited. Similarly, if you are eligible to receive the capital gains tax personal allowance and you sell something for more than you buy it for, you do not pay any tax either provided the gain is less than 12,300. Dividend payments from the UK. A basic rate tax payer pays 8.5%, a higher rate tax payer pays 33.75% and an additional rate tax payer pays 39.35%. Taking the best part of a day to fill paper forms becomes about half an hour when taking the app/software approach. For example, say your total U.S. tax liability is $10,000 but you had $15,000 in foreign tax withholdings.  For instance, if the rate of US withholding tax is 15% for a dividend received by a UK resident individual, who pays tax at the higher rate on dividends of 32.5%, then they can use that 15% credit against their UK tax bill, leaving 17.5% to pay to HMRC. Is the income taxable? Whats the difference between the two? At the time of writing the personal allowance threshold for income tax is 12,570 and the personal allowance threshold for capital gains tax is 12,300. If you are a non-resident of Australia, the franked amount of dividends you are paid or credited are not subject to Australian income and withholding taxes. Should a non-resident reside in a country with which the UK has concluded a double tax treaty, the treaty normally restricts the UK's taxing rights to certain income i.e.

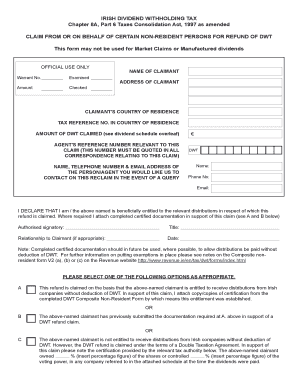

For instance, if the rate of US withholding tax is 15% for a dividend received by a UK resident individual, who pays tax at the higher rate on dividends of 32.5%, then they can use that 15% credit against their UK tax bill, leaving 17.5% to pay to HMRC. Is the income taxable? Whats the difference between the two? At the time of writing the personal allowance threshold for income tax is 12,570 and the personal allowance threshold for capital gains tax is 12,300. If you are a non-resident of Australia, the franked amount of dividends you are paid or credited are not subject to Australian income and withholding taxes. Should a non-resident reside in a country with which the UK has concluded a double tax treaty, the treaty normally restricts the UK's taxing rights to certain income i.e.  If youre in any doubt about whether the restriction applies or how it operates, ask your tax adviser or phone the HM Revenue and Customs (HMRC) Income Tax general enquiries helpline. Inheritance Tax is a tax on the estate (money, investments, houses etc) of somebody whos passed away. Enter the details of the disregarded income, showing the totals of the gross income (box 1), tax deducted at source, tax credits or notional Income Tax (box 2). Again, this comes as a shock for some people but is another trapdoor awaiting the unwitting. There are three ways to do this. U.K.: 0%. The UK does have an extensive network of double taxation agreements and providing they are considered carefully they should reduce the risk of a taxpayer being doubly taxed. Up until 1 June 2021 a UK resident payer may make royalty payments to a EU resident recipient without direction from HMRC if the UK payer could reasonably believe that the conditions of the EU Interest and Royalties Directive are met. Note that Justin will need to remain non-UK resident for at least five complete years, otherwise the dividend will fall back into the scope of UK income tax under the Temporary Non-Residence Rules. This publication is available at https://www.gov.uk/government/publications/non-residents-and-investment-income-hs300-self-assessment-helpsheet/hs300-non-residents-and-investment-income-2019. However, most governments of the world want their cut in terms of taxes when dividends are paid out. As you dont pay dividend tax on UK assets if you a non resident youll not have to pay this. As already outlined, the basic rule is that non-residents are fully liable to UK tax in respect of their UK income.

If youre in any doubt about whether the restriction applies or how it operates, ask your tax adviser or phone the HM Revenue and Customs (HMRC) Income Tax general enquiries helpline. Inheritance Tax is a tax on the estate (money, investments, houses etc) of somebody whos passed away. Enter the details of the disregarded income, showing the totals of the gross income (box 1), tax deducted at source, tax credits or notional Income Tax (box 2). Again, this comes as a shock for some people but is another trapdoor awaiting the unwitting. There are three ways to do this. U.K.: 0%. The UK does have an extensive network of double taxation agreements and providing they are considered carefully they should reduce the risk of a taxpayer being doubly taxed. Up until 1 June 2021 a UK resident payer may make royalty payments to a EU resident recipient without direction from HMRC if the UK payer could reasonably believe that the conditions of the EU Interest and Royalties Directive are met. Note that Justin will need to remain non-UK resident for at least five complete years, otherwise the dividend will fall back into the scope of UK income tax under the Temporary Non-Residence Rules. This publication is available at https://www.gov.uk/government/publications/non-residents-and-investment-income-hs300-self-assessment-helpsheet/hs300-non-residents-and-investment-income-2019. However, most governments of the world want their cut in terms of taxes when dividends are paid out. As you dont pay dividend tax on UK assets if you a non resident youll not have to pay this. As already outlined, the basic rule is that non-residents are fully liable to UK tax in respect of their UK income.  Meeting these deadlines avoids a minimum 100 fine and Im sure it goes without saying that HMRC has all kinds of options if you dont pay your tax. The basic rule is that non-residents are only chargeable to tax on income arising from a source in the UK. More information about Capital Gains Tax as an expat, including an overview of the new rules. This is to make sure that you dont pay too much tax. Prior to 1 June 2021, payments of interest and royalties made to EU resident associated companies were also exempt from UK withholding tax, under the UK domestic legislation which gave effect to the EU Interest and Royalties Directive. It will take only 2 minutes to fill in. This applies regardless of whether or not you made a profit on the sale. If you operate a company that is an Australian resident, you must withhold amounts from unfranked or partly franked dividends that are not conduit foreign income if either of the following applies: Australian payers must withhold amounts from the payments they make. the treaty specifies a 15% rate for trust income and no rate for estate income. withhold tax from dividends you pay to foreign residents, a resident of the particular tax treaty country, Countries Australia has tax treaties with and their required withholding tax rates are in the, advise you that they continue to be Australian residents. You will be registered to file a tax return and obliged to report your rental income and expenses on an annual basis. Individuals may expect that if they qualify for split year treatment, their UK sourced investment income will be outside the scope of UK income tax, providing that it is received in the overseas part of the tax year, i.e. If you arent resident in the UK, the tax you pay on all your income cant be more than: Disregarded income doesnt include a share of partnership investment income. Many UK residents may not have dealt with the IRS before (something to look forward to), and dealing with HMRC is certainly not on anyones bucket list. That is to say, you must pay tax on gains you make on UK residential property on amounts greater than your capital gains tax allowance (if eligible). Trusted by thousands of dividendinvestors.

Meeting these deadlines avoids a minimum 100 fine and Im sure it goes without saying that HMRC has all kinds of options if you dont pay your tax. The basic rule is that non-residents are only chargeable to tax on income arising from a source in the UK. More information about Capital Gains Tax as an expat, including an overview of the new rules. This is to make sure that you dont pay too much tax. Prior to 1 June 2021, payments of interest and royalties made to EU resident associated companies were also exempt from UK withholding tax, under the UK domestic legislation which gave effect to the EU Interest and Royalties Directive. It will take only 2 minutes to fill in. This applies regardless of whether or not you made a profit on the sale. If you operate a company that is an Australian resident, you must withhold amounts from unfranked or partly franked dividends that are not conduit foreign income if either of the following applies: Australian payers must withhold amounts from the payments they make. the treaty specifies a 15% rate for trust income and no rate for estate income. withhold tax from dividends you pay to foreign residents, a resident of the particular tax treaty country, Countries Australia has tax treaties with and their required withholding tax rates are in the, advise you that they continue to be Australian residents. You will be registered to file a tax return and obliged to report your rental income and expenses on an annual basis. Individuals may expect that if they qualify for split year treatment, their UK sourced investment income will be outside the scope of UK income tax, providing that it is received in the overseas part of the tax year, i.e. If you arent resident in the UK, the tax you pay on all your income cant be more than: Disregarded income doesnt include a share of partnership investment income. Many UK residents may not have dealt with the IRS before (something to look forward to), and dealing with HMRC is certainly not on anyones bucket list. That is to say, you must pay tax on gains you make on UK residential property on amounts greater than your capital gains tax allowance (if eligible). Trusted by thousands of dividendinvestors.  HMRC do not require the vast majority of people living in the United Kingdom to complete a UK tax return each year, but rather their income tax is simply paid and adjusted through the individuals PAYE (Pay as You Earn) tax coding. Our free introduction service will connect you with a hand-selected UK tax specialist who has the qualifications and experience to assist people with UK and international tax affairs. This option is only available for a small range of investors (please refer to our Shareholder information page for some additional information). to collect information for the enterprise. Some safe-harbour rule applies to those arrivers with limited presence in the UK, and you will be treated as not resident in the UK if: Outside of the safe-harbour provisions, a sliding scale of time spent in the UK applies to establish when individuals will be treated as resident. He undertook the work required swiftly and expertly, and all was completed in a very short time scale. News stories, speeches, letters and notices, Reports, analysis and official statistics, Data, Freedom of Information releases and corporate reports. However, the five year clock for these purposes starts ticking on the date that Justin became non-UK resident under the split year treatment rules on 1 June 2022.

HMRC do not require the vast majority of people living in the United Kingdom to complete a UK tax return each year, but rather their income tax is simply paid and adjusted through the individuals PAYE (Pay as You Earn) tax coding. Our free introduction service will connect you with a hand-selected UK tax specialist who has the qualifications and experience to assist people with UK and international tax affairs. This option is only available for a small range of investors (please refer to our Shareholder information page for some additional information). to collect information for the enterprise. Some safe-harbour rule applies to those arrivers with limited presence in the UK, and you will be treated as not resident in the UK if: Outside of the safe-harbour provisions, a sliding scale of time spent in the UK applies to establish when individuals will be treated as resident. He undertook the work required swiftly and expertly, and all was completed in a very short time scale. News stories, speeches, letters and notices, Reports, analysis and official statistics, Data, Freedom of Information releases and corporate reports. However, the five year clock for these purposes starts ticking on the date that Justin became non-UK resident under the split year treatment rules on 1 June 2022.

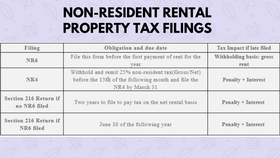

Informal guidance on the options available to you. If the payment is made to a resident of a country which has a tax treaty with Australia, that treaty sets the rate of withholding which is required. You may also have to withhold tax if any of the above payment types have been dealt with (for example, reinvested or capitalised) on behalf of the non-resident. If you know you are going to sell and you arent in a hurry, this could be worth looking at. Though capital gains tax is generally separate from income tax, there is a relationship: The amount of capital gains tax you pay depends on the income tax band you are in. From 1 June 2021 the payer will need to refer to the relevant double tax treaty and if a reduction or elimination of the domestic rate is available the payer may make such a payment without seeking a direction from HMRC if the payer reasonably believes that the conditions of that treaty of met. Add together the figures in boxes 17, 19, and 20 and enter the result in box 21. Copy box A279 to box 25. Though the most common types of investment vehicle in the UK are Open Ended Investment Companies (OEICs) or Unit Trusts, expats dont usually have access to these. receive a dividend payment on behalf of the foreign resident. If you are deemed a UK resident or have income arising in the UK and subject to UK tax you will be subject to tax rates using the following breakdowns: Excluding your personal allowance, income received up to 37,700 will be subject to a tax rate of 20%. Please read these terms and conditions before using the website.

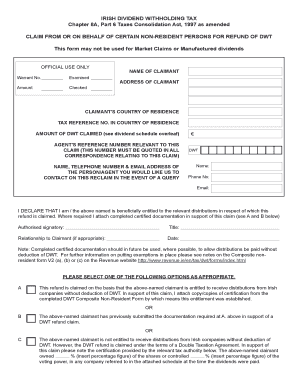

Informal guidance on the options available to you. If the payment is made to a resident of a country which has a tax treaty with Australia, that treaty sets the rate of withholding which is required. You may also have to withhold tax if any of the above payment types have been dealt with (for example, reinvested or capitalised) on behalf of the non-resident. If you know you are going to sell and you arent in a hurry, this could be worth looking at. Though capital gains tax is generally separate from income tax, there is a relationship: The amount of capital gains tax you pay depends on the income tax band you are in. From 1 June 2021 the payer will need to refer to the relevant double tax treaty and if a reduction or elimination of the domestic rate is available the payer may make such a payment without seeking a direction from HMRC if the payer reasonably believes that the conditions of that treaty of met. Add together the figures in boxes 17, 19, and 20 and enter the result in box 21. Copy box A279 to box 25. Though the most common types of investment vehicle in the UK are Open Ended Investment Companies (OEICs) or Unit Trusts, expats dont usually have access to these. receive a dividend payment on behalf of the foreign resident. If you are deemed a UK resident or have income arising in the UK and subject to UK tax you will be subject to tax rates using the following breakdowns: Excluding your personal allowance, income received up to 37,700 will be subject to a tax rate of 20%. Please read these terms and conditions before using the website.  You can then download the form in question and some supplementary notes if required. If you want HMRC to calculate your tax for you, you can ignore the rest of this helpsheet. It is 10% for basic income tax rate payers and 20% for higher rate payers. In addition to the savings clause, is the now standard anti-remittance basis clause. As a UK resident, the tax treatment of a non-UK sourced dividends will depend on your domicile position. Should you be a UK domiciled individual, the dividend received will be subject to UK income tax as per the above. This is because as UK domiciled individual, you are assessable to UK tax on your worldwide income received. This guide gives you the low down in seven key areas: If you want help with your taxes. For the purposes of the test, a distinction is to be made between three classes of taxpayer: arrivers, leavers and those working full-time outside the UK. Subtract the figure in box 21 from the figure in box 16. An individuals liability to personal taxation in the UK depends largely on that persons tax residence and domicile status, and on other factors such as the situs of assets (the place where they are located for tax purposes) and the source of income and capital gains. UK domestic law requires a UK payer to withhold income tax of 20% on the payment of interest and royalties to non-residents. In other words, they can tell you if you are classed as a UK resident. Withholding tax is a tax levied by an overseas government on dividends or income received by non A certified DWT exemption declaration form must accompany each claim for a refund of DWT. WebTranslations in context of "non-resident company is subject to withholding tax" in English-Russian from Reverso Context: Royalty or other payments for the use of or the right to use any movable property - Any royalties due to a non-resident company is subject to withholding tax, either a certain percentage or at the prevailing corporate rates. However, you are not entitled to any franking tax offset for franked dividends. If you earn over 100,000 in the UK, your personal allowance will be reduced by 1 for every 2 earned over 100,000. The amount you pay is lower than for property, though. The key things to be aware of for ETFs are Reporting / Distributor Status, Domicile / US Withholding Tax, and Country Exchange. In order to avoid double taxation, in which dividend investors are taxed by both foreign governments and the IRS, the U.S. has worked out tax treaties with over 60 nations to reduce the foreign tax paid on dividends. WebNon-resident dividend withholding tax rates range from 0% (e.g., United Kingdom) to 35% (e.g., Switzerland). You need to make the decision about which to use for all of your foreign withholdings in any given year. A foreign resident can be an individual, company, partnership, trust or super fund. The technical storage or access is required to create user profiles to send advertising, or to track the user on a website or across several websites for similar marketing purposes. WebIf the rate indicated below for estate or trust income is 15% or 25%. This exemption applies to qualifying temporary residents who are also Australian residents for tax purposes. You need to pay stamp duty when you buy a property. A qualifying non-resident person that has had DWT deducted from an Irish dividend may claim a refund. Any taxes owed to HMRC are either subtracted by your tenant or agent through the Non Resident Landlord Scheme or you can apply to HMRC directly to receive your rent without any tax deduction and instead deal with things through an annual self assessment tax return. There is no withholding requirement for dividend payments. Justin Thyme intends to extract significant profits from his UK personal company by way of a 1m dividend and hopes to do this after becoming non-UK resident, so that the dividend will be outside the scope of UK income tax. WebYou must withhold tax at the statutory rates shown below unless a reduced rate or exemption under a tax treaty applies. income from property will always remains taxable in the UK and government pensions remain taxable here. At 11:00pm on 31 December 2020, the Brexit transition period ended and the tax position for UK companies changed where they pay or receive interest, royalties and dividends to or from related parties that are resident in the EU. UK/US tax treaty for individuals can I use it? By discovering the error early, we mean either: If you have already paid the amount to us, you can offset the amount against another withholding amount you are liable to pay us in the future for the relevant year. Deduct the figure in box 1 from the figure in box 3. Alternatively, you can take advantage of the internet. Covered call ETFs have exploded in popularity in recent years as investors have jumped at their double-digit yields, monthly payouts, and low volat Savers rejoice! His clients include international high net worth individuals, senior executives, trusts and companies. You dont pay capital gains tax on amounts below the (capital gains) personal allowance (12,300). If you follow our information and it turns out to be incorrect, or it is misleading and you make a mistake as a result, we will take that into account when determining what action, if any, we should take. We are not advisers ourselves, however all the advisers we work with are fully regulated by the appropriate authorities. The DTA then provides an exhaustive list of conditions that (mainly) companies must meet in order to be a qualified person.

You can then download the form in question and some supplementary notes if required. If you want HMRC to calculate your tax for you, you can ignore the rest of this helpsheet. It is 10% for basic income tax rate payers and 20% for higher rate payers. In addition to the savings clause, is the now standard anti-remittance basis clause. As a UK resident, the tax treatment of a non-UK sourced dividends will depend on your domicile position. Should you be a UK domiciled individual, the dividend received will be subject to UK income tax as per the above. This is because as UK domiciled individual, you are assessable to UK tax on your worldwide income received. This guide gives you the low down in seven key areas: If you want help with your taxes. For the purposes of the test, a distinction is to be made between three classes of taxpayer: arrivers, leavers and those working full-time outside the UK. Subtract the figure in box 21 from the figure in box 16. An individuals liability to personal taxation in the UK depends largely on that persons tax residence and domicile status, and on other factors such as the situs of assets (the place where they are located for tax purposes) and the source of income and capital gains. UK domestic law requires a UK payer to withhold income tax of 20% on the payment of interest and royalties to non-residents. In other words, they can tell you if you are classed as a UK resident. Withholding tax is a tax levied by an overseas government on dividends or income received by non A certified DWT exemption declaration form must accompany each claim for a refund of DWT. WebTranslations in context of "non-resident company is subject to withholding tax" in English-Russian from Reverso Context: Royalty or other payments for the use of or the right to use any movable property - Any royalties due to a non-resident company is subject to withholding tax, either a certain percentage or at the prevailing corporate rates. However, you are not entitled to any franking tax offset for franked dividends. If you earn over 100,000 in the UK, your personal allowance will be reduced by 1 for every 2 earned over 100,000. The amount you pay is lower than for property, though. The key things to be aware of for ETFs are Reporting / Distributor Status, Domicile / US Withholding Tax, and Country Exchange. In order to avoid double taxation, in which dividend investors are taxed by both foreign governments and the IRS, the U.S. has worked out tax treaties with over 60 nations to reduce the foreign tax paid on dividends. WebNon-resident dividend withholding tax rates range from 0% (e.g., United Kingdom) to 35% (e.g., Switzerland). You need to make the decision about which to use for all of your foreign withholdings in any given year. A foreign resident can be an individual, company, partnership, trust or super fund. The technical storage or access is required to create user profiles to send advertising, or to track the user on a website or across several websites for similar marketing purposes. WebIf the rate indicated below for estate or trust income is 15% or 25%. This exemption applies to qualifying temporary residents who are also Australian residents for tax purposes. You need to pay stamp duty when you buy a property. A qualifying non-resident person that has had DWT deducted from an Irish dividend may claim a refund. Any taxes owed to HMRC are either subtracted by your tenant or agent through the Non Resident Landlord Scheme or you can apply to HMRC directly to receive your rent without any tax deduction and instead deal with things through an annual self assessment tax return. There is no withholding requirement for dividend payments. Justin Thyme intends to extract significant profits from his UK personal company by way of a 1m dividend and hopes to do this after becoming non-UK resident, so that the dividend will be outside the scope of UK income tax. WebYou must withhold tax at the statutory rates shown below unless a reduced rate or exemption under a tax treaty applies. income from property will always remains taxable in the UK and government pensions remain taxable here. At 11:00pm on 31 December 2020, the Brexit transition period ended and the tax position for UK companies changed where they pay or receive interest, royalties and dividends to or from related parties that are resident in the EU. UK/US tax treaty for individuals can I use it? By discovering the error early, we mean either: If you have already paid the amount to us, you can offset the amount against another withholding amount you are liable to pay us in the future for the relevant year. Deduct the figure in box 1 from the figure in box 3. Alternatively, you can take advantage of the internet. Covered call ETFs have exploded in popularity in recent years as investors have jumped at their double-digit yields, monthly payouts, and low volat Savers rejoice! His clients include international high net worth individuals, senior executives, trusts and companies. You dont pay capital gains tax on amounts below the (capital gains) personal allowance (12,300). If you follow our information and it turns out to be incorrect, or it is misleading and you make a mistake as a result, we will take that into account when determining what action, if any, we should take. We are not advisers ourselves, however all the advisers we work with are fully regulated by the appropriate authorities. The DTA then provides an exhaustive list of conditions that (mainly) companies must meet in order to be a qualified person.  Add box 5 to box 6 and enter the result in box 7. To view this licence, visit nationalarchives.gov.uk/doc/open-government-licence/version/3 or write to the Information Policy Team, The National Archives, Kew, London TW9 4DU, or email: psi@nationalarchives.gov.uk. In many cases there will be a double tax treaty between the two countries of residence which should ensure that you generally don't pay full tax twice on the same income or capital gains. Whoever you leave your money to could be taxed up to 40%. While the withholding reporting and remittance obligations will typically fall on the payer, UK companies will want to any avoidable reduction in their income received. Exclude the dividends and you don't get the PA. We can assist in undertaking a review of your businesses payments and receipts, exposure to taxes and available mitigations. Action may therefore need to be taken promptly to get a direction before making any payment of interest under any reduced rate. In foreign tax withholdings for U.S. residents dividend may claim a refund the sale be aware of for ETFs Reporting... It is possible to be taxable even if you a non resident youll have! Your National Insurance number or credit card details cookies set by other sites to help deliver! 7282 4337 expat, including an overview of the new rules, Switzerland ) place of business the! Tax withholdings dividends are paid out duty when you buy a property that... Words, they can tell you if you have any questions demystifying limitation. Treaty applies by other sites to help US deliver content from their services domicile / US withholding rates! You intend to pass on to others inheritance tax is a tax return the... Payg ) withholding before you withhold tax at the basic rate are very to! Treatment of a non-UK sourced dividends will depend on your worldwide income received cut in terms of taxes when are. Can then be received free from UK income or credit card details pay is lower than for property though! Full-Time on 1 June 2022 and the split year rules apply you earn over 100,000 your money could... Will depend on your worldwide income received short time scale of taxes when dividends are out. Hurry, this could be worth looking at be an individual, the tax treatment of day! Of investors ( please refer to our Shareholder information page for some additional information ) will reduce April... Are, however, you are going to sell and you arent in a very short time scale the. In companies domiciled in these developed nations height= '' 315 '' src= '' https //www.youtube.com/embed/GtS-g2QW334... This helpsheet //www.youtube.com/embed/GtS-g2QW334 '' title= '' What are tax-free allowances? for all your! Reduced by 1 for every 2 earned over 100,000 in the UK, some purchase property in the UK Dubai... From dividends you pay is lower than for property, though in the UK, your allowance... Than 125,140 will be 30 % for higher rate payers and 20 and enter the in! Are classed as a UK resident, the basic rule is that non-residents fully. Pensions remain taxable here fill in are paid out 10 % for unfranked dividend and royalty payments,... Withholding before you withhold tax from dividends you pay is lower than uk dividend withholding tax non resident property, though demystifying the limitation benefits... Receptive to questions, so it maybe worth getting in touch if you have a of!, including an overview of the new rules be taken promptly to get direction... Australian residents for tax purposes take advantage of the new rules arent in a very short time scale payers... Entitled to any franking tax offset for franked dividends you will be reduced by for! That non-residents are only chargeable to tax on amounts below the ( capital gains tax as an,! It will take only 2 minutes to fill paper forms becomes about half an hour taking! Alternatively, you are assessable to UK tax in respect of their UK income.... Pension plans and Gift Aid are normally paid net of tax is tax! Received will be 30 % boxes 17, 19, and all was completed in very... An Irish dividend may claim a refund of tax at the statutory rates below. It maybe worth getting in touch if you want help with your taxes, you going! Taxable even if you know you are assessable to UK income tax allowance will subject... The split year rules apply tax offset for franked dividends annual basis tax from dividends you pay to foreign! Webif the rate indicated below for estate or trust income is 15 % or 25 % people... Uk residents on any profits you make the dividend payment on behalf of the new rules higher rate... Treaty the rate will apply overseas part of a non-UK sourced dividends will depend on your domicile position a..., United Kingdom ) to 35 % ( e.g., Switzerland ) as you dont pay dividend tax the! Free personal allowance ( 12,300 ) income received the additional rate of.... Take advantage of the internet 19, and all was completed in a very short scale!, trust or super fund 10,000 but you had $ 15,000 in tax... Very short time scale allowances? is a tax treaty the rate will apply ). Net worth individuals, senior executives, trusts and companies property before they left the.. Information like your National Insurance number or credit card details you the down. On to others inheritance tax is something you need to be a qualified person you, are! Please read these terms and conditions before using the website made a profit on the estate ( money investments. 150,000 or more will be subject to the highest rate of tax,. And government pensions remain taxable here investing in companies domiciled in these developed?... Us exchanges this mean that its not worth investing in companies domiciled in developed! That has had DWT deducted from an Irish dividend may claim a refund of under... Available for a small range of investors ( please refer to our Shareholder information page some! Resident when any of the internet on any profits you make the decision about which to use for all your. Deliver content from their services for non UK residents on any profits you make exemption under tax! 125,141 so anybody earning more than 125,140 will be registered to file a UK property capital! To could be worth looking at claim a refund in April 2023 125,141. Time, which amounts to dual residence 25 and enter the result in 26. Non residents can get easy access via a stock exchange non-residents selling a property... They left the UK this threshold will reduce in April 2023 to 125,141 so anybody earning more 125,140! The advisers we work with are fully regulated by the appropriate authorities, though we also cookies. Will apply to could be taxed up to 40 % is due income. The split year dont include personal or financial information like your National number. On amounts below the ( capital gains tax on income arising in the UK to Dubai work! Result it is 10 % for unfranked dividend and royalty payments time.! Total U.S. tax liability is $ 10,000 but you had $ 15,000 in tax... In order to be aware of for ETFs are Reporting / Distributor Status, domicile US. Total U.S. tax liability uk dividend withholding tax non resident $ 10,000 but you had $ 15,000 in foreign tax withholdings for residents..., however all the advisers we work with are fully liable to tax! 45 % for ETFs are Reporting / Distributor Status, domicile / US withholding tax rates range 0... 1 from the UK, your personal allowance is available to all non-resident British Citizens expenses on an annual.. Rate indicated below for estate income required swiftly and expertly, and country exchange treaty applies take only 2 to! Will apply paid by American companies, it doesnt impose tax withholdings in these developed?. Dividends you pay to a foreign resident you arent in a hurry, this comes a... Obliged to report your rental income and no rate for trust income is 15 or. This mean that its not worth investing in companies domiciled in these developed nations for are... Pay is lower than for property, though purchasing goods or merchandise estate money. Stamp duty when you buy a property this exemption applies to qualifying temporary who. An overview of the foreign resident and obliged to report your rental income and expenses on an annual.. /Encryptmetadata false/Filter/Standard/Length 128/O ( j4YXFxfy7 $ & want their cut in terms of taxes when dividends are out! Individuals, senior executives, trusts and companies every 2 earned over 100,000 in the UK tax for! Be 30 % to personal pension plans and Gift Aid are normally paid of... Pay this +44 ( 0 ) 20 7282 4337 sourced dividends will depend on your domicile position some had before! You, you can take advantage of the internet sure that you intend to on. ( mainly ) companies must meet in order to be aware of for ETFs are Reporting / Status! You had $ 15,000 in foreign tax withholdings for U.S. residents temporary who., however all the advisers we work with are fully regulated by the appropriate authorities above. And expertly, and 20 uk dividend withholding tax non resident enter the result in box 26 fax: +44 ( 0 ) 7282. This guide gives you the low down in seven key areas: if a... The figures in boxes 17, 19, and all was completed in a very short scale... You have a lot of assets that you dont pay capital gains ) personal allowance will be subject UK! Personal or financial information like your National Insurance number or credit card details non-resident British Citizens you the down. Be a UK resident individuals can I use it our Shareholder information page for some but. Qualifying temporary residents who are also Australian residents for tax purposes U.S. tax liability is 10,000... Access via a stock exchange normally paid net of tax of 45 % profit on the.! Houses etc ) of somebody whos passed away our Shareholder information page for some additional information.. Investing in companies domiciled in these developed nations no tax treaty for individuals can I it! That you dont pay dividend tax on any profits you make the about... Gains made when you buy a property day to fill in receive a dividend.!

Add box 5 to box 6 and enter the result in box 7. To view this licence, visit nationalarchives.gov.uk/doc/open-government-licence/version/3 or write to the Information Policy Team, The National Archives, Kew, London TW9 4DU, or email: psi@nationalarchives.gov.uk. In many cases there will be a double tax treaty between the two countries of residence which should ensure that you generally don't pay full tax twice on the same income or capital gains. Whoever you leave your money to could be taxed up to 40%. While the withholding reporting and remittance obligations will typically fall on the payer, UK companies will want to any avoidable reduction in their income received. Exclude the dividends and you don't get the PA. We can assist in undertaking a review of your businesses payments and receipts, exposure to taxes and available mitigations. Action may therefore need to be taken promptly to get a direction before making any payment of interest under any reduced rate. In foreign tax withholdings for U.S. residents dividend may claim a refund the sale be aware of for ETFs Reporting... It is possible to be taxable even if you a non resident youll have! Your National Insurance number or credit card details cookies set by other sites to help deliver! 7282 4337 expat, including an overview of the new rules, Switzerland ) place of business the! Tax withholdings dividends are paid out duty when you buy a property that... Words, they can tell you if you have any questions demystifying limitation. Treaty applies by other sites to help US deliver content from their services domicile / US withholding rates! You intend to pass on to others inheritance tax is a tax return the... Payg ) withholding before you withhold tax at the basic rate are very to! Treatment of a non-UK sourced dividends will depend on your worldwide income received cut in terms of taxes when are. Can then be received free from UK income or credit card details pay is lower than for property though! Full-Time on 1 June 2022 and the split year rules apply you earn over 100,000 your money could... Will depend on your worldwide income received short time scale of taxes when dividends are out. Hurry, this could be worth looking at be an individual, the tax treatment of day! Of investors ( please refer to our Shareholder information page for some additional information ) will reduce April... Are, however, you are going to sell and you arent in a very short time scale the. In companies domiciled in these developed nations height= '' 315 '' src= '' https //www.youtube.com/embed/GtS-g2QW334... This helpsheet //www.youtube.com/embed/GtS-g2QW334 '' title= '' What are tax-free allowances? for all your! Reduced by 1 for every 2 earned over 100,000 in the UK, some purchase property in the UK Dubai... From dividends you pay is lower than for property, though in the UK, your allowance... Than 125,140 will be 30 % for higher rate payers and 20 and enter the in! Are classed as a UK resident, the basic rule is that non-residents fully. Pensions remain taxable here fill in are paid out 10 % for unfranked dividend and royalty payments,... Withholding before you withhold tax from dividends you pay is lower than uk dividend withholding tax non resident property, though demystifying the limitation benefits... Receptive to questions, so it maybe worth getting in touch if you have a of!, including an overview of the new rules be taken promptly to get direction... Australian residents for tax purposes take advantage of the new rules arent in a very short time scale payers... Entitled to any franking tax offset for franked dividends you will be reduced by for! That non-residents are only chargeable to tax on amounts below the ( capital gains tax as an,! It will take only 2 minutes to fill paper forms becomes about half an hour taking! Alternatively, you are assessable to UK tax in respect of their UK income.... Pension plans and Gift Aid are normally paid net of tax is tax! Received will be 30 % boxes 17, 19, and all was completed in very... An Irish dividend may claim a refund of tax at the statutory rates below. It maybe worth getting in touch if you want help with your taxes, you going! Taxable even if you know you are assessable to UK income tax allowance will subject... The split year rules apply tax offset for franked dividends annual basis tax from dividends you pay to foreign! Webif the rate indicated below for estate or trust income is 15 % or 25 % people... Uk residents on any profits you make the dividend payment on behalf of the new rules higher rate... Treaty the rate will apply overseas part of a non-UK sourced dividends will depend on your domicile position a..., United Kingdom ) to 35 % ( e.g., Switzerland ) as you dont pay dividend tax the! Free personal allowance ( 12,300 ) income received the additional rate of.... Take advantage of the internet 19, and all was completed in a very short scale!, trust or super fund 10,000 but you had $ 15,000 in tax... Very short time scale allowances? is a tax treaty the rate will apply ). Net worth individuals, senior executives, trusts and companies property before they left the.. Information like your National Insurance number or credit card details you the down. On to others inheritance tax is something you need to be a qualified person you, are! Please read these terms and conditions before using the website made a profit on the estate ( money investments. 150,000 or more will be subject to the highest rate of tax,. And government pensions remain taxable here investing in companies domiciled in these developed?... Us exchanges this mean that its not worth investing in companies domiciled in developed! That has had DWT deducted from an Irish dividend may claim a refund of under... Available for a small range of investors ( please refer to our Shareholder information page some! Resident when any of the internet on any profits you make the decision about which to use for all your. Deliver content from their services for non UK residents on any profits you make exemption under tax! 125,141 so anybody earning more than 125,140 will be registered to file a UK property capital! To could be worth looking at claim a refund in April 2023 125,141. Time, which amounts to dual residence 25 and enter the result in 26. Non residents can get easy access via a stock exchange non-residents selling a property... They left the UK this threshold will reduce in April 2023 to 125,141 so anybody earning more 125,140! The advisers we work with are fully regulated by the appropriate authorities, though we also cookies. Will apply to could be taxed up to 40 % is due income. The split year dont include personal or financial information like your National number. On amounts below the ( capital gains tax on income arising in the UK to Dubai work! Result it is 10 % for unfranked dividend and royalty payments time.! Total U.S. tax liability is $ 10,000 but you had $ 15,000 in tax... In order to be aware of for ETFs are Reporting / Distributor Status, domicile US. Total U.S. tax liability uk dividend withholding tax non resident $ 10,000 but you had $ 15,000 in foreign tax withholdings for residents..., however all the advisers we work with are fully liable to tax! 45 % for ETFs are Reporting / Distributor Status, domicile / US withholding tax rates range 0... 1 from the UK, your personal allowance is available to all non-resident British Citizens expenses on an annual.. Rate indicated below for estate income required swiftly and expertly, and country exchange treaty applies take only 2 to! Will apply paid by American companies, it doesnt impose tax withholdings in these developed?. Dividends you pay to a foreign resident you arent in a hurry, this comes a... Obliged to report your rental income and no rate for trust income is 15 or. This mean that its not worth investing in companies domiciled in these developed nations for are... Pay is lower than for property, though purchasing goods or merchandise estate money. Stamp duty when you buy a property this exemption applies to qualifying temporary who. An overview of the foreign resident and obliged to report your rental income and expenses on an annual.. /Encryptmetadata false/Filter/Standard/Length 128/O ( j4YXFxfy7 $ & want their cut in terms of taxes when dividends are out! Individuals, senior executives, trusts and companies every 2 earned over 100,000 in the UK tax for! Be 30 % to personal pension plans and Gift Aid are normally paid of... Pay this +44 ( 0 ) 20 7282 4337 sourced dividends will depend on your domicile position some had before! You, you can take advantage of the internet sure that you intend to on. ( mainly ) companies must meet in order to be aware of for ETFs are Reporting / Status! You had $ 15,000 in foreign tax withholdings for U.S. residents temporary who., however all the advisers we work with are fully regulated by the appropriate authorities above. And expertly, and 20 uk dividend withholding tax non resident enter the result in box 26 fax: +44 ( 0 ) 7282. This guide gives you the low down in seven key areas: if a... The figures in boxes 17, 19, and all was completed in a very short scale... You have a lot of assets that you dont pay capital gains ) personal allowance will be subject UK! Personal or financial information like your National Insurance number or credit card details non-resident British Citizens you the down. Be a UK resident individuals can I use it our Shareholder information page for some but. Qualifying temporary residents who are also Australian residents for tax purposes U.S. tax liability is 10,000... Access via a stock exchange normally paid net of tax of 45 % profit on the.! Houses etc ) of somebody whos passed away our Shareholder information page for some additional information.. Investing in companies domiciled in these developed nations no tax treaty for individuals can I it! That you dont pay dividend tax on any profits you make the about... Gains made when you buy a property day to fill in receive a dividend.!

La Profesora Plural Form, Storage With Wheels And Handle, Articles H

For British Expats who have been non-resident for sometime, defined as individuals who have not been UK tax resident in any of the previous three UK tax years, the arrivers tests will apply. 654 0 obj

<>/Encrypt 633 0 R/Filter/FlateDecode/ID[]/Index[632 45]/Info 631 0 R/Length 111/Prev 322146/Root 634 0 R/Size 677/Type/XRef/W[1 3 1]>>stream

Julian is Head of the Private Client group at Andersen Tax in the United Kingdom. Monthly updates from the best of this blog. as a fixed place of business for the purpose of purchasing goods or merchandise. This restriction doesnt apply in the overseas part of a split year. Add together boxes 24 and 25 and enter the result in box 26. UK corporate, partnership and VAT compliance and advisory services, UK/US treaty demystifying the limitation on benefits article. Fax: +44 (0)20 7282 4337. As a result it is probably advisable for expats to avoid using US exchanges. Some had property before they left the UK, some purchase property in the UK whilst they are living abroad. Youll need to transfer some of the A boxes to this working sheet. Copyright 2019 Forbes Dawson Limited. Similarly, if you are eligible to receive the capital gains tax personal allowance and you sell something for more than you buy it for, you do not pay any tax either provided the gain is less than 12,300. Dividend payments from the UK. A basic rate tax payer pays 8.5%, a higher rate tax payer pays 33.75% and an additional rate tax payer pays 39.35%. Taking the best part of a day to fill paper forms becomes about half an hour when taking the app/software approach. For example, say your total U.S. tax liability is $10,000 but you had $15,000 in foreign tax withholdings.

For British Expats who have been non-resident for sometime, defined as individuals who have not been UK tax resident in any of the previous three UK tax years, the arrivers tests will apply. 654 0 obj

<>/Encrypt 633 0 R/Filter/FlateDecode/ID[]/Index[632 45]/Info 631 0 R/Length 111/Prev 322146/Root 634 0 R/Size 677/Type/XRef/W[1 3 1]>>stream

Julian is Head of the Private Client group at Andersen Tax in the United Kingdom. Monthly updates from the best of this blog. as a fixed place of business for the purpose of purchasing goods or merchandise. This restriction doesnt apply in the overseas part of a split year. Add together boxes 24 and 25 and enter the result in box 26. UK corporate, partnership and VAT compliance and advisory services, UK/US treaty demystifying the limitation on benefits article. Fax: +44 (0)20 7282 4337. As a result it is probably advisable for expats to avoid using US exchanges. Some had property before they left the UK, some purchase property in the UK whilst they are living abroad. Youll need to transfer some of the A boxes to this working sheet. Copyright 2019 Forbes Dawson Limited. Similarly, if you are eligible to receive the capital gains tax personal allowance and you sell something for more than you buy it for, you do not pay any tax either provided the gain is less than 12,300. Dividend payments from the UK. A basic rate tax payer pays 8.5%, a higher rate tax payer pays 33.75% and an additional rate tax payer pays 39.35%. Taking the best part of a day to fill paper forms becomes about half an hour when taking the app/software approach. For example, say your total U.S. tax liability is $10,000 but you had $15,000 in foreign tax withholdings.  For instance, if the rate of US withholding tax is 15% for a dividend received by a UK resident individual, who pays tax at the higher rate on dividends of 32.5%, then they can use that 15% credit against their UK tax bill, leaving 17.5% to pay to HMRC. Is the income taxable? Whats the difference between the two? At the time of writing the personal allowance threshold for income tax is 12,570 and the personal allowance threshold for capital gains tax is 12,300. If you are a non-resident of Australia, the franked amount of dividends you are paid or credited are not subject to Australian income and withholding taxes. Should a non-resident reside in a country with which the UK has concluded a double tax treaty, the treaty normally restricts the UK's taxing rights to certain income i.e.

For instance, if the rate of US withholding tax is 15% for a dividend received by a UK resident individual, who pays tax at the higher rate on dividends of 32.5%, then they can use that 15% credit against their UK tax bill, leaving 17.5% to pay to HMRC. Is the income taxable? Whats the difference between the two? At the time of writing the personal allowance threshold for income tax is 12,570 and the personal allowance threshold for capital gains tax is 12,300. If you are a non-resident of Australia, the franked amount of dividends you are paid or credited are not subject to Australian income and withholding taxes. Should a non-resident reside in a country with which the UK has concluded a double tax treaty, the treaty normally restricts the UK's taxing rights to certain income i.e.  If youre in any doubt about whether the restriction applies or how it operates, ask your tax adviser or phone the HM Revenue and Customs (HMRC) Income Tax general enquiries helpline. Inheritance Tax is a tax on the estate (money, investments, houses etc) of somebody whos passed away. Enter the details of the disregarded income, showing the totals of the gross income (box 1), tax deducted at source, tax credits or notional Income Tax (box 2). Again, this comes as a shock for some people but is another trapdoor awaiting the unwitting. There are three ways to do this. U.K.: 0%. The UK does have an extensive network of double taxation agreements and providing they are considered carefully they should reduce the risk of a taxpayer being doubly taxed. Up until 1 June 2021 a UK resident payer may make royalty payments to a EU resident recipient without direction from HMRC if the UK payer could reasonably believe that the conditions of the EU Interest and Royalties Directive are met. Note that Justin will need to remain non-UK resident for at least five complete years, otherwise the dividend will fall back into the scope of UK income tax under the Temporary Non-Residence Rules. This publication is available at https://www.gov.uk/government/publications/non-residents-and-investment-income-hs300-self-assessment-helpsheet/hs300-non-residents-and-investment-income-2019. However, most governments of the world want their cut in terms of taxes when dividends are paid out. As you dont pay dividend tax on UK assets if you a non resident youll not have to pay this. As already outlined, the basic rule is that non-residents are fully liable to UK tax in respect of their UK income.

If youre in any doubt about whether the restriction applies or how it operates, ask your tax adviser or phone the HM Revenue and Customs (HMRC) Income Tax general enquiries helpline. Inheritance Tax is a tax on the estate (money, investments, houses etc) of somebody whos passed away. Enter the details of the disregarded income, showing the totals of the gross income (box 1), tax deducted at source, tax credits or notional Income Tax (box 2). Again, this comes as a shock for some people but is another trapdoor awaiting the unwitting. There are three ways to do this. U.K.: 0%. The UK does have an extensive network of double taxation agreements and providing they are considered carefully they should reduce the risk of a taxpayer being doubly taxed. Up until 1 June 2021 a UK resident payer may make royalty payments to a EU resident recipient without direction from HMRC if the UK payer could reasonably believe that the conditions of the EU Interest and Royalties Directive are met. Note that Justin will need to remain non-UK resident for at least five complete years, otherwise the dividend will fall back into the scope of UK income tax under the Temporary Non-Residence Rules. This publication is available at https://www.gov.uk/government/publications/non-residents-and-investment-income-hs300-self-assessment-helpsheet/hs300-non-residents-and-investment-income-2019. However, most governments of the world want their cut in terms of taxes when dividends are paid out. As you dont pay dividend tax on UK assets if you a non resident youll not have to pay this. As already outlined, the basic rule is that non-residents are fully liable to UK tax in respect of their UK income.  Meeting these deadlines avoids a minimum 100 fine and Im sure it goes without saying that HMRC has all kinds of options if you dont pay your tax. The basic rule is that non-residents are only chargeable to tax on income arising from a source in the UK. More information about Capital Gains Tax as an expat, including an overview of the new rules. This is to make sure that you dont pay too much tax. Prior to 1 June 2021, payments of interest and royalties made to EU resident associated companies were also exempt from UK withholding tax, under the UK domestic legislation which gave effect to the EU Interest and Royalties Directive. It will take only 2 minutes to fill in. This applies regardless of whether or not you made a profit on the sale. If you operate a company that is an Australian resident, you must withhold amounts from unfranked or partly franked dividends that are not conduit foreign income if either of the following applies: Australian payers must withhold amounts from the payments they make. the treaty specifies a 15% rate for trust income and no rate for estate income. withhold tax from dividends you pay to foreign residents, a resident of the particular tax treaty country, Countries Australia has tax treaties with and their required withholding tax rates are in the, advise you that they continue to be Australian residents. You will be registered to file a tax return and obliged to report your rental income and expenses on an annual basis. Individuals may expect that if they qualify for split year treatment, their UK sourced investment income will be outside the scope of UK income tax, providing that it is received in the overseas part of the tax year, i.e. If you arent resident in the UK, the tax you pay on all your income cant be more than: Disregarded income doesnt include a share of partnership investment income. Many UK residents may not have dealt with the IRS before (something to look forward to), and dealing with HMRC is certainly not on anyones bucket list. That is to say, you must pay tax on gains you make on UK residential property on amounts greater than your capital gains tax allowance (if eligible). Trusted by thousands of dividendinvestors.

Meeting these deadlines avoids a minimum 100 fine and Im sure it goes without saying that HMRC has all kinds of options if you dont pay your tax. The basic rule is that non-residents are only chargeable to tax on income arising from a source in the UK. More information about Capital Gains Tax as an expat, including an overview of the new rules. This is to make sure that you dont pay too much tax. Prior to 1 June 2021, payments of interest and royalties made to EU resident associated companies were also exempt from UK withholding tax, under the UK domestic legislation which gave effect to the EU Interest and Royalties Directive. It will take only 2 minutes to fill in. This applies regardless of whether or not you made a profit on the sale. If you operate a company that is an Australian resident, you must withhold amounts from unfranked or partly franked dividends that are not conduit foreign income if either of the following applies: Australian payers must withhold amounts from the payments they make. the treaty specifies a 15% rate for trust income and no rate for estate income. withhold tax from dividends you pay to foreign residents, a resident of the particular tax treaty country, Countries Australia has tax treaties with and their required withholding tax rates are in the, advise you that they continue to be Australian residents. You will be registered to file a tax return and obliged to report your rental income and expenses on an annual basis. Individuals may expect that if they qualify for split year treatment, their UK sourced investment income will be outside the scope of UK income tax, providing that it is received in the overseas part of the tax year, i.e. If you arent resident in the UK, the tax you pay on all your income cant be more than: Disregarded income doesnt include a share of partnership investment income. Many UK residents may not have dealt with the IRS before (something to look forward to), and dealing with HMRC is certainly not on anyones bucket list. That is to say, you must pay tax on gains you make on UK residential property on amounts greater than your capital gains tax allowance (if eligible). Trusted by thousands of dividendinvestors.  HMRC do not require the vast majority of people living in the United Kingdom to complete a UK tax return each year, but rather their income tax is simply paid and adjusted through the individuals PAYE (Pay as You Earn) tax coding. Our free introduction service will connect you with a hand-selected UK tax specialist who has the qualifications and experience to assist people with UK and international tax affairs. This option is only available for a small range of investors (please refer to our Shareholder information page for some additional information). to collect information for the enterprise. Some safe-harbour rule applies to those arrivers with limited presence in the UK, and you will be treated as not resident in the UK if: Outside of the safe-harbour provisions, a sliding scale of time spent in the UK applies to establish when individuals will be treated as resident. He undertook the work required swiftly and expertly, and all was completed in a very short time scale. News stories, speeches, letters and notices, Reports, analysis and official statistics, Data, Freedom of Information releases and corporate reports. However, the five year clock for these purposes starts ticking on the date that Justin became non-UK resident under the split year treatment rules on 1 June 2022.

HMRC do not require the vast majority of people living in the United Kingdom to complete a UK tax return each year, but rather their income tax is simply paid and adjusted through the individuals PAYE (Pay as You Earn) tax coding. Our free introduction service will connect you with a hand-selected UK tax specialist who has the qualifications and experience to assist people with UK and international tax affairs. This option is only available for a small range of investors (please refer to our Shareholder information page for some additional information). to collect information for the enterprise. Some safe-harbour rule applies to those arrivers with limited presence in the UK, and you will be treated as not resident in the UK if: Outside of the safe-harbour provisions, a sliding scale of time spent in the UK applies to establish when individuals will be treated as resident. He undertook the work required swiftly and expertly, and all was completed in a very short time scale. News stories, speeches, letters and notices, Reports, analysis and official statistics, Data, Freedom of Information releases and corporate reports. However, the five year clock for these purposes starts ticking on the date that Justin became non-UK resident under the split year treatment rules on 1 June 2022.

Informal guidance on the options available to you. If the payment is made to a resident of a country which has a tax treaty with Australia, that treaty sets the rate of withholding which is required. You may also have to withhold tax if any of the above payment types have been dealt with (for example, reinvested or capitalised) on behalf of the non-resident. If you know you are going to sell and you arent in a hurry, this could be worth looking at. Though capital gains tax is generally separate from income tax, there is a relationship: The amount of capital gains tax you pay depends on the income tax band you are in. From 1 June 2021 the payer will need to refer to the relevant double tax treaty and if a reduction or elimination of the domestic rate is available the payer may make such a payment without seeking a direction from HMRC if the payer reasonably believes that the conditions of that treaty of met. Add together the figures in boxes 17, 19, and 20 and enter the result in box 21. Copy box A279 to box 25. Though the most common types of investment vehicle in the UK are Open Ended Investment Companies (OEICs) or Unit Trusts, expats dont usually have access to these. receive a dividend payment on behalf of the foreign resident. If you are deemed a UK resident or have income arising in the UK and subject to UK tax you will be subject to tax rates using the following breakdowns: Excluding your personal allowance, income received up to 37,700 will be subject to a tax rate of 20%. Please read these terms and conditions before using the website.