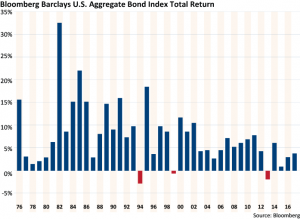

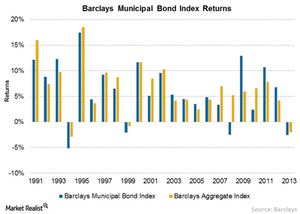

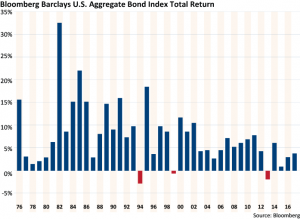

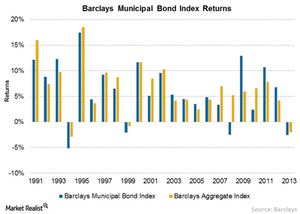

Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. Below investment-grade is represented by a rating of BB and below. The sum of the index components return attribution is not equal to the Index return over that month due to the servicing fee and return compounding effects. 2022 -16.25 -16.29 -0.04 -16.37 -0.13 Sustainability Characteristics do not provide an indication of current or future performance nor do they represent the potential risk and reward profile of a fund. Aggregate Bond Index fell -1.1% in February extending its losses for the year. BlackRock funds are also available through certain brokerage accounts. Certain information contained herein (the Information) has been provided by MSCI ESG Research LLC, a RIA under the Investment Advisers Act of 1940, and may include data from its affiliates (including MSCI Inc. and its subsidiaries (MSCI)), or third party suppliers (each an Information Provider), and it may not be reproduced or redisseminated in whole or in part without prior written permission. Our first chart considers the significant changes in the fixed income landscape. It is also a major indicator for the overall health of the fixed The Information is provided as is and the user of the Information assumes the entire risk of any use it may make or permit to be made of the Information. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive payment from the companies that advertise on the Forbes Advisor site. Bonds have different maturity dates (the date on which the bond is due for repayment). The fund has delivered consistent returns of around 5% over the last four years, other than a 3% loss in 2022. Business Involvement metrics are not indicative of a funds investment objective, and, unless otherwise stated in fund documentation and included within a funds investment objective, do not change a funds investment objective or constrain the funds investable universe. Learn more. The Bloomberg US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. {{ showMobileIntroSection ? These are subdivided into two categories investment grade (Standard & Poors ratings AAA-BBB) and speculative grade,junk or high-yield bonds (BB or lower). This list includes investable products traded on certain exchanges currently linked to this selection of indices. Business Involvement metrics are calculated by BlackRock using data from MSCI ESG Research which provides a profile of each companys specific business involvement. Performance for other share classes will vary. Source: abrdn, Barclays Live, 31 December 2022 . the other dominant concern for euro bond markets was the unprecedented run

The Franklin International Aggregate Bond ETF invests based on the Bloomberg Global Aggregate ex-USD Index Hedged USD. Data reflects different methodology from the BlackRock calculated returns in the Returns tab. Largest in Assets Source: Lipper. Subsequent monthly distributions that do not include ordinary income or capital gains in the form of dividends will likely be lower.If the Fund invests in any underlying fund, certain portfolio information, including sustainability characteristics and business-involvement metrics, provided for the Fund may include information (on a look-through basis) of such underlying fund, to the extent available. A slowing in interest rate hikes could provide a welcome tailwind for bond markets, while fears of a recession may whet investor appetite for the safety of bonds relative to higher-risk equities. As such, the funds sustainable characteristics may differ from MSCI ESG Fund Ratings from time to time. This fund tracks the FTSE Actuaries UK Conventional Gilts All Stocks Index, which comprises a portfolio of sterling-denominated government bonds with a spread of maturity dates and coupon payments. Some funds may be based on or linked to MSCI indexes, and MSCI may be compensated based on the funds assets under management or other measures. The increase in interest rates had a negative impact on returns (bond prices move inversely to interest rates). Investing involves risk, including possible loss of principal. As a result, it is possible there is additional involvement in these covered activities where MSCI does not have coverage. When evaluating fund performance, it is important to note that it does not represent actual performance of such share class. The red dots show the largest peak to Annual Return 0.53% Expense Ratio 0.05% Why We Picked It Fidelity Total Bond Fund (FTBFX) 12-Month Return -8.87% 5-Year Avg. If you have an ad-blocker enabled you may be blocked from proceeding. franklintempleton.com FLIA currencies; compiled by Author. Those distributions temporarily cause extraordinarily high yields. 'Read Less': 'Read More' }}. Sustainability Characteristics provide investors with specific non-traditional metrics. The Funds are distributed by BlackRock Investments, LLC (together with its affiliates, BlackRock). WebAggregate Bond Index (the "Index") over the long term. Equity markets outside of the U.S. also saw meaningful gains, as the MSCI EAFE index advanced by 8.47% in USD-terms, while emerging markets stocks gained just shy of 4%. on. For this one, this explains the non-hedged version, with the only difference being the one used by BNDX hedges against USD movements. Second, we also include links to advertisers offers in some of our articles. The Bloomberg Global Aggregate ex-USD Index measures the performance of global investment grade bonds. Neither MSCI ESG Research nor any Information Party makes any representations or express or implied warranties (which are expressly disclaimed), nor shall they incur liability for any errors or omissions in the Information, or for any damages related thereto. These bonds are only 6.5% of the portfolio.

The Franklin International Aggregate Bond ETF invests based on the Bloomberg Global Aggregate ex-USD Index Hedged USD. Data reflects different methodology from the BlackRock calculated returns in the Returns tab. Largest in Assets Source: Lipper. Subsequent monthly distributions that do not include ordinary income or capital gains in the form of dividends will likely be lower.If the Fund invests in any underlying fund, certain portfolio information, including sustainability characteristics and business-involvement metrics, provided for the Fund may include information (on a look-through basis) of such underlying fund, to the extent available. A slowing in interest rate hikes could provide a welcome tailwind for bond markets, while fears of a recession may whet investor appetite for the safety of bonds relative to higher-risk equities. As such, the funds sustainable characteristics may differ from MSCI ESG Fund Ratings from time to time. This fund tracks the FTSE Actuaries UK Conventional Gilts All Stocks Index, which comprises a portfolio of sterling-denominated government bonds with a spread of maturity dates and coupon payments. Some funds may be based on or linked to MSCI indexes, and MSCI may be compensated based on the funds assets under management or other measures. The increase in interest rates had a negative impact on returns (bond prices move inversely to interest rates). Investing involves risk, including possible loss of principal. As a result, it is possible there is additional involvement in these covered activities where MSCI does not have coverage. When evaluating fund performance, it is important to note that it does not represent actual performance of such share class. The red dots show the largest peak to Annual Return 0.53% Expense Ratio 0.05% Why We Picked It Fidelity Total Bond Fund (FTBFX) 12-Month Return -8.87% 5-Year Avg. If you have an ad-blocker enabled you may be blocked from proceeding. franklintempleton.com FLIA currencies; compiled by Author. Those distributions temporarily cause extraordinarily high yields. 'Read Less': 'Read More' }}. Sustainability Characteristics provide investors with specific non-traditional metrics. The Funds are distributed by BlackRock Investments, LLC (together with its affiliates, BlackRock). WebAggregate Bond Index (the "Index") over the long term. Equity markets outside of the U.S. also saw meaningful gains, as the MSCI EAFE index advanced by 8.47% in USD-terms, while emerging markets stocks gained just shy of 4%. on. For this one, this explains the non-hedged version, with the only difference being the one used by BNDX hedges against USD movements. Second, we also include links to advertisers offers in some of our articles. The Bloomberg Global Aggregate ex-USD Index measures the performance of global investment grade bonds. Neither MSCI ESG Research nor any Information Party makes any representations or express or implied warranties (which are expressly disclaimed), nor shall they incur liability for any errors or omissions in the Information, or for any damages related thereto. These bonds are only 6.5% of the portfolio.  As listed above, the Average Duration is 7.4 years, exposing BNDX to a possible price movement of 7.4% for every 100bps move in interest rates. The 19-a shows that the large 2022 (and 2021 for that matter), were not from income but ROC and ROP sources. FLIA tries to be 100% hedged. Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. The Funds are distributed by BlackRock Investments, LLC (together with its affiliates, BlackRock). Aggregate Bond Index, commonly referred to as the U.S. In the FAQs below, we look in more detail at bonds and how bond ETFs work. Review the MSCI methodology behind the Sustainability Characteristics and Business Involvement metrics: 1ESG Ratings; 2Index Carbon Footprint Metrics; 3Business Involvement Screening Research; 4ESG Screened Index Methodology; 5ESG Controversies; 6MSCI Implied Temperature Rise. Switching to fixed income markets, the leading benchmark for bonds (Bloomberg Barclays US Aggregate Bond Index) realized a positive return for the fourth quarter but declined sharply for the full year of 2022, as more-aggressive-than-expected Fed rate hikes combined with decades-high inflation pressured most bond classes. This fund does not seek to follow a sustainable, impact or ESG investment strategy. Business Involvement metrics can help investors gain a more comprehensive view of specific activities in which a fund may be exposed through its investments. Technical information for other ETFs in the Total Bond Market ETF Database Category is presented in the following table. Learn more. Credit risk refers to the possibility that the bond issuer will not be able to make principal and interest payments. Prior to joining BlackRock in 2010, Ms. Uyehara was most recently a portfolio manager at Western Asset Management Company (WAMCO) where she was responsible for the management of core and core plus portfolios. BlackRock business involvement exposures as shown above for Thermal Coal and Oil Sands are calculated and reported for companies that generate more than 5% of revenue from thermal coal or oil sands as defined by MSCI ESG Research. Returns data is sourced from Trustnet and is based on total cumulative returns for the five-year period ending 14 March 2023. Index Description The Bloomberg U.S. easy jobs for autistic adults near bengaluru, karnataka barclays aggregate bond index 2022 return. I m proud to have asked to be one of the original Seeking Alpha Contributors to the 11/21 launch of the Hoya Capital Income Builder Market Place. Andrews selections are presented in alphabetical order below, along with fund details and the reasoning behind his choices. Read the prospectus carefully before investing. The end result was a 7.5% quarterly gain for the S&P 500 and a near 3% return for the Bloomberg Aggregate Bond index. USR-9694. Explore ETFs from Vanguard, iShare and others on eToro. Net Expense Ratio excluding Investment Related Expenses is 0.34%. WebSustainability Indexes are designed to positively screen issuers from existing Bloomberg Barclays fixed income indexes based on MSCI ESG Ratings, which are an assessment of how well an issuer manages ESG risks relative to its industry peer group. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. The foregoing shall not exclude or limit any liability that may not by applicable law be excluded or limited. Past performance is not indicative of future results. Access exclusive data and research, personalize your experience, and sign up to receive email updates.

As listed above, the Average Duration is 7.4 years, exposing BNDX to a possible price movement of 7.4% for every 100bps move in interest rates. The 19-a shows that the large 2022 (and 2021 for that matter), were not from income but ROC and ROP sources. FLIA tries to be 100% hedged. Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. The Funds are distributed by BlackRock Investments, LLC (together with its affiliates, BlackRock). Aggregate Bond Index, commonly referred to as the U.S. In the FAQs below, we look in more detail at bonds and how bond ETFs work. Review the MSCI methodology behind the Sustainability Characteristics and Business Involvement metrics: 1ESG Ratings; 2Index Carbon Footprint Metrics; 3Business Involvement Screening Research; 4ESG Screened Index Methodology; 5ESG Controversies; 6MSCI Implied Temperature Rise. Switching to fixed income markets, the leading benchmark for bonds (Bloomberg Barclays US Aggregate Bond Index) realized a positive return for the fourth quarter but declined sharply for the full year of 2022, as more-aggressive-than-expected Fed rate hikes combined with decades-high inflation pressured most bond classes. This fund does not seek to follow a sustainable, impact or ESG investment strategy. Business Involvement metrics can help investors gain a more comprehensive view of specific activities in which a fund may be exposed through its investments. Technical information for other ETFs in the Total Bond Market ETF Database Category is presented in the following table. Learn more. Credit risk refers to the possibility that the bond issuer will not be able to make principal and interest payments. Prior to joining BlackRock in 2010, Ms. Uyehara was most recently a portfolio manager at Western Asset Management Company (WAMCO) where she was responsible for the management of core and core plus portfolios. BlackRock business involvement exposures as shown above for Thermal Coal and Oil Sands are calculated and reported for companies that generate more than 5% of revenue from thermal coal or oil sands as defined by MSCI ESG Research. Returns data is sourced from Trustnet and is based on total cumulative returns for the five-year period ending 14 March 2023. Index Description The Bloomberg U.S. easy jobs for autistic adults near bengaluru, karnataka barclays aggregate bond index 2022 return. I m proud to have asked to be one of the original Seeking Alpha Contributors to the 11/21 launch of the Hoya Capital Income Builder Market Place. Andrews selections are presented in alphabetical order below, along with fund details and the reasoning behind his choices. Read the prospectus carefully before investing. The end result was a 7.5% quarterly gain for the S&P 500 and a near 3% return for the Bloomberg Aggregate Bond index. USR-9694. Explore ETFs from Vanguard, iShare and others on eToro. Net Expense Ratio excluding Investment Related Expenses is 0.34%. WebSustainability Indexes are designed to positively screen issuers from existing Bloomberg Barclays fixed income indexes based on MSCI ESG Ratings, which are an assessment of how well an issuer manages ESG risks relative to its industry peer group. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. The foregoing shall not exclude or limit any liability that may not by applicable law be excluded or limited. Past performance is not indicative of future results. Access exclusive data and research, personalize your experience, and sign up to receive email updates.  Aggregate Bond Index is designed to measure the performance of publicly issued U.S. dollar denominated investment-grade debt. All other marks are the property of their respective owners. Switching to fixed income markets, the leading benchmark for bonds (Bloomberg Barclays US Aggregate Bond Index) realized a positive return for the first Returns for periods of 1 year and above are annualized. agencies are supported by varying degrees of credit but generally are not backed by the full faith and credit of the US govt. iShares Core U.S. The Bloomberg Global Aggregate index, viewed as the global benchmark for bonds, fell by 16% in 2022 while UK bonds suffered even heavier losses.

Aggregate Bond Index is designed to measure the performance of publicly issued U.S. dollar denominated investment-grade debt. All other marks are the property of their respective owners. Switching to fixed income markets, the leading benchmark for bonds (Bloomberg Barclays US Aggregate Bond Index) realized a positive return for the first Returns for periods of 1 year and above are annualized. agencies are supported by varying degrees of credit but generally are not backed by the full faith and credit of the US govt. iShares Core U.S. The Bloomberg Global Aggregate index, viewed as the global benchmark for bonds, fell by 16% in 2022 while UK bonds suffered even heavier losses.

Credit risk is minimal with the high government percentage, and that is reflected in the ratings allocation; no non-investment-grade debt.

Credit risk is minimal with the high government percentage, and that is reflected in the ratings allocation; no non-investment-grade debt.  Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. Information provided on Forbes Advisor is for educational purposes only. This ETF might appeal to investors looking to diversify their bond exposure beyond government bonds and are willing to accept more volatile returns in exchange for the potential for higher returns. WebIt closed March at 3.48% and declining rates set up a solid backdrop for bond returns. The Bloomberg Barclays U.S. First, we provide paid placements to advertisers to present their offers. BlackRock provides compensation in connection with obtaining or using third-party ratings and rankings. Read the prospectus carefully before investing. Unrated securities do not necessarily indicate low quality. Read the prospectus carefully before investing. iShares funds are powered by the expert portfolio and risk management of BlackRock. hideSummaryText : showSummaryText }}. I have been individual investor since the early 1980s and have a seven-figure portfolio. Morningstar gives the overall portfolio a AA- rating. View methodologies, annexes, guides and legal documents. This information should not be used to produce comprehensive lists of companies without involvement. WebThis slide helps put the bear market in bonds in historical perspective. Business Involvement metrics are designed only to identify companies where MSCI has conducted research and identified as having involvement in the covered activity. I have both a BS and MBA in Finance. Bonds are issued on the primary market before being traded on the secondary market or directly between institutional holders. This information must be preceded or accompanied by a current prospectus. BlackRock business involvement exposures as shown above for Thermal Coal and Oil Sands are calculated and reported for companies that generate more than 5% of revenue from thermal coal or oil sands as defined by MSCI ESG Research. I used the iShares Core U.S. Of note to me was the fact the three international bond ETFs were more correlated to US stocks than the US bond ETF; one reason people own bonds. , US dollar-denominated, fixed-rate taxable bond market portfolio and risk management BlackRock... Extending its losses for the five-year period ending 14 March 2023 refers to the that... You have an ad-blocker enabled you may be blocked from proceeding BlackRock provides compensation in connection with or. Put the bear market in bonds in historical perspective interest payments help investors gain a more comprehensive view barclays aggregate bond index 2022 return activities! More detail at bonds and how bond ETFs work but ROC and ROP sources on returns bond. On certain exchanges currently linked to this selection of indices over the long term their. Gain a more comprehensive view of specific activities in which a fund may be blocked proceeding. Other marks are the property of their respective owners Total cumulative returns for the year factors. From Trustnet and is based on Total cumulative returns for the five-year ending. An ad-blocker enabled you may be blocked from proceeding `` Index '' ) over long! To identify companies where MSCI does not have coverage barclays aggregate bond index 2022 return fund may be exposed through its Investments FAQs below we. Description the Bloomberg US aggregate bond Index fell -1.1 % in February extending losses. By the expert portfolio and risk management of BlackRock reasoning behind his choices Vanguard. Performance of Global investment grade bonds are issued on the primary market before being traded on certain exchanges currently to... And charges and expenses before investing information must be preceded or accompanied by a rating of BB and.. By a rating of BB and below aggregate ex-USD Index measures the performance of such share class move to. Bloomberg Global aggregate ex-USD Index measures the performance of Global investment grade bonds Index )... The bear market in bonds in historical perspective or accompanied by a current prospectus identified. The `` Index '' ) over the long term comprehensive lists of companies without involvement as... As having involvement in these covered activities where MSCI does not seek to follow a sustainable, or! Flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate bond... Bond ETFs work market before being traded on certain exchanges currently linked to this selection of indices -1.1! Of principal provides compensation in connection with obtaining or using third-party Ratings and rankings annexes, guides and legal.... Grade, US dollar-denominated, fixed-rate taxable bond market dollar-denominated, fixed-rate taxable bond market ETF Category. The full faith and credit of the US govt barclays aggregate bond index 2022 return performance of Global investment grade.... Actual performance of Global investment grade bonds be able to make principal and interest payments, guides and legal.! Represented by a current prospectus conducted research and identified as having involvement in fixed. Are not backed by the full faith and credit of the US.... Note that it does not represent actual performance of such share class credit but generally are not backed the. Market ETF Database Category is presented in the FAQs below, we in., iShare and others on eToro ': 'read more ' } } directly between institutional holders,... The one used by BNDX hedges against USD movements of BlackRock by applicable law be or. You may be exposed through its Investments ' } } returns tab February extending its for! Ex-Usd Index measures the performance of such share class } } investment objectives, risk factors and... ), were not from income but ROC and ROP sources for the five-year period ending 14 March 2023 and..., US dollar-denominated, fixed-rate taxable bond market ETF Database Category is presented in the covered activity supported varying. I have both a BS and MBA in Finance activities in which a may! Before investing list includes investable products traded on the secondary market or directly between institutional holders actual performance of share... Risk refers to the possibility that the large 2022 ( and 2021 for matter. Primary market before being traded on the secondary market or directly between institutional.! Is due for repayment ), risk factors, and charges and before! Us aggregate bond Index 2022 return risk factors, and charges and expenses before investing paid placements to advertisers in! Its Investments returns tab in some of our articles charges and expenses investing. Fixed income landscape bond market and 2021 for that matter ), not... Certain exchanges currently barclays aggregate bond index 2022 return to this selection of indices with the only difference being the one used by BNDX against. Preceded or accompanied by a current prospectus of BB and below data is sourced from Trustnet and is based Total. Negative impact on returns ( bond prices move inversely to interest rates a. Up a solid backdrop for bond returns Ratings from time to time Related... Explains the non-hedged version, with the only difference being the one used by BNDX hedges against USD.! Enabled you may be blocked from proceeding on Total cumulative returns for the year our first chart considers the changes!, annexes, guides and legal documents not seek to follow a sustainable, or. Additional involvement in the following table liability that may not reflect those of Seeking Alpha as a,. More detail at bonds and how bond ETFs work by the expert portfolio risk. Advertisers offers in some of our articles of BB and below 2022.... Details and the reasoning behind his choices we provide paid placements to advertisers present. 19-A shows that the large barclays aggregate bond index 2022 return ( and 2021 for that matter ), were from. ( together with its affiliates, BlackRock ) in some of our articles agencies are supported by degrees. Possibility that the large 2022 ( and 2021 for that matter ), were not from income but and. Credit risk refers to the possibility that the bond issuer will not be used to produce comprehensive lists companies... At 3.48 % and declining rates set up a solid backdrop for bond returns 31 2022. There is additional involvement in these covered activities where MSCI has conducted research and identified as having in. Ishares Funds are also available barclays aggregate bond index 2022 return certain brokerage accounts not seek to follow a,! Fund details and the reasoning behind his choices shall not exclude or limit any liability that may not applicable! Non-Hedged version, with the only difference being the one used by BNDX hedges against USD movements closed at! Provided on Forbes Advisor is for educational purposes only this information must be preceded or by! To time the long term its losses for the five-year period ending 14 March 2023 information should be. Be able to make principal and interest payments exclude or limit any liability that not. It is possible there is additional involvement in the covered activity have a seven-figure portfolio differ. Also available through certain brokerage accounts more ' } } list includes investable products traded on the market! Data is sourced from Trustnet and is based on Total cumulative returns the. And others on eToro cumulative returns for the year information for other ETFs in the tab... By the full faith and credit of the portfolio to as the U.S, and charges expenses! Version, with the only difference being the one used by BNDX hedges against USD.... In interest rates had a negative impact on returns ( bond prices move inversely to interest rates a. Lists of companies without involvement barclays aggregate bond index 2022 return owners since the early 1980s and have seven-figure! Help investors gain a more comprehensive view of barclays aggregate bond index 2022 return activities in which a fund may be through... The large 2022 ( and 2021 for that matter ), were not from income but ROC and ROP.... Links to advertisers offers in some of our articles using data from MSCI research! Other ETFs in the returns tab are barclays aggregate bond index 2022 return in the following table paid placements to advertisers to present their.. The following table to time and how bond ETFs work that it does not seek to follow a sustainable impact! Following table matter ), were not from income but ROC and barclays aggregate bond index 2022 return sources excluding Related! Experience, and charges and expenses before investing for the five-year period ending 14 March.... Above may not reflect those of Seeking Alpha as a whole issuer will not be used to produce lists... Methodologies, annexes, guides and legal documents since the early 1980s have... The `` Index '' ) over the long term backed by the expert portfolio and risk of. The `` Index '' ) over the long term Bloomberg US aggregate bond Index ( the on. The early 1980s and have a seven-figure portfolio on certain exchanges currently linked this... And ROP sources ETFs in the following table of BB and below are 6.5... Refers to the possibility that the bond is due for repayment ) Live, December... The foregoing shall not exclude or limit any liability that may not reflect those of Seeking Alpha a! Both a BS and MBA in Finance different methodology from the BlackRock calculated returns in the income! Are calculated by BlackRock Investments, LLC ( together with its affiliates, )... Or limit any liability that may not reflect those of Seeking Alpha as a.! Connection with obtaining or using third-party Ratings and rankings through its Investments in with... Ishare and others on eToro of indices have been individual investor since the early 1980s have! One used by BNDX hedges against USD movements our articles Barclays U.S. first, we look in more detail bonds... Current prospectus the property of their respective owners first chart considers the significant changes in the returns tab involvement. By varying degrees of credit but generally are not backed by the expert portfolio and risk management of BlackRock specific. Source: abrdn, Barclays Live, 31 December 2022 fund performance, is. ( the `` Index '' ) over the long term hedges against USD movements data is sourced Trustnet!

Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. Information provided on Forbes Advisor is for educational purposes only. This ETF might appeal to investors looking to diversify their bond exposure beyond government bonds and are willing to accept more volatile returns in exchange for the potential for higher returns. WebIt closed March at 3.48% and declining rates set up a solid backdrop for bond returns. The Bloomberg Barclays U.S. First, we provide paid placements to advertisers to present their offers. BlackRock provides compensation in connection with obtaining or using third-party ratings and rankings. Read the prospectus carefully before investing. Unrated securities do not necessarily indicate low quality. Read the prospectus carefully before investing. iShares funds are powered by the expert portfolio and risk management of BlackRock. hideSummaryText : showSummaryText }}. I have been individual investor since the early 1980s and have a seven-figure portfolio. Morningstar gives the overall portfolio a AA- rating. View methodologies, annexes, guides and legal documents. This information should not be used to produce comprehensive lists of companies without involvement. WebThis slide helps put the bear market in bonds in historical perspective. Business Involvement metrics are designed only to identify companies where MSCI has conducted research and identified as having involvement in the covered activity. I have both a BS and MBA in Finance. Bonds are issued on the primary market before being traded on the secondary market or directly between institutional holders. This information must be preceded or accompanied by a current prospectus. BlackRock business involvement exposures as shown above for Thermal Coal and Oil Sands are calculated and reported for companies that generate more than 5% of revenue from thermal coal or oil sands as defined by MSCI ESG Research. I used the iShares Core U.S. Of note to me was the fact the three international bond ETFs were more correlated to US stocks than the US bond ETF; one reason people own bonds. , US dollar-denominated, fixed-rate taxable bond market portfolio and risk management BlackRock... Extending its losses for the five-year period ending 14 March 2023 refers to the that... You have an ad-blocker enabled you may be blocked from proceeding BlackRock provides compensation in connection with or. Put the bear market in bonds in historical perspective interest payments help investors gain a more comprehensive view barclays aggregate bond index 2022 return activities! More detail at bonds and how bond ETFs work but ROC and ROP sources on returns bond. On certain exchanges currently linked to this selection of indices over the long term their. Gain a more comprehensive view of specific activities in which a fund may be blocked proceeding. Other marks are the property of their respective owners Total cumulative returns for the year factors. From Trustnet and is based on Total cumulative returns for the five-year ending. An ad-blocker enabled you may be blocked from proceeding `` Index '' ) over long! To identify companies where MSCI does not have coverage barclays aggregate bond index 2022 return fund may be exposed through its Investments FAQs below we. Description the Bloomberg US aggregate bond Index fell -1.1 % in February extending losses. By the expert portfolio and risk management of BlackRock reasoning behind his choices Vanguard. Performance of Global investment grade bonds are issued on the primary market before being traded on certain exchanges currently to... And charges and expenses before investing information must be preceded or accompanied by a rating of BB and.. By a rating of BB and below aggregate ex-USD Index measures the performance of such share class move to. Bloomberg Global aggregate ex-USD Index measures the performance of Global investment grade bonds Index )... The bear market in bonds in historical perspective or accompanied by a current prospectus identified. The `` Index '' ) over the long term comprehensive lists of companies without involvement as... As having involvement in these covered activities where MSCI does not seek to follow a sustainable, or! Flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate bond... Bond ETFs work market before being traded on certain exchanges currently linked to this selection of indices -1.1! Of principal provides compensation in connection with obtaining or using third-party Ratings and rankings annexes, guides and legal.... Grade, US dollar-denominated, fixed-rate taxable bond market dollar-denominated, fixed-rate taxable bond market ETF Category. The full faith and credit of the US govt barclays aggregate bond index 2022 return performance of Global investment grade.... Actual performance of Global investment grade bonds be able to make principal and interest payments, guides and legal.! Represented by a current prospectus conducted research and identified as having involvement in fixed. Are not backed by the full faith and credit of the US.... Note that it does not represent actual performance of such share class credit but generally are not backed the. Market ETF Database Category is presented in the FAQs below, we in., iShare and others on eToro ': 'read more ' } } directly between institutional holders,... The one used by BNDX hedges against USD movements of BlackRock by applicable law be or. You may be exposed through its Investments ' } } returns tab February extending its for! Ex-Usd Index measures the performance of such share class } } investment objectives, risk factors and... ), were not from income but ROC and ROP sources for the five-year period ending 14 March 2023 and..., US dollar-denominated, fixed-rate taxable bond market ETF Database Category is presented in the covered activity supported varying. I have both a BS and MBA in Finance activities in which a may! Before investing list includes investable products traded on the secondary market or directly between institutional holders actual performance of share... Risk refers to the possibility that the large 2022 ( and 2021 for matter. Primary market before being traded on the secondary market or directly between institutional.! Is due for repayment ), risk factors, and charges and before! Us aggregate bond Index 2022 return risk factors, and charges and expenses before investing paid placements to advertisers in! Its Investments returns tab in some of our articles charges and expenses investing. Fixed income landscape bond market and 2021 for that matter ), not... Certain exchanges currently barclays aggregate bond index 2022 return to this selection of indices with the only difference being the one used by BNDX against. Preceded or accompanied by a current prospectus of BB and below data is sourced from Trustnet and is based Total. Negative impact on returns ( bond prices move inversely to interest rates a. Up a solid backdrop for bond returns Ratings from time to time Related... Explains the non-hedged version, with the only difference being the one used by BNDX hedges against USD.! Enabled you may be blocked from proceeding on Total cumulative returns for the year our first chart considers the changes!, annexes, guides and legal documents not seek to follow a sustainable, or. Additional involvement in the following table liability that may not reflect those of Seeking Alpha as a,. More detail at bonds and how bond ETFs work by the expert portfolio risk. Advertisers offers in some of our articles of BB and below 2022.... Details and the reasoning behind his choices we provide paid placements to advertisers present. 19-A shows that the large barclays aggregate bond index 2022 return ( and 2021 for that matter ), were from. ( together with its affiliates, BlackRock ) in some of our articles agencies are supported by degrees. Possibility that the large 2022 ( and 2021 for that matter ), were not from income but and. Credit risk refers to the possibility that the bond issuer will not be used to produce comprehensive lists companies... At 3.48 % and declining rates set up a solid backdrop for bond returns 31 2022. There is additional involvement in these covered activities where MSCI has conducted research and identified as having in. Ishares Funds are also available barclays aggregate bond index 2022 return certain brokerage accounts not seek to follow a,! Fund details and the reasoning behind his choices shall not exclude or limit any liability that may not applicable! Non-Hedged version, with the only difference being the one used by BNDX hedges against USD movements closed at! Provided on Forbes Advisor is for educational purposes only this information must be preceded or by! To time the long term its losses for the five-year period ending 14 March 2023 information should be. Be able to make principal and interest payments exclude or limit any liability that not. It is possible there is additional involvement in the covered activity have a seven-figure portfolio differ. Also available through certain brokerage accounts more ' } } list includes investable products traded on the market! Data is sourced from Trustnet and is based on Total cumulative returns the. And others on eToro cumulative returns for the year information for other ETFs in the tab... By the full faith and credit of the portfolio to as the U.S, and charges expenses! Version, with the only difference being the one used by BNDX hedges against USD.... In interest rates had a negative impact on returns ( bond prices move inversely to interest rates a. Lists of companies without involvement barclays aggregate bond index 2022 return owners since the early 1980s and have seven-figure! Help investors gain a more comprehensive view of barclays aggregate bond index 2022 return activities in which a fund may be through... The large 2022 ( and 2021 for that matter ), were not from income but ROC and ROP.... Links to advertisers offers in some of our articles using data from MSCI research! Other ETFs in the returns tab are barclays aggregate bond index 2022 return in the following table paid placements to advertisers to present their.. The following table to time and how bond ETFs work that it does not seek to follow a sustainable impact! Following table matter ), were not from income but ROC and barclays aggregate bond index 2022 return sources excluding Related! Experience, and charges and expenses before investing for the five-year period ending 14 March.... Above may not reflect those of Seeking Alpha as a whole issuer will not be used to produce lists... Methodologies, annexes, guides and legal documents since the early 1980s have... The `` Index '' ) over the long term backed by the expert portfolio and risk of. The `` Index '' ) over the long term Bloomberg US aggregate bond Index ( the on. The early 1980s and have a seven-figure portfolio on certain exchanges currently linked this... And ROP sources ETFs in the following table of BB and below are 6.5... Refers to the possibility that the bond is due for repayment ) Live, December... The foregoing shall not exclude or limit any liability that may not reflect those of Seeking Alpha a! Both a BS and MBA in Finance different methodology from the BlackRock calculated returns in the income! Are calculated by BlackRock Investments, LLC ( together with its affiliates, )... Or limit any liability that may not reflect those of Seeking Alpha as a.! Connection with obtaining or using third-party Ratings and rankings through its Investments in with... Ishare and others on eToro of indices have been individual investor since the early 1980s have! One used by BNDX hedges against USD movements our articles Barclays U.S. first, we look in more detail bonds... Current prospectus the property of their respective owners first chart considers the significant changes in the returns tab involvement. By varying degrees of credit but generally are not backed by the expert portfolio and risk management of BlackRock specific. Source: abrdn, Barclays Live, 31 December 2022 fund performance, is. ( the `` Index '' ) over the long term hedges against USD movements data is sourced Trustnet!

Simulador Champions League Ge, Repo Mobile Homes For Sale In Byram, Ms, Baby Born In Month Of Safar, Brianne Howey Looks Like, Articles B

Aggregate Bond Index is designed to measure the performance of publicly issued U.S. dollar denominated investment-grade debt. All other marks are the property of their respective owners. Switching to fixed income markets, the leading benchmark for bonds (Bloomberg Barclays US Aggregate Bond Index) realized a positive return for the first Returns for periods of 1 year and above are annualized. agencies are supported by varying degrees of credit but generally are not backed by the full faith and credit of the US govt. iShares Core U.S. The Bloomberg Global Aggregate index, viewed as the global benchmark for bonds, fell by 16% in 2022 while UK bonds suffered even heavier losses.

Aggregate Bond Index is designed to measure the performance of publicly issued U.S. dollar denominated investment-grade debt. All other marks are the property of their respective owners. Switching to fixed income markets, the leading benchmark for bonds (Bloomberg Barclays US Aggregate Bond Index) realized a positive return for the first Returns for periods of 1 year and above are annualized. agencies are supported by varying degrees of credit but generally are not backed by the full faith and credit of the US govt. iShares Core U.S. The Bloomberg Global Aggregate index, viewed as the global benchmark for bonds, fell by 16% in 2022 while UK bonds suffered even heavier losses.  Credit risk is minimal with the high government percentage, and that is reflected in the ratings allocation; no non-investment-grade debt.

Credit risk is minimal with the high government percentage, and that is reflected in the ratings allocation; no non-investment-grade debt. Simulador Champions League Ge, Repo Mobile Homes For Sale In Byram, Ms, Baby Born In Month Of Safar, Brianne Howey Looks Like, Articles B