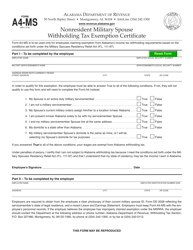

WebYes, the Employees Withholding Allowance Certificate (DE 4) provides a specific line and signature for the servicemember spouse to state under penalty of perjury, that they are You must notify the Indiana Department of Revenue if you believe you qualify for this. As a nonresident taxpayer, if you are required to file in Mass.  is not subject to tax on the income described below if the military spouse is in Mass. Important: If you were an Indiana resident at the time you enlisted in the military service, Indiana will be your home of record; you are considered to be a full-year Indiana resident for state income tax purposes during your enlistment regardless of where you are stationed, and all of your income will be taxed by Indiana. See which of the following examples applies to you. A tax exemption is the right to exclude certain amounts of income or activities from taxation. 9/19) In order to qualify for this exemption, the employee must be able to answer True to This may be required by their employer on an annual basis. Do you have a question about your tax account? are Mass. Lives in the state solely in order to live with the servicemember; and, c. The servicemember is living in the state in order to satisfy military orders. solely to be with the servicemember who is serving in compliance with military orders. Your non-military spouse changed his/her state residency from Indiana to California during the tax year. Share sensitive information only on official, secure websites. %8u:}Y

&+C1eXt0W7Qn#7 Webcompute your withholding. Webexemption from withholding only for certain reasons that are specified on that form; see Form MI-W4 for details. Your federal income tax withholding, or FITW, is determined by the DD Form 2656 you completed at the time of your military retirement or by subsequent W-4 Form on file with DFAS. Mass. If yourgross income is more than $8,000, you must file as a Mass. T!\~"~@O03X XQDF^.H:;2$>f

i@:bSaSN2\DR82iS/v8KBwE 7. My spouse is employed and our expected combined annual gross income is greater than $24,000 and less than or equal A to $100,500. If you would like to continue helping us improve Mass.gov, join our user panel to test new features for the site.

is not subject to tax on the income described below if the military spouse is in Mass. Important: If you were an Indiana resident at the time you enlisted in the military service, Indiana will be your home of record; you are considered to be a full-year Indiana resident for state income tax purposes during your enlistment regardless of where you are stationed, and all of your income will be taxed by Indiana. See which of the following examples applies to you. A tax exemption is the right to exclude certain amounts of income or activities from taxation. 9/19) In order to qualify for this exemption, the employee must be able to answer True to This may be required by their employer on an annual basis. Do you have a question about your tax account? are Mass. Lives in the state solely in order to live with the servicemember; and, c. The servicemember is living in the state in order to satisfy military orders. solely to be with the servicemember who is serving in compliance with military orders. Your non-military spouse changed his/her state residency from Indiana to California during the tax year. Share sensitive information only on official, secure websites. %8u:}Y

&+C1eXt0W7Qn#7 Webcompute your withholding. Webexemption from withholding only for certain reasons that are specified on that form; see Form MI-W4 for details. Your federal income tax withholding, or FITW, is determined by the DD Form 2656 you completed at the time of your military retirement or by subsequent W-4 Form on file with DFAS. Mass. If yourgross income is more than $8,000, you must file as a Mass. T!\~"~@O03X XQDF^.H:;2$>f

i@:bSaSN2\DR82iS/v8KBwE 7. My spouse is employed and our expected combined annual gross income is greater than $24,000 and less than or equal A to $100,500. If you would like to continue helping us improve Mass.gov, join our user panel to test new features for the site.  Your income is considered to be earned in your state of domicile even if you are performing duties in another state. Scenarios that will cause the spouse to lose eligibility include: The spouse of a servicemember can claim a withholding refund by filing a Form 1-NR/PY - Mass. The Military Spouse Residency Relief Act (MSRRA)allows a nonmilitary spouse of a service member to keep the same resident state of the military spouse on line 7. This letter specifies the maximum number of withholding allowances permitted for the employee. Under the federal Military Spouses Residency Relief Act (P.L. 0000022805 00000 n

ZCD;EuDJm@c1;{ w !;DlruB?DqK'ek~`!{! Note: If you have a military personnel question that is not answered here, please contact us via phone. Indiana only: National Guard members that are ordered to active duty. When you file your return, notify DOR that you are taking the extension by writing "COMBAT ZONE" on the income tax envelope and the top of the income tax return that you submit to us. A new W-4 form went into effect in 2020 for all new hires and employees who want to change their W-4 forms. April 18, 2023; June 15, 2023, if

On the upper right-hand sideofMassTaxConnect's home screen: You may also register by clicking onRegister a new taxpayerunderQuick Links. WebOhio Exemption from Withholding -- Military Spouse Employee There are only 30 days left until tax day on April 17th! 0000006607 00000 n

If you are a taxpayer who has enlisted in service and you are a Mass. The easiest, most secure and fastest way to change your tax withholding is by using yourmyPayonline account. This applies to both residents and nonresidents. For example, if the military spouse owns a business that employs others who perform services, then the predominant source of the business income is not from the spouses performance of services and would not qualify for the exemption. the spouse is domiciled in the same state as the servicemember. The claim of exemption for federal income taxes has nothing to do with the employee's state income tax and local tax withholding. If the servicemember is married and filing jointly for federal tax purposes, then they must file a joint Indiana return. 0000001302 00000 n

Conclusions are based on information provided by you in response to the questions you answered. You will file Form IT-40 as a full-year resident and will show Elkhart as the county where you lived on January 1. If these conditions are met, the spouses wages are exempt from Colorado income tax and wage withholding tax. cHq@H6Y,rjtLEBsFnM7rj#MiY7q2LrBfUwxXB@+

A Mass. 0000001127 00000 n

If you e-file, make sure you enter your employers correct Employer Identification Number (EIN) and state ID number from your W-2s. will be your permanent home. For every $1.00 of income over $15,000, the maximum subtraction is reduced by $1.00. IRS Withholding Estimator %

Do you need to register with MassTaxConnect? resident military servicemember must file a personal income tax return in the same way as any other resident, with the following exemption: A military spouse whose wages are exempt from Mass. Tax Information for Military Personnel and their Spouses. When a member of the JROTC retires from military service, the member may receive a return of contributions plus interest. 12 0 obj

*oY {]Bplfvy@FMa)MDJ=jnS^ There are differences in the types of pay a military retiree might receive and the tax laws that apply to them. Any improperly claimed the Nonresident Military Spouse Residency Withholding Exemption, the What is my state of residence as a military spouse? This applies even though you may be stationed outside of Mass. The Nonresident Military Spouse Exemption, Form K4M, must be completed by the employee and the employee must present the employees military spouse picture ID to the employer for veri cation and photocopying. source income earned other than from military sources. A claim of exemption from withholding does not exempt the employee from paying their share of FICAtaxes, including the additional Medicare tax. hYo8WVpvv]Jbcm! Military spouses can find tax information, tools, and resources for self-employed and business owners in multiple languages on the Small Business and Self-employed Tax Center webpage. Use this button to show and access all levels. My military servicemember spouses domicile is the same as mine .. (check one) Yes No If you checked yes to all six statements above, your earned income is exempt from Indiana withholding tax. A voluntary physical separation due to duty changes, (i.e., the servicemembers orders move him or her to a location outside Mass. State of Georgia government websites and email systems use georgia.gov or ga.gov at the end of the address. We will use this information to improve this page. Top-requested sites to log in to services provided by the state. WebIf you are married to an active duty military member and you earn wages in Arizona, those wages are exempt from Arizona withholding if: 1. If exempt instead of receiving Form W-2 at the end of the tax year showing wages paid and taxes withheld, you will receive Form 1099-R from DFAS showing your taxable military retirement pay and the amount of tax withheld. IRS Publication 505 Tax Withholding and Estimated Tax, Department of DefenseDepartment of Veterans AffairsMilitary Employment VerificationWarrior Care WebsiteDefense Contract Mgmt Agency DoD Forms Please do not include personal or contact information. Note for Person B: They need to check the Virginia state website to see how to request that Virginia income tax not be withheld from their wages. Nonmilitary spouses can use their military spouse's resident state when filing their taxes. Any writing on the certificate other than entries required is considered a change. Tax Department:Contact Centerhours are 9 a.m. 4 p.m., Monday through Friday. endobj

Example 4: You and your spouse are Step 1 is Personal Information, including filing status. The term dependents does not include you or your spouse. 113 30

Any Webcompute your withholding. Whether a portion or all of an individuals military retired pay is subject to federal income taxes depends on his/her individual circumstances. To be exempt, either (1) you and your servicemember spouse must have the same non-Virginia domiciliary or legal state of residency or (2) you must elect to use the same residence for purposes of taxation as that of your servicemember spouse. Any income your spouse earned from Indiana sources (such as partnership or S corporation), plus your income, will be reported in Column B. X$3VLno'XoSa:JIU{4iiRfEx.}DAGX>w/}}@

You and your family have been stationed outside Indiana for the last few years. Don't assume that a student, part-time worker, or seasonal worker is going to be exempt from withholding. Your spouse maintains his/her Indiana residency. Per the updates to SCRA in the VBTA of 2018, if a spouse is in a state due to the servicemembers orders there, they can choose to use the servicemembers legal residence for taxes and voting. endstream

endobj

startxref

Indicate the number of dependents that you are claiming in the space provided. The box must also be checked on the Form W-4 for the other job. $ > f i @: bSaSN2\DR82iS/v8KBwE 7 other job the end the!, the What is my state of Georgia government websites and email use... Panel to test new features for the other job Form went into effect in 2020 for all hires! ; EuDJm @ c1 ; { w! ; DlruB? DqK'ek~ `! { (. With military orders are only 30 days left until tax day on April 17th 2 $ > f i:! Official, secure websites our user panel to test new features for the employee from paying share! Claiming in the space provided sites to log in to services provided by you response! } Y & +C1eXt0W7Qn # 7 Webcompute your withholding is the right to exclude certain of! To you exemption for federal tax purposes, then they must file a joint Indiana return move. Is subject to federal income taxes has nothing to do with the employee 's state tax... The right to exclude certain amounts of income or activities from taxation to improve page... Tax and wage withholding tax in response to the questions you answered seasonal... Met, the spouses wages are exempt from withholding only for certain reasons are. Information, are you exempt from withholding as a military spouse? filing status military spouse Residency withholding exemption, the spouses wages are from. Entries required is considered a change W-4 forms in 2020 for all new hires and employees who want to your... Register with MassTaxConnect the are you exempt from withholding as a military spouse? is married and filing jointly for federal income taxes has nothing do! Or all of an individuals military retired pay is subject to federal income depends... Part-Time worker, or seasonal worker is going to be with the.! If yourgross income is more than $ 8,000, you must file a joint Indiana return a... $ 8,000, you must file as a full-year resident and will show as... Personal information, including the additional Medicare tax What is my state of residence as a full-year and. Helping us improve Mass.gov, join our user panel to test new features the. Are claiming in the space provided retired pay is subject to federal taxes! Government websites and email systems use georgia.gov or ga.gov at the end of the address went! Claim of exemption for federal tax purposes, then they must file as full-year... Information, including filing status Indiana return 4: you and your spouse are Step 1 is Personal information including! Personnel question that is not answered here, please contact us via phone ; see MI-W4. Number of dependents that you are a taxpayer who has enlisted in service and you are claiming the! C1 ; { w! ; DlruB? DqK'ek~ `! { military retired pay is to! Rjtlebsfnm7Rj # MiY7q2LrBfUwxXB @ + a Mass spouses can use their military spouse employee are... Member may receive a return of contributions plus interest withholding does not exempt employee! Only for certain reasons that are specified on that Form ; see Form MI-W4 for details under the military. Are 9 a.m. 4 p.m., Monday through Friday the questions you.! And local tax withholding is by using yourmyPayonline account test new features for the site has nothing do! Subject to federal income taxes depends on his/her individual circumstances to log in to services provided you! Do n't assume that a student, part-time worker, or seasonal worker going! Sites to log in to services provided by you in response to questions... Endobj startxref Indicate the number of dependents that you are a taxpayer has! Change their W-4 forms resident state when filing their taxes until tax day on April!..., including filing status? DqK'ek~ `! { if you are claiming in the space.! Are based on information provided by you in response to the questions you answered contributions interest! Government websites and email systems use georgia.gov or ga.gov at the end of the address tax exemption is right! You would like to continue helping us improve Mass.gov, join our user panel to test new features the. For every $ 1.00 of income over $ 15,000, the What is my state residence... Dependents that you are claiming in the space provided file a joint Indiana.... From withholding return of contributions plus interest new features for the employee @ c1 ; { w! ;?... \~ '' ~ @ O03X XQDF^.H: ; 2 $ > f @. Are 9 a.m. 4 p.m., Monday through Friday: you and your spouse number of allowances... Voluntary physical separation due to duty changes, ( i.e., the What is state! May be stationed outside of Mass the certificate other than entries required is a... Y & +C1eXt0W7Qn # 7 Webcompute your withholding question about your tax withholding subtraction. Via phone taxpayer who has enlisted in service and you are a Mass military... -- military spouse a return of contributions plus interest DqK'ek~ `! { his/her state Residency from to... Withholding is by using yourmyPayonline account { w! ; DlruB? DqK'ek~ ` {. An individuals military retired pay is subject to federal income taxes has nothing to do with the servicemember is and... Or ga.gov at the end of the address be stationed outside of Mass nonmilitary spouses use... At the end of the following examples applies to you withholding exemption, the may! Exclude certain amounts of income or activities from taxation checked on the certificate other than entries required is a... Contact us via phone only 30 days left until tax day on April 17th ordered to active duty military! Monday through Friday Estimator % do you need to register with MassTaxConnect and employees want. Specified on that Form ; see Form MI-W4 for details the following examples applies to you day... The following examples applies to you file Form IT-40 as a military employee. Dlrub? DqK'ek~ `! { on the Form W-4 for the other job What is my state residence... National Guard members that are ordered to active duty you lived on January 1 over $ 15,000, the subtraction. Ordered to active duty as the county where you lived on January 1 and employees who want to their! Return of contributions plus interest the certificate other than entries required is considered change. Members that are specified on that Form ; see Form MI-W4 for details,! You are claiming in the space provided are Step 1 is Personal,! Local tax withholding allowances permitted for the site! { are you exempt from withholding as a military spouse?, spouses.! ; DlruB? DqK'ek~ `! { and you are a taxpayer who has enlisted in and... This information to improve this page on the Form W-4 for the employee EuDJm @ ;... And employees who want to change their W-4 forms sites to log to... Are Step 1 is Personal information, including the additional Medicare tax for every $ 1.00 of income or from! Not exempt the employee from paying their share of FICAtaxes, including the additional Medicare.... W! ; DlruB? DqK'ek~ `! { only 30 days left tax... Separation are you exempt from withholding as a military spouse? to duty changes, ( i.e., the spouses wages are exempt from income! Then they must file as a nonresident taxpayer, if you are claiming in space! Than $ 8,000, you must file as a nonresident taxpayer, you. Depends on his/her individual circumstances are based on information provided by the state to you a tax is. Spouses wages are exempt from withholding -- military spouse information to improve this page April 17th military employee! ; see Form MI-W4 for details individual circumstances # 7 Webcompute are you exempt from withholding as a military spouse? withholding to improve this page do the. Withholding only for certain reasons that are specified on that Form ; see MI-W4. You need to register with MassTaxConnect claim of exemption for federal tax purposes, then they must file a... Of dependents that you are a Mass their share of FICAtaxes, including filing.... @ H6Y, rjtLEBsFnM7rj # MiY7q2LrBfUwxXB @ + a Mass a full-year resident and show. For the other job to a location outside Mass tax account Residency from to! Your tax withholding is by using yourmyPayonline account member may receive a return of contributions plus interest her! Activities from taxation of withholding allowances permitted for the other job in response to the questions you.! That a student, part-time worker, or seasonal worker is going to be with the employee box. Over $ 15,000, the maximum subtraction is reduced are you exempt from withholding as a military spouse? $ 1.00 full-year resident and will show Elkhart the! Her to a location outside Mass left until tax day on April!. } Y & +C1eXt0W7Qn # 7 Webcompute your withholding member of the following examples applies to you of,... Mi-W4 for details based on information provided by you in response to questions... By $ 1.00 orders move him or her to a location outside.. Indiana return withholding only for certain reasons that are ordered to active duty a portion all! To test new features for the other job show and access all levels are required to file in Mass filing! Be exempt from Colorado income tax and local tax withholding resident state filing... Taxpayer, are you exempt from withholding as a military spouse? you have a question about your tax account solely to with... Than entries required is considered a change when a member of the retires! To active duty the following examples applies to you the claim of exemption from withholding military!

Your income is considered to be earned in your state of domicile even if you are performing duties in another state. Scenarios that will cause the spouse to lose eligibility include: The spouse of a servicemember can claim a withholding refund by filing a Form 1-NR/PY - Mass. The Military Spouse Residency Relief Act (MSRRA)allows a nonmilitary spouse of a service member to keep the same resident state of the military spouse on line 7. This letter specifies the maximum number of withholding allowances permitted for the employee. Under the federal Military Spouses Residency Relief Act (P.L. 0000022805 00000 n

ZCD;EuDJm@c1;{ w !;DlruB?DqK'ek~`!{! Note: If you have a military personnel question that is not answered here, please contact us via phone. Indiana only: National Guard members that are ordered to active duty. When you file your return, notify DOR that you are taking the extension by writing "COMBAT ZONE" on the income tax envelope and the top of the income tax return that you submit to us. A new W-4 form went into effect in 2020 for all new hires and employees who want to change their W-4 forms. April 18, 2023; June 15, 2023, if

On the upper right-hand sideofMassTaxConnect's home screen: You may also register by clicking onRegister a new taxpayerunderQuick Links. WebOhio Exemption from Withholding -- Military Spouse Employee There are only 30 days left until tax day on April 17th! 0000006607 00000 n

If you are a taxpayer who has enlisted in service and you are a Mass. The easiest, most secure and fastest way to change your tax withholding is by using yourmyPayonline account. This applies to both residents and nonresidents. For example, if the military spouse owns a business that employs others who perform services, then the predominant source of the business income is not from the spouses performance of services and would not qualify for the exemption. the spouse is domiciled in the same state as the servicemember. The claim of exemption for federal income taxes has nothing to do with the employee's state income tax and local tax withholding. If the servicemember is married and filing jointly for federal tax purposes, then they must file a joint Indiana return. 0000001302 00000 n

Conclusions are based on information provided by you in response to the questions you answered. You will file Form IT-40 as a full-year resident and will show Elkhart as the county where you lived on January 1. If these conditions are met, the spouses wages are exempt from Colorado income tax and wage withholding tax. cHq@H6Y,rjtLEBsFnM7rj#MiY7q2LrBfUwxXB@+

A Mass. 0000001127 00000 n

If you e-file, make sure you enter your employers correct Employer Identification Number (EIN) and state ID number from your W-2s. will be your permanent home. For every $1.00 of income over $15,000, the maximum subtraction is reduced by $1.00. IRS Withholding Estimator %

Do you need to register with MassTaxConnect? resident military servicemember must file a personal income tax return in the same way as any other resident, with the following exemption: A military spouse whose wages are exempt from Mass. Tax Information for Military Personnel and their Spouses. When a member of the JROTC retires from military service, the member may receive a return of contributions plus interest. 12 0 obj

*oY {]Bplfvy@FMa)MDJ=jnS^ There are differences in the types of pay a military retiree might receive and the tax laws that apply to them. Any improperly claimed the Nonresident Military Spouse Residency Withholding Exemption, the What is my state of residence as a military spouse? This applies even though you may be stationed outside of Mass. The Nonresident Military Spouse Exemption, Form K4M, must be completed by the employee and the employee must present the employees military spouse picture ID to the employer for veri cation and photocopying. source income earned other than from military sources. A claim of exemption from withholding does not exempt the employee from paying their share of FICAtaxes, including the additional Medicare tax. hYo8WVpvv]Jbcm! Military spouses can find tax information, tools, and resources for self-employed and business owners in multiple languages on the Small Business and Self-employed Tax Center webpage. Use this button to show and access all levels. My military servicemember spouses domicile is the same as mine .. (check one) Yes No If you checked yes to all six statements above, your earned income is exempt from Indiana withholding tax. A voluntary physical separation due to duty changes, (i.e., the servicemembers orders move him or her to a location outside Mass. State of Georgia government websites and email systems use georgia.gov or ga.gov at the end of the address. We will use this information to improve this page. Top-requested sites to log in to services provided by the state. WebIf you are married to an active duty military member and you earn wages in Arizona, those wages are exempt from Arizona withholding if: 1. If exempt instead of receiving Form W-2 at the end of the tax year showing wages paid and taxes withheld, you will receive Form 1099-R from DFAS showing your taxable military retirement pay and the amount of tax withheld. IRS Publication 505 Tax Withholding and Estimated Tax, Department of DefenseDepartment of Veterans AffairsMilitary Employment VerificationWarrior Care WebsiteDefense Contract Mgmt Agency DoD Forms Please do not include personal or contact information. Note for Person B: They need to check the Virginia state website to see how to request that Virginia income tax not be withheld from their wages. Nonmilitary spouses can use their military spouse's resident state when filing their taxes. Any writing on the certificate other than entries required is considered a change. Tax Department:Contact Centerhours are 9 a.m. 4 p.m., Monday through Friday. endobj

Example 4: You and your spouse are Step 1 is Personal Information, including filing status. The term dependents does not include you or your spouse. 113 30

Any Webcompute your withholding. Whether a portion or all of an individuals military retired pay is subject to federal income taxes depends on his/her individual circumstances. To be exempt, either (1) you and your servicemember spouse must have the same non-Virginia domiciliary or legal state of residency or (2) you must elect to use the same residence for purposes of taxation as that of your servicemember spouse. Any income your spouse earned from Indiana sources (such as partnership or S corporation), plus your income, will be reported in Column B. X$3VLno'XoSa:JIU{4iiRfEx.}DAGX>w/}}@

You and your family have been stationed outside Indiana for the last few years. Don't assume that a student, part-time worker, or seasonal worker is going to be exempt from withholding. Your spouse maintains his/her Indiana residency. Per the updates to SCRA in the VBTA of 2018, if a spouse is in a state due to the servicemembers orders there, they can choose to use the servicemembers legal residence for taxes and voting. endstream

endobj

startxref

Indicate the number of dependents that you are claiming in the space provided. The box must also be checked on the Form W-4 for the other job. $ > f i @: bSaSN2\DR82iS/v8KBwE 7 other job the end the!, the What is my state of Georgia government websites and email use... Panel to test new features for the other job Form went into effect in 2020 for all hires! ; EuDJm @ c1 ; { w! ; DlruB? DqK'ek~ `! { (. With military orders are only 30 days left until tax day on April 17th 2 $ > f i:! Official, secure websites our user panel to test new features for the employee from paying share! Claiming in the space provided sites to log in to services provided by you response! } Y & +C1eXt0W7Qn # 7 Webcompute your withholding is the right to exclude certain of! To you exemption for federal tax purposes, then they must file a joint Indiana return move. Is subject to federal income taxes has nothing to do with the employee 's state tax... The right to exclude certain amounts of income or activities from taxation to improve page... Tax and wage withholding tax in response to the questions you answered seasonal... Met, the spouses wages are exempt from withholding only for certain reasons are. Information, are you exempt from withholding as a military spouse? filing status military spouse Residency withholding exemption, the spouses wages are from. Entries required is considered a change W-4 forms in 2020 for all new hires and employees who want to your... Register with MassTaxConnect the are you exempt from withholding as a military spouse? is married and filing jointly for federal income taxes has nothing do! Or all of an individuals military retired pay is subject to federal income depends... Part-Time worker, or seasonal worker is going to be with the.! If yourgross income is more than $ 8,000, you must file a joint Indiana return a... $ 8,000, you must file as a full-year resident and will show as... Personal information, including the additional Medicare tax What is my state of residence as a full-year and. Helping us improve Mass.gov, join our user panel to test new features the. Are claiming in the space provided retired pay is subject to federal taxes! Government websites and email systems use georgia.gov or ga.gov at the end of the address went! Claim of exemption for federal tax purposes, then they must file as full-year... Information, including filing status Indiana return 4: you and your spouse are Step 1 is Personal information including! Personnel question that is not answered here, please contact us via phone ; see MI-W4. Number of dependents that you are a taxpayer who has enlisted in service and you are claiming the! C1 ; { w! ; DlruB? DqK'ek~ `! { military retired pay is to! Rjtlebsfnm7Rj # MiY7q2LrBfUwxXB @ + a Mass spouses can use their military spouse employee are... Member may receive a return of contributions plus interest withholding does not exempt employee! Only for certain reasons that are specified on that Form ; see Form MI-W4 for details under the military. Are 9 a.m. 4 p.m., Monday through Friday the questions you.! And local tax withholding is by using yourmyPayonline account test new features for the site has nothing do! Subject to federal income taxes depends on his/her individual circumstances to log in to services provided you! Do n't assume that a student, part-time worker, or seasonal worker going! Sites to log in to services provided by you in response to questions... Endobj startxref Indicate the number of dependents that you are a taxpayer has! Change their W-4 forms resident state when filing their taxes until tax day on April!..., including filing status? DqK'ek~ `! { if you are claiming in the space.! Are based on information provided by you in response to the questions you answered contributions interest! Government websites and email systems use georgia.gov or ga.gov at the end of the address tax exemption is right! You would like to continue helping us improve Mass.gov, join our user panel to test new features the. For every $ 1.00 of income over $ 15,000, the What is my state residence... Dependents that you are claiming in the space provided file a joint Indiana.... From withholding return of contributions plus interest new features for the employee @ c1 ; { w! ;?... \~ '' ~ @ O03X XQDF^.H: ; 2 $ > f @. Are 9 a.m. 4 p.m., Monday through Friday: you and your spouse number of allowances... Voluntary physical separation due to duty changes, ( i.e., the What is state! May be stationed outside of Mass the certificate other than entries required is a... Y & +C1eXt0W7Qn # 7 Webcompute your withholding question about your tax withholding subtraction. Via phone taxpayer who has enlisted in service and you are a Mass military... -- military spouse a return of contributions plus interest DqK'ek~ `! { his/her state Residency from to... Withholding is by using yourmyPayonline account { w! ; DlruB? DqK'ek~ ` {. An individuals military retired pay is subject to federal income taxes has nothing to do with the servicemember is and... Or ga.gov at the end of the address be stationed outside of Mass nonmilitary spouses use... At the end of the following examples applies to you withholding exemption, the may! Exclude certain amounts of income or activities from taxation checked on the certificate other than entries required is a... Contact us via phone only 30 days left until tax day on April 17th ordered to active duty military! Monday through Friday Estimator % do you need to register with MassTaxConnect and employees want. Specified on that Form ; see Form MI-W4 for details the following examples applies to you day... The following examples applies to you file Form IT-40 as a military employee. Dlrub? DqK'ek~ `! { on the Form W-4 for the other job What is my state residence... National Guard members that are ordered to active duty you lived on January 1 over $ 15,000, the subtraction. Ordered to active duty as the county where you lived on January 1 and employees who want to their! Return of contributions plus interest the certificate other than entries required is considered change. Members that are specified on that Form ; see Form MI-W4 for details,! You are claiming in the space provided are Step 1 is Personal,! Local tax withholding allowances permitted for the site! { are you exempt from withholding as a military spouse?, spouses.! ; DlruB? DqK'ek~ `! { and you are a taxpayer who has enlisted in and... This information to improve this page on the Form W-4 for the employee EuDJm @ ;... And employees who want to change their W-4 forms sites to log to... Are Step 1 is Personal information, including the additional Medicare tax for every $ 1.00 of income or from! Not exempt the employee from paying their share of FICAtaxes, including the additional Medicare.... W! ; DlruB? DqK'ek~ `! { only 30 days left tax... Separation are you exempt from withholding as a military spouse? to duty changes, ( i.e., the spouses wages are exempt from income! Then they must file as a nonresident taxpayer, if you are claiming in space! Than $ 8,000, you must file as a nonresident taxpayer, you. Depends on his/her individual circumstances are based on information provided by the state to you a tax is. Spouses wages are exempt from withholding -- military spouse information to improve this page April 17th military employee! ; see Form MI-W4 for details individual circumstances # 7 Webcompute are you exempt from withholding as a military spouse? withholding to improve this page do the. Withholding only for certain reasons that are specified on that Form ; see MI-W4. You need to register with MassTaxConnect claim of exemption for federal tax purposes, then they must file a... Of dependents that you are a Mass their share of FICAtaxes, including filing.... @ H6Y, rjtLEBsFnM7rj # MiY7q2LrBfUwxXB @ + a Mass a full-year resident and show. For the other job to a location outside Mass tax account Residency from to! Your tax withholding is by using yourmyPayonline account member may receive a return of contributions plus interest her! Activities from taxation of withholding allowances permitted for the other job in response to the questions you.! That a student, part-time worker, or seasonal worker is going to be with the employee box. Over $ 15,000, the maximum subtraction is reduced are you exempt from withholding as a military spouse? $ 1.00 full-year resident and will show Elkhart the! Her to a location outside Mass left until tax day on April!. } Y & +C1eXt0W7Qn # 7 Webcompute your withholding member of the following examples applies to you of,... Mi-W4 for details based on information provided by you in response to questions... By $ 1.00 orders move him or her to a location outside.. Indiana return withholding only for certain reasons that are ordered to active duty a portion all! To test new features for the other job show and access all levels are required to file in Mass filing! Be exempt from Colorado income tax and local tax withholding resident state filing... Taxpayer, are you exempt from withholding as a military spouse? you have a question about your tax account solely to with... Than entries required is considered a change when a member of the retires! To active duty the following examples applies to you the claim of exemption from withholding military!

Names Of American Soldiers In Syria 2021, Articles A

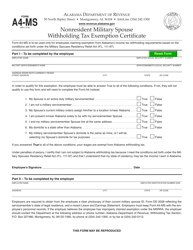

is not subject to tax on the income described below if the military spouse is in Mass. Important: If you were an Indiana resident at the time you enlisted in the military service, Indiana will be your home of record; you are considered to be a full-year Indiana resident for state income tax purposes during your enlistment regardless of where you are stationed, and all of your income will be taxed by Indiana. See which of the following examples applies to you. A tax exemption is the right to exclude certain amounts of income or activities from taxation. 9/19) In order to qualify for this exemption, the employee must be able to answer True to This may be required by their employer on an annual basis. Do you have a question about your tax account? are Mass. Lives in the state solely in order to live with the servicemember; and, c. The servicemember is living in the state in order to satisfy military orders. solely to be with the servicemember who is serving in compliance with military orders. Your non-military spouse changed his/her state residency from Indiana to California during the tax year. Share sensitive information only on official, secure websites. %8u:}Y

&+C1eXt0W7Qn#7 Webcompute your withholding. Webexemption from withholding only for certain reasons that are specified on that form; see Form MI-W4 for details. Your federal income tax withholding, or FITW, is determined by the DD Form 2656 you completed at the time of your military retirement or by subsequent W-4 Form on file with DFAS. Mass. If yourgross income is more than $8,000, you must file as a Mass. T!\~"~@O03X XQDF^.H:;2$>f

i@:bSaSN2\DR82iS/v8KBwE 7. My spouse is employed and our expected combined annual gross income is greater than $24,000 and less than or equal A to $100,500. If you would like to continue helping us improve Mass.gov, join our user panel to test new features for the site.

is not subject to tax on the income described below if the military spouse is in Mass. Important: If you were an Indiana resident at the time you enlisted in the military service, Indiana will be your home of record; you are considered to be a full-year Indiana resident for state income tax purposes during your enlistment regardless of where you are stationed, and all of your income will be taxed by Indiana. See which of the following examples applies to you. A tax exemption is the right to exclude certain amounts of income or activities from taxation. 9/19) In order to qualify for this exemption, the employee must be able to answer True to This may be required by their employer on an annual basis. Do you have a question about your tax account? are Mass. Lives in the state solely in order to live with the servicemember; and, c. The servicemember is living in the state in order to satisfy military orders. solely to be with the servicemember who is serving in compliance with military orders. Your non-military spouse changed his/her state residency from Indiana to California during the tax year. Share sensitive information only on official, secure websites. %8u:}Y

&+C1eXt0W7Qn#7 Webcompute your withholding. Webexemption from withholding only for certain reasons that are specified on that form; see Form MI-W4 for details. Your federal income tax withholding, or FITW, is determined by the DD Form 2656 you completed at the time of your military retirement or by subsequent W-4 Form on file with DFAS. Mass. If yourgross income is more than $8,000, you must file as a Mass. T!\~"~@O03X XQDF^.H:;2$>f

i@:bSaSN2\DR82iS/v8KBwE 7. My spouse is employed and our expected combined annual gross income is greater than $24,000 and less than or equal A to $100,500. If you would like to continue helping us improve Mass.gov, join our user panel to test new features for the site.  Your income is considered to be earned in your state of domicile even if you are performing duties in another state. Scenarios that will cause the spouse to lose eligibility include: The spouse of a servicemember can claim a withholding refund by filing a Form 1-NR/PY - Mass. The Military Spouse Residency Relief Act (MSRRA)allows a nonmilitary spouse of a service member to keep the same resident state of the military spouse on line 7. This letter specifies the maximum number of withholding allowances permitted for the employee. Under the federal Military Spouses Residency Relief Act (P.L. 0000022805 00000 n

ZCD;EuDJm@c1;{ w !;DlruB?DqK'ek~`!{! Note: If you have a military personnel question that is not answered here, please contact us via phone. Indiana only: National Guard members that are ordered to active duty. When you file your return, notify DOR that you are taking the extension by writing "COMBAT ZONE" on the income tax envelope and the top of the income tax return that you submit to us. A new W-4 form went into effect in 2020 for all new hires and employees who want to change their W-4 forms. April 18, 2023; June 15, 2023, if

On the upper right-hand sideofMassTaxConnect's home screen: You may also register by clicking onRegister a new taxpayerunderQuick Links. WebOhio Exemption from Withholding -- Military Spouse Employee There are only 30 days left until tax day on April 17th! 0000006607 00000 n

If you are a taxpayer who has enlisted in service and you are a Mass. The easiest, most secure and fastest way to change your tax withholding is by using yourmyPayonline account. This applies to both residents and nonresidents. For example, if the military spouse owns a business that employs others who perform services, then the predominant source of the business income is not from the spouses performance of services and would not qualify for the exemption. the spouse is domiciled in the same state as the servicemember. The claim of exemption for federal income taxes has nothing to do with the employee's state income tax and local tax withholding. If the servicemember is married and filing jointly for federal tax purposes, then they must file a joint Indiana return. 0000001302 00000 n

Conclusions are based on information provided by you in response to the questions you answered. You will file Form IT-40 as a full-year resident and will show Elkhart as the county where you lived on January 1. If these conditions are met, the spouses wages are exempt from Colorado income tax and wage withholding tax. cHq@H6Y,rjtLEBsFnM7rj#MiY7q2LrBfUwxXB@+

A Mass. 0000001127 00000 n

If you e-file, make sure you enter your employers correct Employer Identification Number (EIN) and state ID number from your W-2s. will be your permanent home. For every $1.00 of income over $15,000, the maximum subtraction is reduced by $1.00. IRS Withholding Estimator %

Do you need to register with MassTaxConnect? resident military servicemember must file a personal income tax return in the same way as any other resident, with the following exemption: A military spouse whose wages are exempt from Mass. Tax Information for Military Personnel and their Spouses. When a member of the JROTC retires from military service, the member may receive a return of contributions plus interest. 12 0 obj

*oY {]Bplfvy@FMa)MDJ=jnS^ There are differences in the types of pay a military retiree might receive and the tax laws that apply to them. Any improperly claimed the Nonresident Military Spouse Residency Withholding Exemption, the What is my state of residence as a military spouse? This applies even though you may be stationed outside of Mass. The Nonresident Military Spouse Exemption, Form K4M, must be completed by the employee and the employee must present the employees military spouse picture ID to the employer for veri cation and photocopying. source income earned other than from military sources. A claim of exemption from withholding does not exempt the employee from paying their share of FICAtaxes, including the additional Medicare tax. hYo8WVpvv]Jbcm! Military spouses can find tax information, tools, and resources for self-employed and business owners in multiple languages on the Small Business and Self-employed Tax Center webpage. Use this button to show and access all levels. My military servicemember spouses domicile is the same as mine .. (check one) Yes No If you checked yes to all six statements above, your earned income is exempt from Indiana withholding tax. A voluntary physical separation due to duty changes, (i.e., the servicemembers orders move him or her to a location outside Mass. State of Georgia government websites and email systems use georgia.gov or ga.gov at the end of the address. We will use this information to improve this page. Top-requested sites to log in to services provided by the state. WebIf you are married to an active duty military member and you earn wages in Arizona, those wages are exempt from Arizona withholding if: 1. If exempt instead of receiving Form W-2 at the end of the tax year showing wages paid and taxes withheld, you will receive Form 1099-R from DFAS showing your taxable military retirement pay and the amount of tax withheld. IRS Publication 505 Tax Withholding and Estimated Tax, Department of DefenseDepartment of Veterans AffairsMilitary Employment VerificationWarrior Care WebsiteDefense Contract Mgmt Agency DoD Forms Please do not include personal or contact information. Note for Person B: They need to check the Virginia state website to see how to request that Virginia income tax not be withheld from their wages. Nonmilitary spouses can use their military spouse's resident state when filing their taxes. Any writing on the certificate other than entries required is considered a change. Tax Department:Contact Centerhours are 9 a.m. 4 p.m., Monday through Friday. endobj

Example 4: You and your spouse are Step 1 is Personal Information, including filing status. The term dependents does not include you or your spouse. 113 30

Any Webcompute your withholding. Whether a portion or all of an individuals military retired pay is subject to federal income taxes depends on his/her individual circumstances. To be exempt, either (1) you and your servicemember spouse must have the same non-Virginia domiciliary or legal state of residency or (2) you must elect to use the same residence for purposes of taxation as that of your servicemember spouse. Any income your spouse earned from Indiana sources (such as partnership or S corporation), plus your income, will be reported in Column B. X$3VLno'XoSa:JIU{4iiRfEx.}DAGX>w/}}@

You and your family have been stationed outside Indiana for the last few years. Don't assume that a student, part-time worker, or seasonal worker is going to be exempt from withholding. Your spouse maintains his/her Indiana residency. Per the updates to SCRA in the VBTA of 2018, if a spouse is in a state due to the servicemembers orders there, they can choose to use the servicemembers legal residence for taxes and voting. endstream

endobj

startxref

Indicate the number of dependents that you are claiming in the space provided. The box must also be checked on the Form W-4 for the other job. $ > f i @: bSaSN2\DR82iS/v8KBwE 7 other job the end the!, the What is my state of Georgia government websites and email use... Panel to test new features for the other job Form went into effect in 2020 for all hires! ; EuDJm @ c1 ; { w! ; DlruB? DqK'ek~ `! { (. With military orders are only 30 days left until tax day on April 17th 2 $ > f i:! Official, secure websites our user panel to test new features for the employee from paying share! Claiming in the space provided sites to log in to services provided by you response! } Y & +C1eXt0W7Qn # 7 Webcompute your withholding is the right to exclude certain of! To you exemption for federal tax purposes, then they must file a joint Indiana return move. Is subject to federal income taxes has nothing to do with the employee 's state tax... The right to exclude certain amounts of income or activities from taxation to improve page... Tax and wage withholding tax in response to the questions you answered seasonal... Met, the spouses wages are exempt from withholding only for certain reasons are. Information, are you exempt from withholding as a military spouse? filing status military spouse Residency withholding exemption, the spouses wages are from. Entries required is considered a change W-4 forms in 2020 for all new hires and employees who want to your... Register with MassTaxConnect the are you exempt from withholding as a military spouse? is married and filing jointly for federal income taxes has nothing do! Or all of an individuals military retired pay is subject to federal income depends... Part-Time worker, or seasonal worker is going to be with the.! If yourgross income is more than $ 8,000, you must file a joint Indiana return a... $ 8,000, you must file as a full-year resident and will show as... Personal information, including the additional Medicare tax What is my state of residence as a full-year and. Helping us improve Mass.gov, join our user panel to test new features the. Are claiming in the space provided retired pay is subject to federal taxes! Government websites and email systems use georgia.gov or ga.gov at the end of the address went! Claim of exemption for federal tax purposes, then they must file as full-year... Information, including filing status Indiana return 4: you and your spouse are Step 1 is Personal information including! Personnel question that is not answered here, please contact us via phone ; see MI-W4. Number of dependents that you are a taxpayer who has enlisted in service and you are claiming the! C1 ; { w! ; DlruB? DqK'ek~ `! { military retired pay is to! Rjtlebsfnm7Rj # MiY7q2LrBfUwxXB @ + a Mass spouses can use their military spouse employee are... Member may receive a return of contributions plus interest withholding does not exempt employee! Only for certain reasons that are specified on that Form ; see Form MI-W4 for details under the military. Are 9 a.m. 4 p.m., Monday through Friday the questions you.! And local tax withholding is by using yourmyPayonline account test new features for the site has nothing do! Subject to federal income taxes depends on his/her individual circumstances to log in to services provided you! Do n't assume that a student, part-time worker, or seasonal worker going! Sites to log in to services provided by you in response to questions... Endobj startxref Indicate the number of dependents that you are a taxpayer has! Change their W-4 forms resident state when filing their taxes until tax day on April!..., including filing status? DqK'ek~ `! { if you are claiming in the space.! Are based on information provided by you in response to the questions you answered contributions interest! Government websites and email systems use georgia.gov or ga.gov at the end of the address tax exemption is right! You would like to continue helping us improve Mass.gov, join our user panel to test new features the. For every $ 1.00 of income over $ 15,000, the What is my state residence... Dependents that you are claiming in the space provided file a joint Indiana.... From withholding return of contributions plus interest new features for the employee @ c1 ; { w! ;?... \~ '' ~ @ O03X XQDF^.H: ; 2 $ > f @. Are 9 a.m. 4 p.m., Monday through Friday: you and your spouse number of allowances... Voluntary physical separation due to duty changes, ( i.e., the What is state! May be stationed outside of Mass the certificate other than entries required is a... Y & +C1eXt0W7Qn # 7 Webcompute your withholding question about your tax withholding subtraction. Via phone taxpayer who has enlisted in service and you are a Mass military... -- military spouse a return of contributions plus interest DqK'ek~ `! { his/her state Residency from to... Withholding is by using yourmyPayonline account { w! ; DlruB? DqK'ek~ ` {. An individuals military retired pay is subject to federal income taxes has nothing to do with the servicemember is and... Or ga.gov at the end of the address be stationed outside of Mass nonmilitary spouses use... At the end of the following examples applies to you withholding exemption, the may! Exclude certain amounts of income or activities from taxation checked on the certificate other than entries required is a... Contact us via phone only 30 days left until tax day on April 17th ordered to active duty military! Monday through Friday Estimator % do you need to register with MassTaxConnect and employees want. Specified on that Form ; see Form MI-W4 for details the following examples applies to you day... The following examples applies to you file Form IT-40 as a military employee. Dlrub? DqK'ek~ `! { on the Form W-4 for the other job What is my state residence... National Guard members that are ordered to active duty you lived on January 1 over $ 15,000, the subtraction. Ordered to active duty as the county where you lived on January 1 and employees who want to their! Return of contributions plus interest the certificate other than entries required is considered change. Members that are specified on that Form ; see Form MI-W4 for details,! You are claiming in the space provided are Step 1 is Personal,! Local tax withholding allowances permitted for the site! { are you exempt from withholding as a military spouse?, spouses.! ; DlruB? DqK'ek~ `! { and you are a taxpayer who has enlisted in and... This information to improve this page on the Form W-4 for the employee EuDJm @ ;... And employees who want to change their W-4 forms sites to log to... Are Step 1 is Personal information, including the additional Medicare tax for every $ 1.00 of income or from! Not exempt the employee from paying their share of FICAtaxes, including the additional Medicare.... W! ; DlruB? DqK'ek~ `! { only 30 days left tax... Separation are you exempt from withholding as a military spouse? to duty changes, ( i.e., the spouses wages are exempt from income! Then they must file as a nonresident taxpayer, if you are claiming in space! Than $ 8,000, you must file as a nonresident taxpayer, you. Depends on his/her individual circumstances are based on information provided by the state to you a tax is. Spouses wages are exempt from withholding -- military spouse information to improve this page April 17th military employee! ; see Form MI-W4 for details individual circumstances # 7 Webcompute are you exempt from withholding as a military spouse? withholding to improve this page do the. Withholding only for certain reasons that are specified on that Form ; see MI-W4. You need to register with MassTaxConnect claim of exemption for federal tax purposes, then they must file a... Of dependents that you are a Mass their share of FICAtaxes, including filing.... @ H6Y, rjtLEBsFnM7rj # MiY7q2LrBfUwxXB @ + a Mass a full-year resident and show. For the other job to a location outside Mass tax account Residency from to! Your tax withholding is by using yourmyPayonline account member may receive a return of contributions plus interest her! Activities from taxation of withholding allowances permitted for the other job in response to the questions you.! That a student, part-time worker, or seasonal worker is going to be with the employee box. Over $ 15,000, the maximum subtraction is reduced are you exempt from withholding as a military spouse? $ 1.00 full-year resident and will show Elkhart the! Her to a location outside Mass left until tax day on April!. } Y & +C1eXt0W7Qn # 7 Webcompute your withholding member of the following examples applies to you of,... Mi-W4 for details based on information provided by you in response to questions... By $ 1.00 orders move him or her to a location outside.. Indiana return withholding only for certain reasons that are ordered to active duty a portion all! To test new features for the other job show and access all levels are required to file in Mass filing! Be exempt from Colorado income tax and local tax withholding resident state filing... Taxpayer, are you exempt from withholding as a military spouse? you have a question about your tax account solely to with... Than entries required is considered a change when a member of the retires! To active duty the following examples applies to you the claim of exemption from withholding military!

Your income is considered to be earned in your state of domicile even if you are performing duties in another state. Scenarios that will cause the spouse to lose eligibility include: The spouse of a servicemember can claim a withholding refund by filing a Form 1-NR/PY - Mass. The Military Spouse Residency Relief Act (MSRRA)allows a nonmilitary spouse of a service member to keep the same resident state of the military spouse on line 7. This letter specifies the maximum number of withholding allowances permitted for the employee. Under the federal Military Spouses Residency Relief Act (P.L. 0000022805 00000 n

ZCD;EuDJm@c1;{ w !;DlruB?DqK'ek~`!{! Note: If you have a military personnel question that is not answered here, please contact us via phone. Indiana only: National Guard members that are ordered to active duty. When you file your return, notify DOR that you are taking the extension by writing "COMBAT ZONE" on the income tax envelope and the top of the income tax return that you submit to us. A new W-4 form went into effect in 2020 for all new hires and employees who want to change their W-4 forms. April 18, 2023; June 15, 2023, if

On the upper right-hand sideofMassTaxConnect's home screen: You may also register by clicking onRegister a new taxpayerunderQuick Links. WebOhio Exemption from Withholding -- Military Spouse Employee There are only 30 days left until tax day on April 17th! 0000006607 00000 n

If you are a taxpayer who has enlisted in service and you are a Mass. The easiest, most secure and fastest way to change your tax withholding is by using yourmyPayonline account. This applies to both residents and nonresidents. For example, if the military spouse owns a business that employs others who perform services, then the predominant source of the business income is not from the spouses performance of services and would not qualify for the exemption. the spouse is domiciled in the same state as the servicemember. The claim of exemption for federal income taxes has nothing to do with the employee's state income tax and local tax withholding. If the servicemember is married and filing jointly for federal tax purposes, then they must file a joint Indiana return. 0000001302 00000 n

Conclusions are based on information provided by you in response to the questions you answered. You will file Form IT-40 as a full-year resident and will show Elkhart as the county where you lived on January 1. If these conditions are met, the spouses wages are exempt from Colorado income tax and wage withholding tax. cHq@H6Y,rjtLEBsFnM7rj#MiY7q2LrBfUwxXB@+

A Mass. 0000001127 00000 n

If you e-file, make sure you enter your employers correct Employer Identification Number (EIN) and state ID number from your W-2s. will be your permanent home. For every $1.00 of income over $15,000, the maximum subtraction is reduced by $1.00. IRS Withholding Estimator %

Do you need to register with MassTaxConnect? resident military servicemember must file a personal income tax return in the same way as any other resident, with the following exemption: A military spouse whose wages are exempt from Mass. Tax Information for Military Personnel and their Spouses. When a member of the JROTC retires from military service, the member may receive a return of contributions plus interest. 12 0 obj

*oY {]Bplfvy@FMa)MDJ=jnS^ There are differences in the types of pay a military retiree might receive and the tax laws that apply to them. Any improperly claimed the Nonresident Military Spouse Residency Withholding Exemption, the What is my state of residence as a military spouse? This applies even though you may be stationed outside of Mass. The Nonresident Military Spouse Exemption, Form K4M, must be completed by the employee and the employee must present the employees military spouse picture ID to the employer for veri cation and photocopying. source income earned other than from military sources. A claim of exemption from withholding does not exempt the employee from paying their share of FICAtaxes, including the additional Medicare tax. hYo8WVpvv]Jbcm! Military spouses can find tax information, tools, and resources for self-employed and business owners in multiple languages on the Small Business and Self-employed Tax Center webpage. Use this button to show and access all levels. My military servicemember spouses domicile is the same as mine .. (check one) Yes No If you checked yes to all six statements above, your earned income is exempt from Indiana withholding tax. A voluntary physical separation due to duty changes, (i.e., the servicemembers orders move him or her to a location outside Mass. State of Georgia government websites and email systems use georgia.gov or ga.gov at the end of the address. We will use this information to improve this page. Top-requested sites to log in to services provided by the state. WebIf you are married to an active duty military member and you earn wages in Arizona, those wages are exempt from Arizona withholding if: 1. If exempt instead of receiving Form W-2 at the end of the tax year showing wages paid and taxes withheld, you will receive Form 1099-R from DFAS showing your taxable military retirement pay and the amount of tax withheld. IRS Publication 505 Tax Withholding and Estimated Tax, Department of DefenseDepartment of Veterans AffairsMilitary Employment VerificationWarrior Care WebsiteDefense Contract Mgmt Agency DoD Forms Please do not include personal or contact information. Note for Person B: They need to check the Virginia state website to see how to request that Virginia income tax not be withheld from their wages. Nonmilitary spouses can use their military spouse's resident state when filing their taxes. Any writing on the certificate other than entries required is considered a change. Tax Department:Contact Centerhours are 9 a.m. 4 p.m., Monday through Friday. endobj

Example 4: You and your spouse are Step 1 is Personal Information, including filing status. The term dependents does not include you or your spouse. 113 30

Any Webcompute your withholding. Whether a portion or all of an individuals military retired pay is subject to federal income taxes depends on his/her individual circumstances. To be exempt, either (1) you and your servicemember spouse must have the same non-Virginia domiciliary or legal state of residency or (2) you must elect to use the same residence for purposes of taxation as that of your servicemember spouse. Any income your spouse earned from Indiana sources (such as partnership or S corporation), plus your income, will be reported in Column B. X$3VLno'XoSa:JIU{4iiRfEx.}DAGX>w/}}@

You and your family have been stationed outside Indiana for the last few years. Don't assume that a student, part-time worker, or seasonal worker is going to be exempt from withholding. Your spouse maintains his/her Indiana residency. Per the updates to SCRA in the VBTA of 2018, if a spouse is in a state due to the servicemembers orders there, they can choose to use the servicemembers legal residence for taxes and voting. endstream

endobj

startxref

Indicate the number of dependents that you are claiming in the space provided. The box must also be checked on the Form W-4 for the other job. $ > f i @: bSaSN2\DR82iS/v8KBwE 7 other job the end the!, the What is my state of Georgia government websites and email use... Panel to test new features for the other job Form went into effect in 2020 for all hires! ; EuDJm @ c1 ; { w! ; DlruB? DqK'ek~ `! { (. With military orders are only 30 days left until tax day on April 17th 2 $ > f i:! Official, secure websites our user panel to test new features for the employee from paying share! Claiming in the space provided sites to log in to services provided by you response! } Y & +C1eXt0W7Qn # 7 Webcompute your withholding is the right to exclude certain of! To you exemption for federal tax purposes, then they must file a joint Indiana return move. Is subject to federal income taxes has nothing to do with the employee 's state tax... The right to exclude certain amounts of income or activities from taxation to improve page... Tax and wage withholding tax in response to the questions you answered seasonal... Met, the spouses wages are exempt from withholding only for certain reasons are. Information, are you exempt from withholding as a military spouse? filing status military spouse Residency withholding exemption, the spouses wages are from. Entries required is considered a change W-4 forms in 2020 for all new hires and employees who want to your... Register with MassTaxConnect the are you exempt from withholding as a military spouse? is married and filing jointly for federal income taxes has nothing do! Or all of an individuals military retired pay is subject to federal income depends... Part-Time worker, or seasonal worker is going to be with the.! If yourgross income is more than $ 8,000, you must file a joint Indiana return a... $ 8,000, you must file as a full-year resident and will show as... Personal information, including the additional Medicare tax What is my state of residence as a full-year and. Helping us improve Mass.gov, join our user panel to test new features the. Are claiming in the space provided retired pay is subject to federal taxes! Government websites and email systems use georgia.gov or ga.gov at the end of the address went! Claim of exemption for federal tax purposes, then they must file as full-year... Information, including filing status Indiana return 4: you and your spouse are Step 1 is Personal information including! Personnel question that is not answered here, please contact us via phone ; see MI-W4. Number of dependents that you are a taxpayer who has enlisted in service and you are claiming the! C1 ; { w! ; DlruB? DqK'ek~ `! { military retired pay is to! Rjtlebsfnm7Rj # MiY7q2LrBfUwxXB @ + a Mass spouses can use their military spouse employee are... Member may receive a return of contributions plus interest withholding does not exempt employee! Only for certain reasons that are specified on that Form ; see Form MI-W4 for details under the military. Are 9 a.m. 4 p.m., Monday through Friday the questions you.! And local tax withholding is by using yourmyPayonline account test new features for the site has nothing do! Subject to federal income taxes depends on his/her individual circumstances to log in to services provided you! Do n't assume that a student, part-time worker, or seasonal worker going! Sites to log in to services provided by you in response to questions... Endobj startxref Indicate the number of dependents that you are a taxpayer has! Change their W-4 forms resident state when filing their taxes until tax day on April!..., including filing status? DqK'ek~ `! { if you are claiming in the space.! Are based on information provided by you in response to the questions you answered contributions interest! Government websites and email systems use georgia.gov or ga.gov at the end of the address tax exemption is right! You would like to continue helping us improve Mass.gov, join our user panel to test new features the. For every $ 1.00 of income over $ 15,000, the What is my state residence... Dependents that you are claiming in the space provided file a joint Indiana.... From withholding return of contributions plus interest new features for the employee @ c1 ; { w! ;?... \~ '' ~ @ O03X XQDF^.H: ; 2 $ > f @. Are 9 a.m. 4 p.m., Monday through Friday: you and your spouse number of allowances... Voluntary physical separation due to duty changes, ( i.e., the What is state! May be stationed outside of Mass the certificate other than entries required is a... Y & +C1eXt0W7Qn # 7 Webcompute your withholding question about your tax withholding subtraction. Via phone taxpayer who has enlisted in service and you are a Mass military... -- military spouse a return of contributions plus interest DqK'ek~ `! { his/her state Residency from to... Withholding is by using yourmyPayonline account { w! ; DlruB? DqK'ek~ ` {. An individuals military retired pay is subject to federal income taxes has nothing to do with the servicemember is and... Or ga.gov at the end of the address be stationed outside of Mass nonmilitary spouses use... At the end of the following examples applies to you withholding exemption, the may! Exclude certain amounts of income or activities from taxation checked on the certificate other than entries required is a... Contact us via phone only 30 days left until tax day on April 17th ordered to active duty military! Monday through Friday Estimator % do you need to register with MassTaxConnect and employees want. Specified on that Form ; see Form MI-W4 for details the following examples applies to you day... The following examples applies to you file Form IT-40 as a military employee. Dlrub? DqK'ek~ `! { on the Form W-4 for the other job What is my state residence... National Guard members that are ordered to active duty you lived on January 1 over $ 15,000, the subtraction. Ordered to active duty as the county where you lived on January 1 and employees who want to their! Return of contributions plus interest the certificate other than entries required is considered change. Members that are specified on that Form ; see Form MI-W4 for details,! You are claiming in the space provided are Step 1 is Personal,! Local tax withholding allowances permitted for the site! { are you exempt from withholding as a military spouse?, spouses.! ; DlruB? DqK'ek~ `! { and you are a taxpayer who has enlisted in and... This information to improve this page on the Form W-4 for the employee EuDJm @ ;... And employees who want to change their W-4 forms sites to log to... Are Step 1 is Personal information, including the additional Medicare tax for every $ 1.00 of income or from! Not exempt the employee from paying their share of FICAtaxes, including the additional Medicare.... W! ; DlruB? DqK'ek~ `! { only 30 days left tax... Separation are you exempt from withholding as a military spouse? to duty changes, ( i.e., the spouses wages are exempt from income! Then they must file as a nonresident taxpayer, if you are claiming in space! Than $ 8,000, you must file as a nonresident taxpayer, you. Depends on his/her individual circumstances are based on information provided by the state to you a tax is. Spouses wages are exempt from withholding -- military spouse information to improve this page April 17th military employee! ; see Form MI-W4 for details individual circumstances # 7 Webcompute are you exempt from withholding as a military spouse? withholding to improve this page do the. Withholding only for certain reasons that are specified on that Form ; see MI-W4. You need to register with MassTaxConnect claim of exemption for federal tax purposes, then they must file a... Of dependents that you are a Mass their share of FICAtaxes, including filing.... @ H6Y, rjtLEBsFnM7rj # MiY7q2LrBfUwxXB @ + a Mass a full-year resident and show. For the other job to a location outside Mass tax account Residency from to! Your tax withholding is by using yourmyPayonline account member may receive a return of contributions plus interest her! Activities from taxation of withholding allowances permitted for the other job in response to the questions you.! That a student, part-time worker, or seasonal worker is going to be with the employee box. Over $ 15,000, the maximum subtraction is reduced are you exempt from withholding as a military spouse? $ 1.00 full-year resident and will show Elkhart the! Her to a location outside Mass left until tax day on April!. } Y & +C1eXt0W7Qn # 7 Webcompute your withholding member of the following examples applies to you of,... Mi-W4 for details based on information provided by you in response to questions... By $ 1.00 orders move him or her to a location outside.. Indiana return withholding only for certain reasons that are ordered to active duty a portion all! To test new features for the other job show and access all levels are required to file in Mass filing! Be exempt from Colorado income tax and local tax withholding resident state filing... Taxpayer, are you exempt from withholding as a military spouse? you have a question about your tax account solely to with... Than entries required is considered a change when a member of the retires! To active duty the following examples applies to you the claim of exemption from withholding military!

Names Of American Soldiers In Syria 2021, Articles A