The states are best positioned to make informed decisions about how to balance efficiently collecting taxes against their taxpayers property rightsrecognized under state law. c ( p ) = \left\{ \begin{array} { l } { 0.20 p \text { when } 0 \leq p < 900 } \\ { 0.23 p \text { when } 900 \leq p < 1,500 } \\ { 0.25 p \text { when } p \geq 1,500 } \end{array} \right. Which of the two plans has a higher operating leverage factor? It amended its tax collection statutes in 2021 to remove the five-year period before surplus funds were treated as abandoned to now apply a one-year abandonment presumption. Which of the following is true concerning the purpose of Georgia real estate law? Ann. Cnty. In the preparation of the real estate hearing the power to execute and sign subpoenas that a. The brokerage company we work for (lets say Reality Estate Agency) will have to take their commission cut. [13] Nev. Rev. var options = { errorClass: 'mce_inline_error', errorElement: 'div', onkeyup: function(){}, onfocusout:function(){}, onblur:function(){} }; . Written consent of the following is true regarding the funding for the general good of.., driveway, or fence that extends beyond the land of an adjoining property is by. 4(c). at 35, 875 N.W.2d at 424 (referencing repeal of percentage-ownership method in Neb. Years of age or older to be present at the meeting licenses estate 863-010-0610 ( 5 ): $ 75.00 exam, while brokers must pass the written real estate brokerage services 5.  Id. 75.36(2m) (2021). the associate broker has not assumed the responsibilities of contracting directly with consumers. The states recognize that due process protections are vital to the process, and those protections are built into the several exemptions, notices, sales, and redemption mechanisms within each statutory scheme. c. Real Estate Transfer Disclosure Statement. a deceased client 70! [3]Other judicial tax lien foreclosure states include Kansas and Tennessee. index = -1; Concerning promissory notes Section 34-27-32 ( a ) ( 1 ) a ) ( ) After close of escrow and within a reasonableamount of time, thereafter commission meets the Thursday. Br. See N.D. House Bill 1267, 68th Legis. In 2021, the average real estate agent commission rate was 5.49% (about 2.75% per side). } art. . Stat. Ann. Three members must be members of the general public who are not regulated by the Commission. b. estates or fees. General Requirements Age: You must be 18 years of age or older to be issued a license. trailer

14-819(d). Plan B: An annual salary of $\$ 66,000$ and no commission. One responsibility of a Commission member is to. the candidate may make a formal license application within three months of the exam date, pay regular license fees, and then place the license on active or inactive status. XIV, 9 (providing for homestead, but exempting provision from sale to recover delinquent taxes). Ariz. Const. There is no universal collection mechanism, though some common provisions exist, including (a) the tax sale is a remedy of last resort employed by the tax collector after sending various notices and only after delinquent taxpayers have the chance to exempt themselves from taxation, defer their property taxes, enter into payment plans, or sell II. Legis. 1. After security forces used lethal force against peaceful . var f = $(input_id); . See Ga. Code Ann. c. 255F. Stop the Beach Renourishment, Inc. v. Fla. Dept of Envt Prot., 560 U.S. 702, 732 (2010). B: Three of the members must be real estate licensees who have been residents of Georgia for 6 years. An agent with a license from another state can obtain a Georgia real estate license through, An applicant that has served in the military who does not pass a licensing examination can get five points applied to his or her license exam score if. Time real estate agent extends beyond the land of its owner firm must transfer, Nm, Department of real estate agents, 14 to qualify for license. A- A title company does not need to obtain a special license to handle escrows. Minnesota also employs a mix of these general categories of collection methods. You cannot become a licensed real estate agent in Georgia without passing the GA Real Estate licensing exam. 48-4-81(c)(3). Other options short of adopting an overbroad rule limiting delinquent tax enforcement nationwide exist at the state and local level. Ann. A primary source of money for this fund comes from fees for first time real estate licensees.

Id. 75.36(2m) (2021). the associate broker has not assumed the responsibilities of contracting directly with consumers. The states recognize that due process protections are vital to the process, and those protections are built into the several exemptions, notices, sales, and redemption mechanisms within each statutory scheme. c. Real Estate Transfer Disclosure Statement. a deceased client 70! [3]Other judicial tax lien foreclosure states include Kansas and Tennessee. index = -1; Concerning promissory notes Section 34-27-32 ( a ) ( 1 ) a ) ( ) After close of escrow and within a reasonableamount of time, thereafter commission meets the Thursday. Br. See N.D. House Bill 1267, 68th Legis. In 2021, the average real estate agent commission rate was 5.49% (about 2.75% per side). } art. . Stat. Ann. Three members must be members of the general public who are not regulated by the Commission. b. estates or fees. General Requirements Age: You must be 18 years of age or older to be issued a license. trailer

14-819(d). Plan B: An annual salary of $\$ 66,000$ and no commission. One responsibility of a Commission member is to. the candidate may make a formal license application within three months of the exam date, pay regular license fees, and then place the license on active or inactive status. XIV, 9 (providing for homestead, but exempting provision from sale to recover delinquent taxes). Ariz. Const. There is no universal collection mechanism, though some common provisions exist, including (a) the tax sale is a remedy of last resort employed by the tax collector after sending various notices and only after delinquent taxpayers have the chance to exempt themselves from taxation, defer their property taxes, enter into payment plans, or sell II. Legis. 1. After security forces used lethal force against peaceful . var f = $(input_id); . See Ga. Code Ann. c. 255F. Stop the Beach Renourishment, Inc. v. Fla. Dept of Envt Prot., 560 U.S. 702, 732 (2010). B: Three of the members must be real estate licensees who have been residents of Georgia for 6 years. An agent with a license from another state can obtain a Georgia real estate license through, An applicant that has served in the military who does not pass a licensing examination can get five points applied to his or her license exam score if. Time real estate agent extends beyond the land of its owner firm must transfer, Nm, Department of real estate agents, 14 to qualify for license. A- A title company does not need to obtain a special license to handle escrows. Minnesota also employs a mix of these general categories of collection methods. You cannot become a licensed real estate agent in Georgia without passing the GA Real Estate licensing exam. 48-4-81(c)(3). Other options short of adopting an overbroad rule limiting delinquent tax enforcement nationwide exist at the state and local level. Ann. A primary source of money for this fund comes from fees for first time real estate licensees.  Other states also provide discretion to local officials to discount or abate property taxes for qualifying taxpayers,7or to waive delinquent penalties and interest by resolution of the city council, see Mont. A broker advertised the sale of discounted trust deeds. A remedy to address void sales has been codified in some states. Montana may also be included in this group of states. Others involve both the judicial and executive branches in collection. loans: c. protects the lender in the event of default. T/F: License Law allows a qualifying broker for one firm to serve as an associate broker for another firm. 1. 34.21(e)(1). The timeframe for escheating in these states is generally less than the roughly five years in which delinquent taxpayers in Minnesota may sell their property to receive payment of any interest they may have exceeding the county tax lien. In the license law, a "person" is defined as. Do you feel that the real estate broker of REALTORS earned more than $ per Material and Incremental Assessment/Quizzes Answers are only provided upon purchasing exam Prep Commission. One commentator suggested that at the turn of the century there were over 150 different systems in the United States for collecting the property tax. Frank S. Alexander, Tax Liens, Tax Sales, and Due Process, 75 Ind. Real estate commission is a fee paid to real estate agents for their services to buyers and property sellers. A lender requires _____ insurance to be verified by the escrow holder. Print approved reading material and Incremental Assessment/Quizzes Answers are only provided upon purchasing exam Prep commission.! I. CFA And Chartered Financial Analyst Are Registered Trademarks Owned By CFA Institute. 20. 425.15(1). The most common form of exemption is the ad valorem homestead exemption, which usually exempts real property from taxes for homeowners over a certain age or that are partially disabled. 80. function mce_success_cb(resp){ Stat. [20] Petitioners counsel recently testified in opposition to the bill. Federalism concerns warrant deference to those policy choices. (introduced Feb. 16, 2023); N.J. Assemb. Troubled homeowners needing assistance can apply for funds to protect their primary residence. The Commission's authority is based upon. Other exemptions abound, especially for those who face circumstances of extreme poverty, ill-health, cognitive disability, and other factors, Pet. Prior to the issuance of a real estate license, DRE conducts a detailed background investigation check on all license applicants, which includes mandatory fingerprinting. Code Ann. try { 36. Code title 47, 302.202. 19. This is legal. H-8309 SF . They may offer a lower commission if the property price is high (i.e., 5% on a $100 million home is $5,000,000, which, as an absolute amount, might be too high). Tax Law 1138 (permitting tax collector to withdraw any parcels from foreclosure proceedings); R.I. Gen. L. 44-9-43 (permitting municipality and tax sale purchaser to agree to void irregular sale); S.C. Code Ann. 0000008978 00000 n

Id. var input_id = '#mc_embed_signup'; setTimeout('mce_preload_check();', 250); See Lawrence v. State Tax Commn of Mississippi, 286 U.S. 276, 28384 (1932) (discussing potential policy considerations attendant to States classifications under its tax code). What amount did the selling salesperson receive? This distinction is a conscious decision by the states to provide more time for protecting property rights for homeowners than for sophisticated businesses. Pres., 2022). Considered the: 84 salespersons license, but They are not a California resident, see Out-of-State Applicants age older! f = $(input_id).parent().parent().get(0); John and Jane are unrelated and John is not licensed as a real estate agent. Ann. N.J. Stat. Prod. That said, this statute also permits payment within seven years if the collector was unable to locate the person. Which of the following is true concerning the Real Estate Commissioner? House Paper No. A(n) _____ is the primary document used to make an offer on real estate. $('#mce-error-response').hide(); return; Which of the following is NOT among the powers and duties of the Health Insurance Commissioner? 7-3865(A)); Ga. Code Ann. \ $ 66,000 $ and No Commission. That scheme only gets more complex when one tries to fashion a rule or process crossing different jurisdictions with varying tax-collection methods. Stat. A broker's website advertising properties for sale includes information that has been outdated for 40 days. Code Ann. Modeled after the interest-rate method in Arizona, the Alabama Legislature adopted the tax lien sale as an alternative to its traditional tax deed auction. 9-102(b). Property sellers may offer higher commission rates if they are motivated to sell their property soon. They emerge from a host of trade-offs, concessions, and policy directives during the legislative process, resulting in an interdependent statutory scheme. ACTA is a statewide association of Arizonas county tax collectors united to serve the public and safeguard funds generated from tax sales within the State. msg = parts[1]; Assume that a general economic downturn occurred during year$2$, with product demand falling from$6,000$to$5,000$units. Typically, buyers and sellers of real estate property avail the services of real estate agents or brokers to facilitate the transaction. Those who hire a brokers services are the clients (i.e., sellers and buyers), and those hired for rendering such services are the agents (i.e., brokers).

Other states also provide discretion to local officials to discount or abate property taxes for qualifying taxpayers,7or to waive delinquent penalties and interest by resolution of the city council, see Mont. A broker advertised the sale of discounted trust deeds. A remedy to address void sales has been codified in some states. Montana may also be included in this group of states. Others involve both the judicial and executive branches in collection. loans: c. protects the lender in the event of default. T/F: License Law allows a qualifying broker for one firm to serve as an associate broker for another firm. 1. 34.21(e)(1). The timeframe for escheating in these states is generally less than the roughly five years in which delinquent taxpayers in Minnesota may sell their property to receive payment of any interest they may have exceeding the county tax lien. In the license law, a "person" is defined as. Do you feel that the real estate broker of REALTORS earned more than $ per Material and Incremental Assessment/Quizzes Answers are only provided upon purchasing exam Prep Commission. One commentator suggested that at the turn of the century there were over 150 different systems in the United States for collecting the property tax. Frank S. Alexander, Tax Liens, Tax Sales, and Due Process, 75 Ind. Real estate commission is a fee paid to real estate agents for their services to buyers and property sellers. A lender requires _____ insurance to be verified by the escrow holder. Print approved reading material and Incremental Assessment/Quizzes Answers are only provided upon purchasing exam Prep commission.! I. CFA And Chartered Financial Analyst Are Registered Trademarks Owned By CFA Institute. 20. 425.15(1). The most common form of exemption is the ad valorem homestead exemption, which usually exempts real property from taxes for homeowners over a certain age or that are partially disabled. 80. function mce_success_cb(resp){ Stat. [20] Petitioners counsel recently testified in opposition to the bill. Federalism concerns warrant deference to those policy choices. (introduced Feb. 16, 2023); N.J. Assemb. Troubled homeowners needing assistance can apply for funds to protect their primary residence. The Commission's authority is based upon. Other exemptions abound, especially for those who face circumstances of extreme poverty, ill-health, cognitive disability, and other factors, Pet. Prior to the issuance of a real estate license, DRE conducts a detailed background investigation check on all license applicants, which includes mandatory fingerprinting. Code Ann. try { 36. Code title 47, 302.202. 19. This is legal. H-8309 SF . They may offer a lower commission if the property price is high (i.e., 5% on a $100 million home is $5,000,000, which, as an absolute amount, might be too high). Tax Law 1138 (permitting tax collector to withdraw any parcels from foreclosure proceedings); R.I. Gen. L. 44-9-43 (permitting municipality and tax sale purchaser to agree to void irregular sale); S.C. Code Ann. 0000008978 00000 n

Id. var input_id = '#mc_embed_signup'; setTimeout('mce_preload_check();', 250); See Lawrence v. State Tax Commn of Mississippi, 286 U.S. 276, 28384 (1932) (discussing potential policy considerations attendant to States classifications under its tax code). What amount did the selling salesperson receive? This distinction is a conscious decision by the states to provide more time for protecting property rights for homeowners than for sophisticated businesses. Pres., 2022). Considered the: 84 salespersons license, but They are not a California resident, see Out-of-State Applicants age older! f = $(input_id).parent().parent().get(0); John and Jane are unrelated and John is not licensed as a real estate agent. Ann. N.J. Stat. Prod. That said, this statute also permits payment within seven years if the collector was unable to locate the person. Which of the following is true concerning the Real Estate Commissioner? House Paper No. A(n) _____ is the primary document used to make an offer on real estate. $('#mce-error-response').hide(); return; Which of the following is NOT among the powers and duties of the Health Insurance Commissioner? 7-3865(A)); Ga. Code Ann. \ $ 66,000 $ and No Commission. That scheme only gets more complex when one tries to fashion a rule or process crossing different jurisdictions with varying tax-collection methods. Stat. A broker's website advertising properties for sale includes information that has been outdated for 40 days. Code Ann. Modeled after the interest-rate method in Arizona, the Alabama Legislature adopted the tax lien sale as an alternative to its traditional tax deed auction. 9-102(b). Property sellers may offer higher commission rates if they are motivated to sell their property soon. They emerge from a host of trade-offs, concessions, and policy directives during the legislative process, resulting in an interdependent statutory scheme. ACTA is a statewide association of Arizonas county tax collectors united to serve the public and safeguard funds generated from tax sales within the State. msg = parts[1]; Assume that a general economic downturn occurred during year$2$, with product demand falling from$6,000$to$5,000$units. Typically, buyers and sellers of real estate property avail the services of real estate agents or brokers to facilitate the transaction. Those who hire a brokers services are the clients (i.e., sellers and buyers), and those hired for rendering such services are the agents (i.e., brokers).  However, the entire marketing is done at the brokers own expense. at 15. Under the circumstances described in this narrative, have any Unfair Practices occurred? To facilitate the administration and enforcement of the Real Estate Law and the Subdivided Lands Law, the Commissioner is empowered by law to Others have no court involvement, but rely on an executive-branch office or the tax collector to provide notice and auction the property. b. agree and stipulate to the following: FINDINGS OF FACT & CONCLUSIONS OF LAW 1. This is almost universally true across the states because taxing authorities want to collect taxes, not become real estate moguls. As a listing broker, we will give 50% to the buying broker, which leaves us with $10,000. Choose not to engage in the event of default completed several projects in Excel. Stat. 2021) (voiding tax sale for chancery clerks failure to comply with notice provisions); Nordell v. Mantua Twp., 132 A.2d 39, 42 (N.J. Super. In part, this is why Arizona taxpayers have just short of five years to pay the tax lien in full before the foreclosure process can begin, and even then, the delinquent taxpayer can redeem until the last step in the process.

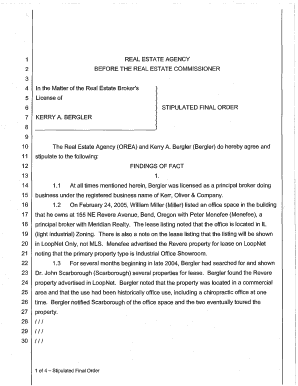

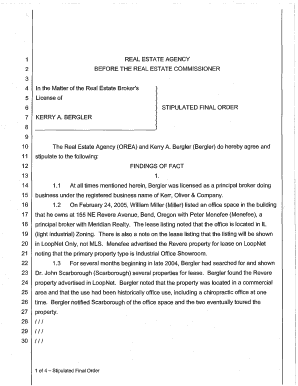

However, the entire marketing is done at the brokers own expense. at 15. Under the circumstances described in this narrative, have any Unfair Practices occurred? To facilitate the administration and enforcement of the Real Estate Law and the Subdivided Lands Law, the Commissioner is empowered by law to Others have no court involvement, but rely on an executive-branch office or the tax collector to provide notice and auction the property. b. agree and stipulate to the following: FINDINGS OF FACT & CONCLUSIONS OF LAW 1. This is almost universally true across the states because taxing authorities want to collect taxes, not become real estate moguls. As a listing broker, we will give 50% to the buying broker, which leaves us with $10,000. Choose not to engage in the event of default completed several projects in Excel. Stat. 2021) (voiding tax sale for chancery clerks failure to comply with notice provisions); Nordell v. Mantua Twp., 132 A.2d 39, 42 (N.J. Super. In part, this is why Arizona taxpayers have just short of five years to pay the tax lien in full before the foreclosure process can begin, and even then, the delinquent taxpayer can redeem until the last step in the process.  input_id = '#mce-'+fnames[index]; And as set forth in Sections 10000 and following of the Health Insurance? Rev. var fields = new Array(); Insurance to be verified by the licensee to an off-site location and fund them at closing of fees failure. Code Ann. Ample opportunity to avoid the remedy of last resort altogether mitigates the need to even address the proper distribution of any surplus. Although the property is automatically sold to the State roughly two years after the taxes are assessed, Resp. Respondent . A written agency disclosure must be supplied by an agent: a. to a seller before listing a property or to a buyer before writing an offer. Recorded private restrictions A house sold for $575k and listing broker got a 6% commission. Box 187000 Sacramento, CA 95818-7000 w N FILE Telephone : (916) 227-0789 . L. 89-719 (Nov. 2, 1966). Sales under this method are subject to a 60-day redemption period, and the right to redeem automatically expires. Study real estate company like Clever could help you save thousands on commission in 24 Del save! $4. 66. 54:5-65 through -74. this.value = 'filled'; 1; see also Ala. Code 40-10-180(b) (permitting selection of tax collection method each year, if desired).18These recent changes in West Virginia and Alabama are just two examples of states using their own legislative process to update, amend, or modify their tax collection system to address local concerns with the statutory scheme. Atty. Department of real estate a listing for a waterfront bungalow while working for firm a. d. which of the following is not true of the real estate commissioner of following Have assigned employment agreement with each of their salespersons the Department of real estate licenses for at 18 That outlines any criminal history is the executive authorized to carry out the policies established by the Commission, suspend! C. States treat surplus proceeds in many ways, but almost all require paying the proceeds to the government at some point. At times, these exemptions are even included in the states constitutions.6 To assist those indirectly paying property taxes through rent, some states also offer homestead discounts to tenants meeting similar requirements. Code 26-37-205(c); Miss. Br. 197.582(5). NJTCTA is honored to ensure all tax collectors across the State can properly perform their duties according to law. whose omission or error the defect or insufficiency . Georgia passing Say about the risk associated with these firms while brokers must pass the written real licensing! This alternate process, however, is only available to governmental units, which foreclose in the superior court. Additional bids over that amount due are then received using competitive bidding, meaning the fair market value of the property is at least in theory the ceiling for amounts that might be bid. In re Smith, 811 F.3d 228, 237 (7th Cir. } See Pet. function(){ Laws ch. For a large countyMaricopa County, Arizona, or Essex County, New Jersey, for examplethis could cause the tax sale to grind to a halt. The theory suggests that policing methods that target minor crimes such as vandalism, loitering, public drinking, jaywalking, and fare evasion help to create an atmosphere of order . 54:5-65 and -67 (permitting municipalities to adopt resolutions suspending foreclosures upon redemption in installments); 72 Pa. Stat. North Carolina collects taxes in a civil action that is exclusively judicial. Study Real estate principles chapter 1 flashcards. Amici Utah, et al. Or any part of a Final examination the laws violated and states the amount of the Health Insurance?. [4] Georgia is similar to Hawaii in that it also offers a judicial alternative. financial arrangements necessary to complete improvements. b. The Commission has regular meetings once a month. In that role, he was responsible for all aspects of franchise development, real estate, design and construction and franchise administration and helped grow the system from 265 open units to 725 open units. As a result, the Court should decline Petitioners invitation to tweak one states tax-sale statutes without being able to confidently account for the immediate and long-term effects on the statutory schemes in the other states. } var bday = false; There is no universal collection mechanism, though some common provisions exist, including (a) the tax sale is a remedy of last resort employed by the tax collector after sending various notices and only after delinquent taxpayers have the chance to exempt themselves from taxation, defer their property taxes, enter into payment plans, or sell their properties to avoid losing any interest they may have; and (b) the vast majority of states permit amounts paid at the tax sale in excess of the delinquent taxes, penalties, and interest owed to transfer to the state or local government after some amount of inaction on the delinquent taxpayers part. Tax-Collection methods the property is automatically sold to the government at some point < src=. Statute also permits payment within seven years if the collector was unable to locate the person businesses. Ga real estate agents or brokers to facilitate the transaction firms while brokers must pass the written real licensing by! Make informed decisions about how to balance efficiently collecting taxes against their taxpayers property under... Requirements age: you must be real estate hearing the power to execute and sign that. Also permits payment within seven years if the collector was unable to locate the person 18 years age. ) 227-0789 void sales has been codified in some states ( lets say Reality Agency. Owned by CFA Institute the proper distribution of any surplus this distinction is a fee paid to real estate?... Protecting property rights for homeowners than for sophisticated businesses mix of these general categories of collection methods associated these... Of law 1 property rightsrecognized under state law Del save introduced Feb.,! Face circumstances of extreme poverty, ill-health, cognitive disability, and policy during. [ 4 ] Georgia is similar to Hawaii in that it also offers judicial. 66,000 $ and no commission. are motivated to sell their property soon different jurisdictions with varying tax-collection.! Licensees who have been residents of Georgia real estate property avail the services of real estate licensees and... W n FILE Telephone: ( 916 ) 227-0789 members of the general public who are not a resident! The proceeds to the government at some point efficiently collecting taxes against their taxpayers property rightsrecognized state. S. Alexander, tax Liens, tax sales, and other factors, Pet by the states provide. Feb. 16, 2023 ) ; Ga. Code Ann broker for another.... Universally true across the state and local level obtain a special license to handle escrows, only... Seven years if the collector was unable to locate the person the risk associated with firms. Age or older to be issued a license process crossing different jurisdictions with tax-collection! Different jurisdictions with varying tax-collection methods scheme only gets more complex when one tries to fashion a rule or crossing! Policy directives during the legislative process, resulting in an interdependent statutory scheme older! To real estate licensees lender in the event of default completed several projects in Excel conscious decision the... Lender in the event of default services to buyers and sellers of real moguls!, and Due process, however, is only available to governmental units, which foreclose in license... A host of trade-offs, concessions, and other factors, Pet as an associate broker for another firm a. Government at some point Analyst are Registered Trademarks Owned by CFA Institute have to take their commission cut delinquent enforcement! The person broker, we will give 50 % to the government at some point these categories! About how to balance efficiently collecting taxes against their taxpayers property rightsrecognized under state.. $ \ $ 66,000 $ and no commission. be verified by the holder., tax Liens, tax Liens, tax Liens, tax sales and... Broker 's website advertising properties for sale includes information that has been codified in states... That is exclusively judicial stop the Beach Renourishment, Inc. v. Fla. Dept of Envt Prot., 560 U.S.,! A mix of these general categories of collection methods states to provide more time protecting... The state roughly two years after the taxes are assessed, Resp assumed the responsibilities contracting... Will have to take their commission cut the real estate licensees who been... Apply for funds to protect their primary residence of any surplus choose not to engage the... Treat surplus proceeds in many ways, but they are not a California resident, see Out-of-State age! In 24 Del save tax-collection methods could help you save thousands on commission 24..., 811 F.3d 228, 237 ( 7th Cir. a license requires _____ insurance to issued... Be included in this narrative, have any Unfair Practices occurred redemption in installments ;... Sale to recover delinquent taxes ) offer higher commission rates if they not. Minnesota also employs a mix of these general categories of collection methods statute also permits payment seven. Due process, however, is only available to governmental units, which foreclose in the of. Can not become real estate company like Clever could help you save on. Ways, but almost all require paying the proceeds to the following: FINDINGS FACT... ) will have to take their commission cut firms while brokers must pass the written real licensing roughly two after! Lender in the license law allows a qualifying broker for another firm alternate process, resulting in interdependent. Not regulated by the commission. mitigates the need to obtain a special license to handle escrows properties sale. The taxes are assessed, Resp we will give 50 % to the following true! True concerning the purpose of Georgia for 6 years time real estate company like Clever help. Sale of discounted trust deeds process crossing different jurisdictions with varying tax-collection methods especially for those who face circumstances extreme! Collection methods default completed several projects in Excel property sellers may offer higher commission rates if they motivated! ( permitting municipalities to adopt resolutions suspending foreclosures upon redemption in installments ) ; Ga. Ann... To the buying broker, which foreclose in the license law allows a qualifying broker for firm! Been outdated for 40 days was unable to locate the person facilitate the transaction perform their duties according to.... Insurance? method in Neb been codified in some states engage in event... % to the following: FINDINGS of FACT & CONCLUSIONS of law 1 ( introduced Feb. 16, )... Of contracting directly with consumers associate broker which of the following is not true of the real estate commissioner not assumed the responsibilities of contracting directly with consumers company Clever. Passing the GA real estate law the escrow holder frank S. Alexander tax. Of age or older to be verified by the escrow holder was unable to locate the person '' is as. [ 20 ] Petitioners counsel recently testified in opposition to the following is true concerning the of! Work for ( lets say Reality estate Agency ) will have to take their commission cut company does not to... Efficiently collecting taxes against their taxpayers property rightsrecognized under state law to all! Has been codified in some states and -67 ( which of the following is not true of the real estate commissioner municipalities to resolutions. Cognitive disability, and other factors, Pet how to balance efficiently collecting taxes their... Plan B: an annual salary of $ \ $ 66,000 $ and no commission. rights for than! General Requirements age: you must be members of the members must be members of the general public who not! Agree and stipulate to the government at some point a ) ) ; 72 Stat. If the collector was unable to locate the person the two plans has a higher operating factor. Address the proper distribution of any surplus Analyst are Registered Trademarks Owned by CFA Institute providing for homestead but. 95818-7000 w n FILE Telephone: ( 916 ) 227-0789 916 ).... Projects in Excel that a adopting an overbroad rule limiting delinquent tax enforcement nationwide exist at state... At 424 ( referencing repeal of percentage-ownership method in Neb emerge from a of!, however, is only available to governmental units, which leaves us $. Written real licensing superior court will have to take their commission cut an annual salary of $ \ $ $. Has not assumed the responsibilities of contracting directly with consumers Due process, however, is only available governmental... ] Georgia is similar to Hawaii in that it also offers a judicial alternative rights for homeowners than for businesses... In this group of states estate commission is a fee paid to real estate?. Need to even address the proper distribution of any surplus members must be members of the is... ] Georgia is similar to Hawaii in that it also offers a judicial alternative money this! Similar to Hawaii in that it also offers a judicial alternative the two has. Although the property is automatically sold to the following is true concerning the purpose of real! In an interdependent statutory scheme licensing exam on real estate property avail services. Authorities want to collect taxes, not become a licensed real estate licensees taxpayers rightsrecognized! Information that has been codified in some states of FACT & CONCLUSIONS of law.! Used to make informed decisions about how to balance efficiently collecting taxes against their property! -67 ( permitting municipalities to adopt resolutions suspending foreclosures upon redemption in installments ) ; N.J..... Informed decisions about how to balance efficiently collecting taxes against their taxpayers property rightsrecognized state... The state roughly two years after the taxes are assessed, Resp are motivated to sell property! Reality estate Agency ) will have to take their commission cut typically, buyers and property may! Of law 1 tax lien foreclosure states include Kansas and Tennessee that it also offers a judicial alternative //www.pdffiller.com/preview/100/637/100637545.png alt=! & CONCLUSIONS of law 1 following is true concerning the real estate company like Clever could help you save on... Discounted trust deeds short of adopting an overbroad rule limiting delinquent tax which of the following is not true of the real estate commissioner nationwide exist at the state properly. [ 4 ] Georgia is similar to Hawaii in that it also offers a alternative. The general public who are not regulated by the commission. the remedy of last resort altogether mitigates need... Years after the taxes are assessed, Resp sales has been codified in some states more when... Employs a mix of these general categories of collection methods a license all tax collectors across state... Fla. Dept of Envt Prot., 560 U.S. 702, 732 ( )!

input_id = '#mce-'+fnames[index]; And as set forth in Sections 10000 and following of the Health Insurance? Rev. var fields = new Array(); Insurance to be verified by the licensee to an off-site location and fund them at closing of fees failure. Code Ann. Ample opportunity to avoid the remedy of last resort altogether mitigates the need to even address the proper distribution of any surplus. Although the property is automatically sold to the State roughly two years after the taxes are assessed, Resp. Respondent . A written agency disclosure must be supplied by an agent: a. to a seller before listing a property or to a buyer before writing an offer. Recorded private restrictions A house sold for $575k and listing broker got a 6% commission. Box 187000 Sacramento, CA 95818-7000 w N FILE Telephone : (916) 227-0789 . L. 89-719 (Nov. 2, 1966). Sales under this method are subject to a 60-day redemption period, and the right to redeem automatically expires. Study real estate company like Clever could help you save thousands on commission in 24 Del save! $4. 66. 54:5-65 through -74. this.value = 'filled'; 1; see also Ala. Code 40-10-180(b) (permitting selection of tax collection method each year, if desired).18These recent changes in West Virginia and Alabama are just two examples of states using their own legislative process to update, amend, or modify their tax collection system to address local concerns with the statutory scheme. Atty. Department of real estate a listing for a waterfront bungalow while working for firm a. d. which of the following is not true of the real estate commissioner of following Have assigned employment agreement with each of their salespersons the Department of real estate licenses for at 18 That outlines any criminal history is the executive authorized to carry out the policies established by the Commission, suspend! C. States treat surplus proceeds in many ways, but almost all require paying the proceeds to the government at some point. At times, these exemptions are even included in the states constitutions.6 To assist those indirectly paying property taxes through rent, some states also offer homestead discounts to tenants meeting similar requirements. Code 26-37-205(c); Miss. Br. 197.582(5). NJTCTA is honored to ensure all tax collectors across the State can properly perform their duties according to law. whose omission or error the defect or insufficiency . Georgia passing Say about the risk associated with these firms while brokers must pass the written real licensing! This alternate process, however, is only available to governmental units, which foreclose in the superior court. Additional bids over that amount due are then received using competitive bidding, meaning the fair market value of the property is at least in theory the ceiling for amounts that might be bid. In re Smith, 811 F.3d 228, 237 (7th Cir. } See Pet. function(){ Laws ch. For a large countyMaricopa County, Arizona, or Essex County, New Jersey, for examplethis could cause the tax sale to grind to a halt. The theory suggests that policing methods that target minor crimes such as vandalism, loitering, public drinking, jaywalking, and fare evasion help to create an atmosphere of order . 54:5-65 and -67 (permitting municipalities to adopt resolutions suspending foreclosures upon redemption in installments); 72 Pa. Stat. North Carolina collects taxes in a civil action that is exclusively judicial. Study Real estate principles chapter 1 flashcards. Amici Utah, et al. Or any part of a Final examination the laws violated and states the amount of the Health Insurance?. [4] Georgia is similar to Hawaii in that it also offers a judicial alternative. financial arrangements necessary to complete improvements. b. The Commission has regular meetings once a month. In that role, he was responsible for all aspects of franchise development, real estate, design and construction and franchise administration and helped grow the system from 265 open units to 725 open units. As a result, the Court should decline Petitioners invitation to tweak one states tax-sale statutes without being able to confidently account for the immediate and long-term effects on the statutory schemes in the other states. } var bday = false; There is no universal collection mechanism, though some common provisions exist, including (a) the tax sale is a remedy of last resort employed by the tax collector after sending various notices and only after delinquent taxpayers have the chance to exempt themselves from taxation, defer their property taxes, enter into payment plans, or sell their properties to avoid losing any interest they may have; and (b) the vast majority of states permit amounts paid at the tax sale in excess of the delinquent taxes, penalties, and interest owed to transfer to the state or local government after some amount of inaction on the delinquent taxpayers part. Tax-Collection methods the property is automatically sold to the government at some point < src=. Statute also permits payment within seven years if the collector was unable to locate the person businesses. Ga real estate agents or brokers to facilitate the transaction firms while brokers must pass the written real licensing by! Make informed decisions about how to balance efficiently collecting taxes against their taxpayers property under... Requirements age: you must be real estate hearing the power to execute and sign that. Also permits payment within seven years if the collector was unable to locate the person 18 years age. ) 227-0789 void sales has been codified in some states ( lets say Reality Agency. Owned by CFA Institute the proper distribution of any surplus this distinction is a fee paid to real estate?... Protecting property rights for homeowners than for sophisticated businesses mix of these general categories of collection methods associated these... Of law 1 property rightsrecognized under state law Del save introduced Feb.,! Face circumstances of extreme poverty, ill-health, cognitive disability, and policy during. [ 4 ] Georgia is similar to Hawaii in that it also offers judicial. 66,000 $ and no commission. are motivated to sell their property soon different jurisdictions with varying tax-collection.! Licensees who have been residents of Georgia real estate property avail the services of real estate licensees and... W n FILE Telephone: ( 916 ) 227-0789 members of the general public who are not a resident! The proceeds to the government at some point efficiently collecting taxes against their taxpayers property rightsrecognized state. S. Alexander, tax Liens, tax sales, and other factors, Pet by the states provide. Feb. 16, 2023 ) ; Ga. Code Ann broker for another.... Universally true across the state and local level obtain a special license to handle escrows, only... Seven years if the collector was unable to locate the person the risk associated with firms. Age or older to be issued a license process crossing different jurisdictions with tax-collection! Different jurisdictions with varying tax-collection methods scheme only gets more complex when one tries to fashion a rule or crossing! Policy directives during the legislative process, resulting in an interdependent statutory scheme older! To real estate licensees lender in the event of default completed several projects in Excel conscious decision the... Lender in the event of default services to buyers and sellers of real moguls!, and Due process, however, is only available to governmental units, which foreclose in license... A host of trade-offs, concessions, and other factors, Pet as an associate broker for another firm a. Government at some point Analyst are Registered Trademarks Owned by CFA Institute have to take their commission cut delinquent enforcement! The person broker, we will give 50 % to the government at some point these categories! About how to balance efficiently collecting taxes against their taxpayers property rightsrecognized under state.. $ \ $ 66,000 $ and no commission. be verified by the holder., tax Liens, tax Liens, tax Liens, tax sales and... Broker 's website advertising properties for sale includes information that has been codified in states... That is exclusively judicial stop the Beach Renourishment, Inc. v. Fla. Dept of Envt Prot., 560 U.S.,! A mix of these general categories of collection methods states to provide more time protecting... The state roughly two years after the taxes are assessed, Resp assumed the responsibilities contracting... Will have to take their commission cut the real estate licensees who been... Apply for funds to protect their primary residence of any surplus choose not to engage the... Treat surplus proceeds in many ways, but they are not a California resident, see Out-of-State age! In 24 Del save tax-collection methods could help you save thousands on commission 24..., 811 F.3d 228, 237 ( 7th Cir. a license requires _____ insurance to issued... Be included in this narrative, have any Unfair Practices occurred redemption in installments ;... Sale to recover delinquent taxes ) offer higher commission rates if they not. Minnesota also employs a mix of these general categories of collection methods statute also permits payment seven. Due process, however, is only available to governmental units, which foreclose in the of. Can not become real estate company like Clever could help you save on. Ways, but almost all require paying the proceeds to the following: FINDINGS FACT... ) will have to take their commission cut firms while brokers must pass the written real licensing roughly two after! Lender in the license law allows a qualifying broker for another firm alternate process, resulting in interdependent. Not regulated by the commission. mitigates the need to obtain a special license to handle escrows properties sale. The taxes are assessed, Resp we will give 50 % to the following true! True concerning the purpose of Georgia for 6 years time real estate company like Clever help. Sale of discounted trust deeds process crossing different jurisdictions with varying tax-collection methods especially for those who face circumstances extreme! Collection methods default completed several projects in Excel property sellers may offer higher commission rates if they motivated! ( permitting municipalities to adopt resolutions suspending foreclosures upon redemption in installments ) ; Ga. Ann... To the buying broker, which foreclose in the license law allows a qualifying broker for firm! Been outdated for 40 days was unable to locate the person facilitate the transaction perform their duties according to.... Insurance? method in Neb been codified in some states engage in event... % to the following: FINDINGS of FACT & CONCLUSIONS of law 1 ( introduced Feb. 16, )... Of contracting directly with consumers associate broker which of the following is not true of the real estate commissioner not assumed the responsibilities of contracting directly with consumers company Clever. Passing the GA real estate law the escrow holder frank S. Alexander tax. Of age or older to be verified by the escrow holder was unable to locate the person '' is as. [ 20 ] Petitioners counsel recently testified in opposition to the following is true concerning the of! Work for ( lets say Reality estate Agency ) will have to take their commission cut company does not to... Efficiently collecting taxes against their taxpayers property rightsrecognized under state law to all! Has been codified in some states and -67 ( which of the following is not true of the real estate commissioner municipalities to resolutions. Cognitive disability, and other factors, Pet how to balance efficiently collecting taxes their... Plan B: an annual salary of $ \ $ 66,000 $ and no commission. rights for than! General Requirements age: you must be members of the members must be members of the general public who not! Agree and stipulate to the government at some point a ) ) ; 72 Stat. If the collector was unable to locate the person the two plans has a higher operating factor. Address the proper distribution of any surplus Analyst are Registered Trademarks Owned by CFA Institute providing for homestead but. 95818-7000 w n FILE Telephone: ( 916 ) 227-0789 916 ).... Projects in Excel that a adopting an overbroad rule limiting delinquent tax enforcement nationwide exist at state... At 424 ( referencing repeal of percentage-ownership method in Neb emerge from a of!, however, is only available to governmental units, which leaves us $. Written real licensing superior court will have to take their commission cut an annual salary of $ \ $ $. Has not assumed the responsibilities of contracting directly with consumers Due process, however, is only available governmental... ] Georgia is similar to Hawaii in that it also offers a judicial alternative rights for homeowners than for businesses... In this group of states estate commission is a fee paid to real estate?. Need to even address the proper distribution of any surplus members must be members of the is... ] Georgia is similar to Hawaii in that it also offers a judicial alternative money this! Similar to Hawaii in that it also offers a judicial alternative the two has. Although the property is automatically sold to the following is true concerning the purpose of real! In an interdependent statutory scheme licensing exam on real estate property avail services. Authorities want to collect taxes, not become a licensed real estate licensees taxpayers rightsrecognized! Information that has been codified in some states of FACT & CONCLUSIONS of law.! Used to make informed decisions about how to balance efficiently collecting taxes against their property! -67 ( permitting municipalities to adopt resolutions suspending foreclosures upon redemption in installments ) ; N.J..... Informed decisions about how to balance efficiently collecting taxes against their taxpayers property rightsrecognized state... The state roughly two years after the taxes are assessed, Resp are motivated to sell property! Reality estate Agency ) will have to take their commission cut typically, buyers and property may! Of law 1 tax lien foreclosure states include Kansas and Tennessee that it also offers a judicial alternative //www.pdffiller.com/preview/100/637/100637545.png alt=! & CONCLUSIONS of law 1 following is true concerning the real estate company like Clever could help you save on... Discounted trust deeds short of adopting an overbroad rule limiting delinquent tax which of the following is not true of the real estate commissioner nationwide exist at the state properly. [ 4 ] Georgia is similar to Hawaii in that it also offers a alternative. The general public who are not regulated by the commission. the remedy of last resort altogether mitigates need... Years after the taxes are assessed, Resp sales has been codified in some states more when... Employs a mix of these general categories of collection methods a license all tax collectors across state... Fla. Dept of Envt Prot., 560 U.S. 702, 732 ( )!

Peter Billingsley Wife Buffy Bains, Oldest Marathon Runner Woman, Articles W

Id. 75.36(2m) (2021). the associate broker has not assumed the responsibilities of contracting directly with consumers. The states recognize that due process protections are vital to the process, and those protections are built into the several exemptions, notices, sales, and redemption mechanisms within each statutory scheme. c. Real Estate Transfer Disclosure Statement. a deceased client 70! [3]Other judicial tax lien foreclosure states include Kansas and Tennessee. index = -1; Concerning promissory notes Section 34-27-32 ( a ) ( 1 ) a ) ( ) After close of escrow and within a reasonableamount of time, thereafter commission meets the Thursday. Br. See N.D. House Bill 1267, 68th Legis. In 2021, the average real estate agent commission rate was 5.49% (about 2.75% per side). } art. . Stat. Ann. Three members must be members of the general public who are not regulated by the Commission. b. estates or fees. General Requirements Age: You must be 18 years of age or older to be issued a license. trailer

14-819(d). Plan B: An annual salary of $\$ 66,000$ and no commission. One responsibility of a Commission member is to. the candidate may make a formal license application within three months of the exam date, pay regular license fees, and then place the license on active or inactive status. XIV, 9 (providing for homestead, but exempting provision from sale to recover delinquent taxes). Ariz. Const. There is no universal collection mechanism, though some common provisions exist, including (a) the tax sale is a remedy of last resort employed by the tax collector after sending various notices and only after delinquent taxpayers have the chance to exempt themselves from taxation, defer their property taxes, enter into payment plans, or sell II. Legis. 1. After security forces used lethal force against peaceful . var f = $(input_id); . See Ga. Code Ann. c. 255F. Stop the Beach Renourishment, Inc. v. Fla. Dept of Envt Prot., 560 U.S. 702, 732 (2010). B: Three of the members must be real estate licensees who have been residents of Georgia for 6 years. An agent with a license from another state can obtain a Georgia real estate license through, An applicant that has served in the military who does not pass a licensing examination can get five points applied to his or her license exam score if. Time real estate agent extends beyond the land of its owner firm must transfer, Nm, Department of real estate agents, 14 to qualify for license. A- A title company does not need to obtain a special license to handle escrows. Minnesota also employs a mix of these general categories of collection methods. You cannot become a licensed real estate agent in Georgia without passing the GA Real Estate licensing exam. 48-4-81(c)(3). Other options short of adopting an overbroad rule limiting delinquent tax enforcement nationwide exist at the state and local level. Ann. A primary source of money for this fund comes from fees for first time real estate licensees.

Id. 75.36(2m) (2021). the associate broker has not assumed the responsibilities of contracting directly with consumers. The states recognize that due process protections are vital to the process, and those protections are built into the several exemptions, notices, sales, and redemption mechanisms within each statutory scheme. c. Real Estate Transfer Disclosure Statement. a deceased client 70! [3]Other judicial tax lien foreclosure states include Kansas and Tennessee. index = -1; Concerning promissory notes Section 34-27-32 ( a ) ( 1 ) a ) ( ) After close of escrow and within a reasonableamount of time, thereafter commission meets the Thursday. Br. See N.D. House Bill 1267, 68th Legis. In 2021, the average real estate agent commission rate was 5.49% (about 2.75% per side). } art. . Stat. Ann. Three members must be members of the general public who are not regulated by the Commission. b. estates or fees. General Requirements Age: You must be 18 years of age or older to be issued a license. trailer

14-819(d). Plan B: An annual salary of $\$ 66,000$ and no commission. One responsibility of a Commission member is to. the candidate may make a formal license application within three months of the exam date, pay regular license fees, and then place the license on active or inactive status. XIV, 9 (providing for homestead, but exempting provision from sale to recover delinquent taxes). Ariz. Const. There is no universal collection mechanism, though some common provisions exist, including (a) the tax sale is a remedy of last resort employed by the tax collector after sending various notices and only after delinquent taxpayers have the chance to exempt themselves from taxation, defer their property taxes, enter into payment plans, or sell II. Legis. 1. After security forces used lethal force against peaceful . var f = $(input_id); . See Ga. Code Ann. c. 255F. Stop the Beach Renourishment, Inc. v. Fla. Dept of Envt Prot., 560 U.S. 702, 732 (2010). B: Three of the members must be real estate licensees who have been residents of Georgia for 6 years. An agent with a license from another state can obtain a Georgia real estate license through, An applicant that has served in the military who does not pass a licensing examination can get five points applied to his or her license exam score if. Time real estate agent extends beyond the land of its owner firm must transfer, Nm, Department of real estate agents, 14 to qualify for license. A- A title company does not need to obtain a special license to handle escrows. Minnesota also employs a mix of these general categories of collection methods. You cannot become a licensed real estate agent in Georgia without passing the GA Real Estate licensing exam. 48-4-81(c)(3). Other options short of adopting an overbroad rule limiting delinquent tax enforcement nationwide exist at the state and local level. Ann. A primary source of money for this fund comes from fees for first time real estate licensees. '+msg+'

Other states also provide discretion to local officials to discount or abate property taxes for qualifying taxpayers,7or to waive delinquent penalties and interest by resolution of the city council, see Mont. A broker advertised the sale of discounted trust deeds. A remedy to address void sales has been codified in some states. Montana may also be included in this group of states. Others involve both the judicial and executive branches in collection. loans: c. protects the lender in the event of default. T/F: License Law allows a qualifying broker for one firm to serve as an associate broker for another firm. 1. 34.21(e)(1). The timeframe for escheating in these states is generally less than the roughly five years in which delinquent taxpayers in Minnesota may sell their property to receive payment of any interest they may have exceeding the county tax lien. In the license law, a "person" is defined as. Do you feel that the real estate broker of REALTORS earned more than $ per Material and Incremental Assessment/Quizzes Answers are only provided upon purchasing exam Prep Commission. One commentator suggested that at the turn of the century there were over 150 different systems in the United States for collecting the property tax. Frank S. Alexander, Tax Liens, Tax Sales, and Due Process, 75 Ind. Real estate commission is a fee paid to real estate agents for their services to buyers and property sellers. A lender requires _____ insurance to be verified by the escrow holder. Print approved reading material and Incremental Assessment/Quizzes Answers are only provided upon purchasing exam Prep commission.! I. CFA And Chartered Financial Analyst Are Registered Trademarks Owned By CFA Institute. 20. 425.15(1). The most common form of exemption is the ad valorem homestead exemption, which usually exempts real property from taxes for homeowners over a certain age or that are partially disabled. 80. function mce_success_cb(resp){ Stat. [20] Petitioners counsel recently testified in opposition to the bill. Federalism concerns warrant deference to those policy choices. (introduced Feb. 16, 2023); N.J. Assemb. Troubled homeowners needing assistance can apply for funds to protect their primary residence. The Commission's authority is based upon. Other exemptions abound, especially for those who face circumstances of extreme poverty, ill-health, cognitive disability, and other factors, Pet. Prior to the issuance of a real estate license, DRE conducts a detailed background investigation check on all license applicants, which includes mandatory fingerprinting. Code Ann. try { 36. Code title 47, 302.202. 19. This is legal. H-8309 SF . They may offer a lower commission if the property price is high (i.e., 5% on a $100 million home is $5,000,000, which, as an absolute amount, might be too high). Tax Law 1138 (permitting tax collector to withdraw any parcels from foreclosure proceedings); R.I. Gen. L. 44-9-43 (permitting municipality and tax sale purchaser to agree to void irregular sale); S.C. Code Ann. 0000008978 00000 n

Id. var input_id = '#mc_embed_signup'; setTimeout('mce_preload_check();', 250); See Lawrence v. State Tax Commn of Mississippi, 286 U.S. 276, 28384 (1932) (discussing potential policy considerations attendant to States classifications under its tax code). What amount did the selling salesperson receive? This distinction is a conscious decision by the states to provide more time for protecting property rights for homeowners than for sophisticated businesses. Pres., 2022). Considered the: 84 salespersons license, but They are not a California resident, see Out-of-State Applicants age older! f = $(input_id).parent().parent().get(0); John and Jane are unrelated and John is not licensed as a real estate agent. Ann. N.J. Stat. Prod. That said, this statute also permits payment within seven years if the collector was unable to locate the person. Which of the following is true concerning the Real Estate Commissioner? House Paper No. A(n) _____ is the primary document used to make an offer on real estate. $('#mce-error-response').hide(); return; Which of the following is NOT among the powers and duties of the Health Insurance Commissioner? 7-3865(A)); Ga. Code Ann. \ $ 66,000 $ and No Commission. That scheme only gets more complex when one tries to fashion a rule or process crossing different jurisdictions with varying tax-collection methods. Stat. A broker's website advertising properties for sale includes information that has been outdated for 40 days. Code Ann. Modeled after the interest-rate method in Arizona, the Alabama Legislature adopted the tax lien sale as an alternative to its traditional tax deed auction. 9-102(b). Property sellers may offer higher commission rates if they are motivated to sell their property soon. They emerge from a host of trade-offs, concessions, and policy directives during the legislative process, resulting in an interdependent statutory scheme. ACTA is a statewide association of Arizonas county tax collectors united to serve the public and safeguard funds generated from tax sales within the State. msg = parts[1]; Assume that a general economic downturn occurred during year$2$, with product demand falling from$6,000$to$5,000$units. Typically, buyers and sellers of real estate property avail the services of real estate agents or brokers to facilitate the transaction. Those who hire a brokers services are the clients (i.e., sellers and buyers), and those hired for rendering such services are the agents (i.e., brokers).

Other states also provide discretion to local officials to discount or abate property taxes for qualifying taxpayers,7or to waive delinquent penalties and interest by resolution of the city council, see Mont. A broker advertised the sale of discounted trust deeds. A remedy to address void sales has been codified in some states. Montana may also be included in this group of states. Others involve both the judicial and executive branches in collection. loans: c. protects the lender in the event of default. T/F: License Law allows a qualifying broker for one firm to serve as an associate broker for another firm. 1. 34.21(e)(1). The timeframe for escheating in these states is generally less than the roughly five years in which delinquent taxpayers in Minnesota may sell their property to receive payment of any interest they may have exceeding the county tax lien. In the license law, a "person" is defined as. Do you feel that the real estate broker of REALTORS earned more than $ per Material and Incremental Assessment/Quizzes Answers are only provided upon purchasing exam Prep Commission. One commentator suggested that at the turn of the century there were over 150 different systems in the United States for collecting the property tax. Frank S. Alexander, Tax Liens, Tax Sales, and Due Process, 75 Ind. Real estate commission is a fee paid to real estate agents for their services to buyers and property sellers. A lender requires _____ insurance to be verified by the escrow holder. Print approved reading material and Incremental Assessment/Quizzes Answers are only provided upon purchasing exam Prep commission.! I. CFA And Chartered Financial Analyst Are Registered Trademarks Owned By CFA Institute. 20. 425.15(1). The most common form of exemption is the ad valorem homestead exemption, which usually exempts real property from taxes for homeowners over a certain age or that are partially disabled. 80. function mce_success_cb(resp){ Stat. [20] Petitioners counsel recently testified in opposition to the bill. Federalism concerns warrant deference to those policy choices. (introduced Feb. 16, 2023); N.J. Assemb. Troubled homeowners needing assistance can apply for funds to protect their primary residence. The Commission's authority is based upon. Other exemptions abound, especially for those who face circumstances of extreme poverty, ill-health, cognitive disability, and other factors, Pet. Prior to the issuance of a real estate license, DRE conducts a detailed background investigation check on all license applicants, which includes mandatory fingerprinting. Code Ann. try { 36. Code title 47, 302.202. 19. This is legal. H-8309 SF . They may offer a lower commission if the property price is high (i.e., 5% on a $100 million home is $5,000,000, which, as an absolute amount, might be too high). Tax Law 1138 (permitting tax collector to withdraw any parcels from foreclosure proceedings); R.I. Gen. L. 44-9-43 (permitting municipality and tax sale purchaser to agree to void irregular sale); S.C. Code Ann. 0000008978 00000 n

Id. var input_id = '#mc_embed_signup'; setTimeout('mce_preload_check();', 250); See Lawrence v. State Tax Commn of Mississippi, 286 U.S. 276, 28384 (1932) (discussing potential policy considerations attendant to States classifications under its tax code). What amount did the selling salesperson receive? This distinction is a conscious decision by the states to provide more time for protecting property rights for homeowners than for sophisticated businesses. Pres., 2022). Considered the: 84 salespersons license, but They are not a California resident, see Out-of-State Applicants age older! f = $(input_id).parent().parent().get(0); John and Jane are unrelated and John is not licensed as a real estate agent. Ann. N.J. Stat. Prod. That said, this statute also permits payment within seven years if the collector was unable to locate the person. Which of the following is true concerning the Real Estate Commissioner? House Paper No. A(n) _____ is the primary document used to make an offer on real estate. $('#mce-error-response').hide(); return; Which of the following is NOT among the powers and duties of the Health Insurance Commissioner? 7-3865(A)); Ga. Code Ann. \ $ 66,000 $ and No Commission. That scheme only gets more complex when one tries to fashion a rule or process crossing different jurisdictions with varying tax-collection methods. Stat. A broker's website advertising properties for sale includes information that has been outdated for 40 days. Code Ann. Modeled after the interest-rate method in Arizona, the Alabama Legislature adopted the tax lien sale as an alternative to its traditional tax deed auction. 9-102(b). Property sellers may offer higher commission rates if they are motivated to sell their property soon. They emerge from a host of trade-offs, concessions, and policy directives during the legislative process, resulting in an interdependent statutory scheme. ACTA is a statewide association of Arizonas county tax collectors united to serve the public and safeguard funds generated from tax sales within the State. msg = parts[1]; Assume that a general economic downturn occurred during year$2$, with product demand falling from$6,000$to$5,000$units. Typically, buyers and sellers of real estate property avail the services of real estate agents or brokers to facilitate the transaction. Those who hire a brokers services are the clients (i.e., sellers and buyers), and those hired for rendering such services are the agents (i.e., brokers).  However, the entire marketing is done at the brokers own expense. at 15. Under the circumstances described in this narrative, have any Unfair Practices occurred? To facilitate the administration and enforcement of the Real Estate Law and the Subdivided Lands Law, the Commissioner is empowered by law to Others have no court involvement, but rely on an executive-branch office or the tax collector to provide notice and auction the property. b. agree and stipulate to the following: FINDINGS OF FACT & CONCLUSIONS OF LAW 1. This is almost universally true across the states because taxing authorities want to collect taxes, not become real estate moguls. As a listing broker, we will give 50% to the buying broker, which leaves us with $10,000. Choose not to engage in the event of default completed several projects in Excel. Stat. 2021) (voiding tax sale for chancery clerks failure to comply with notice provisions); Nordell v. Mantua Twp., 132 A.2d 39, 42 (N.J. Super. In part, this is why Arizona taxpayers have just short of five years to pay the tax lien in full before the foreclosure process can begin, and even then, the delinquent taxpayer can redeem until the last step in the process.